INTRODUCTION

The Fever about cryptocurrency is increasing, people have heard about it, and more and more people want to find more about it, and find a way to be a part of it. When blockchain technology came, so many things changedfor better, we say. So many businesses have improved, so many companies have started using crypto currencies in their work. The new ideas are coming every day. People want to invest in the new projects. We have the biggest tool in the world, and it is called the Internet. The internet is an enormous base of information where we can do anything. Internet has connected the entire world.

Because of the access to the internet we are able to get information about one of the most incredible crypto-project which is known as Yearn Insurance Farming.

WHAT IS yEarn?

yEarn is a liquidity aggregator providing automated yield farming strategy through a number of lending pools. The protocol’s most well-known pool, yearn finance, shifts capital between top DeFi lending protocol like Compound, Aave and dYdX – ultimately geared at providing lenders the best return on liquidity.

yEarn also created a Curve's Y pool, a lending pool consisting of top stablecoins like USDC, DAI, TUSD and USDT, and is used for the BUSD Curve pool thanks to yEarn’s interest-earning yToken standard.

yEarn recently released a native governance token, YFI (Yield Farmj g Index), which is earned through liquidity money on a number of different pools. YFI is earned by staking proof of liquidity and is one of the only DeFi tokens which was launched with no premine and no initial DEX offering.

BACKGROUND

yEarn was founded by Andre Cronje in February of 2020. yEarn never raised funds as Andre says he builds software for himself.

Andre is notorious for “testing in prod” – meaning all of his contracts are pushed directly to mainnet without receiving formal audits. He is open about losing money to his very own smart contract, as well as openly stating for people to "not to use this software" in regards to certain portions of yEarn.

Andre has since handed control of virtually every aspect of the protocol over to the community, including governance and the ability to mint new YFI. Now, the yEarn protocol rest in the hands of the community.

Until July 16, Yearn was a simple DeFi credit aggregator designed to optimize user profitability. It had $8 million in assets under management, and since its launch in January, it has earned a combined 10.58 % profit per annum for its liquidity providers. But most importantly, it did not have a token.

Everything changed the next day, on July 17, when yearn.finance founder, Andre Cronje, published a notorious blog post called “YFI“. In an effort to transfer control over the yearn.finance protocol to the users, Cronje developed a plan for users to manage YFI by providing liquidity to Curve and Balancer pools. This may have been the first truly honest launch in years when Cronje did not allocate YFI tokens to himself, abandoning the funding rounds, tokens for project advisers, pre-mines, and the like. All YFI tokens were distributed to the yearn.finance protocol users.

A couple of months later, a supposedly “completely useless token” is worth $670 million and drives an “industrial-scale agricultural machine” of $770 million (and over a billion USD at peak) and provides token holders with about 20 million dollars of profit a year.

Why yEarn?

yEarn offers an easy and intuitive way to enter various yield farming opportunities in a few clicks. The protocol is constantly adding innovative new pools that, while risky, are pushing composability to its limit to make the most out of what DeFi has to offer.

As a passive participant, depositing capital to one of yEarn’s vetted pools, like Curve’s Y pool, offers a novel way to yield farm with little to no overhead.

YFI PROSPECTS

There may not be a single project that is more suitable for reflecting Yield Farming growth than YFI. YFI’s short term total available market is the common market for Yield Farming, which currently provides $7.3 million in daily liquidity rewards. This implies an annual rate of $2.6 billion and the strongest tailwind for YFI.

However, although YFI is currently the leader in Yield Farming, it is not the only one fighting for the “yield pie”. Apart from several (often questionable) forks of YFI, a couple of new Yield Farming aggregators such as APY.Finance and asset management platforms such as Set V2, appeared on the market, which will increase competition. In addition, as mentioned earlier, the current returns from Yield Farming will not last forever. Speