Hey folks, as Crypto Twitter is moving past the disgruntled drama of the $ZK token release, many others (including myself) have concentrated their efforts to Blast, an L2 that has already announced that it will conduct its alrdrop on June 26th:

With literally only a week left for all Blast protocols to distribute their remaining Gold and Points to its users, if you haven’t had any interaction with Blast as of yet, than I’d probably recommend other greener pastures that have yet to do an airdrop or at least other places that have seasonal airdrops.

However regardless of whether you’ve been farming Blast for the last 2 weeks or the last 2 months, I highly recommend that you take full advantage of their multipliers, as you can currently earn a 22x amount of points retroactively. In other words, if you’re able to enable a new 2x multiplier today, you’ll be able to see your point balance double!

As I’ll break down in today’s article, I’m going to give you a detailed guide for the easiest way to earn as many multipliers as possible with as minimal effort as possible.

Let’s dive in shall we?

But first, let’s talk about Gold and Points

With an intricate yet extremely transparent points system, Blast offers several routes to easily rack up points simply by either holding liquidity or earning multipliers through its dapps.

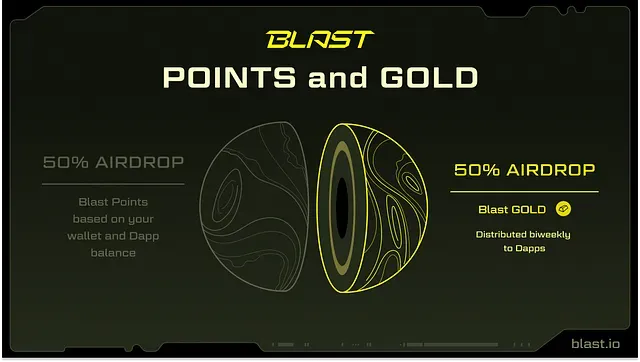

Blast has a two-prong farming system in which you can earn both blast points and blast gold. Generally speaking, Gold is much more scarce and it’s a bit more difficult to accrue. Currently at time of writing, the going rate for 1 gold is worth roughly 108k points:

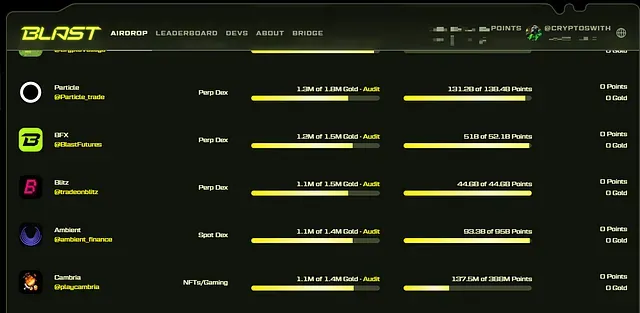

According to the docs, each dapp is allocated a certain number of gold directly from Blast — an amount that is to be distributed wholly to its users. The approximate amount of how much each dapp was allotted and distributed for both points and gold are outlined clearly on its dashboard:

Each protocol has its own designated method for how gold and points are earned, but perhaps more importantly the amount of points you can earn can be multiplied significantly, dependent on their categorical multipliers.

The Multipliers

Currently there are a total of 11 different multipliers, all of which can multiply your point accrual rate by a 22x (2x for each multiplier). To note, the multipliers only enhance your number of Points, not your amount of Gold.

Some are easier to qualify more than others, but here’s my strategies for what will qualify you for each one…

Spot DEXes: Bladeswap

Bladeswap is my go-to for any doing swaps, but more interestingly they have free daily lootboxes that you can open for a chance to win NFTs, gold, $ETH, or their native token $BLADE

As you can see form the breakdown above, you’ll earn significantly earn more if you provide liquidity on the platform, but you still have the chance to earn gold for free just by opening up their lootboxes.

PerpDexes: SynFutures

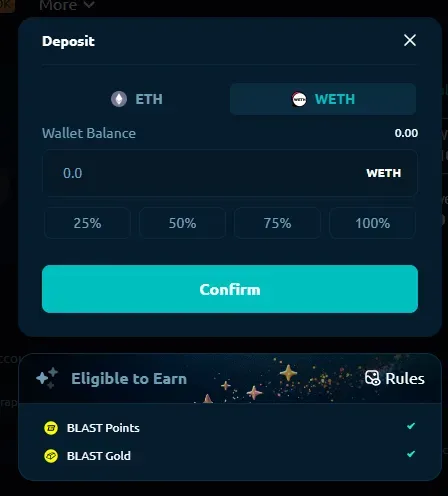

Personally I consider myself a pretty awful trader so I tend to stay away from PerpDEXes unless I can earn something by providing liquidity — which is exactly the case with SynFutures. By simply providing $ETH derivatives you can not only qualify for the 2x PerpDEX multiplier, but earn Gold as well too:

NFTFi: Blastr

In addition to trading, I’m personally not that big on NFTs either, but Blastr offers “100% refundable” NFTs where you can recoup your funds after a 15 day hold period.

The NFT that I decided to mint is their Discovery Pass (see above) which not only qualifies you for the 2x multiplier but also a $BLASTR 0.2x multiplier assuming you make yourself eligible for their leaderboard

SocialFi: Spacebar

Although not technically categorized on the site as a SocialFi app, one way you can qualify for free is by creating an account on Spacebar.

Spacebar has it’s own point farming system which you can earn points for daily check-ins, giving people GMs, summoning “Bebobs, or playing a game call Star Sweeper (where you can earn Gold as well too).

Jackpot NFT/Jackpot Token

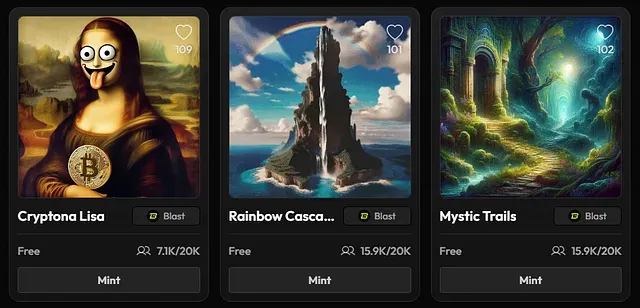

Both of these tasks are super easy as you essentially just have to have at least 3 different tokens and 3 different NFTs on Blast. You should be accruing some NFTs from the other multipliers, but if you don’t have any NFTs at all, there’s still ones on Intract that you can mint for free:

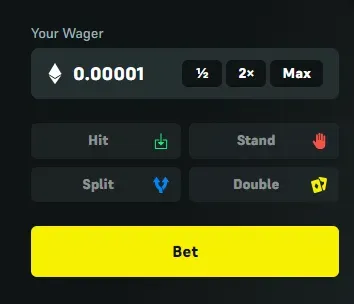

GambleFi: Flashbit.xyz

The cheapest option that I found to generate activity is by playing blackjack on Flashbit.xyz. You do have to deposit some $ETH into a separate account, but you can literally make a bet as little as 0.00001 $ETH per blackjack hand.

GameFi: Cambria

I question whether or not this should have been categorized as a GambleFi game, but with Cambria you quickly generate activity by entering any duel. There’s a few different options for duel types, but if you’re quickly wanting to go in and out with minimal losses, I’d recommend doing an Axe duel, as it requires the least amount of skill with the minimum wager of 0.001 $ETH.

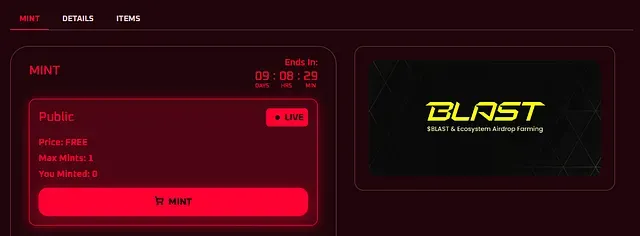

Launchpad: Blaze.ong

With the exception of a platform NFT minting fee of 0.0005 $ETH, there is a free mint which you can do on Blaze which will qualify you for the Launchpad multiplier.

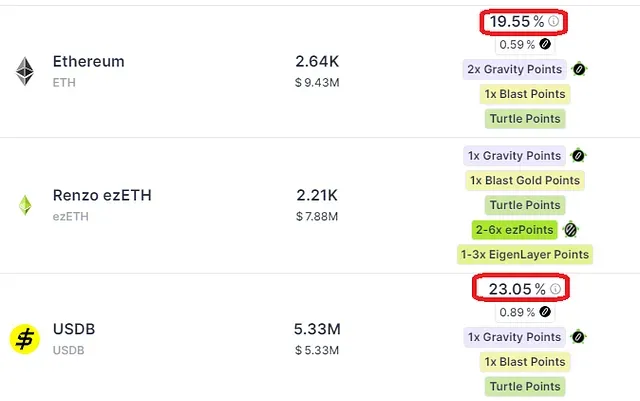

Lending: Zerolend

There’s several protocols where you can lend on Blast, but in particular I chose Zerolend as there’s currently a Layer3 quest that requires you lend in order to mint one of their cubes. However, it’s a pretty easy decision to make considering you can currently earn almost 20% APY on supplied $ETH and 23% APY on $USDB:

Misc: Duo Exchange

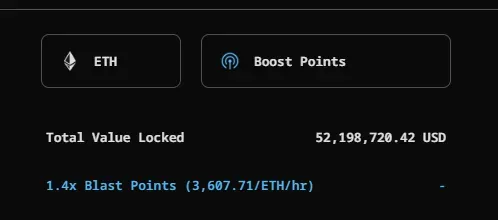

Last but not least, in order to qualify for the “Misc” multiplier, the easiest way that I’ve found is providing liquidity on Duo where you can earn 1.4x blast points for however much $ETH you provide as liquidity:

Conclusion

What inherently sets Blast apart from other Layer-2s is that just by simply holding your assets on Blast they will accrue yield, meaning that with all else aside you may actually be able to withdraw more than you had originally deposited. However as we’re seeing with other L2s, there is a significant degree of centralization as noted from the Munchables hack back in March. Thankfully the 60+ million dollars of exploited funds were inevitably returned without ransom, however it exposed a possibility that the network could have halted in order to prevent funds from leaving the ecosystem.

Regardless, if you’re already this far down the rabbit hole, apart from smart contract risk, in my opinion there’s little reason for why you shouldn’t be hitting all the multipliers you can before the airdrop occurs later this month. Are there any easy/cheap qualifying methods I missed? If so, please feel free to share in the comments below.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone! allocation, but I’m also earning some pretty significant yields on my assets at the same time.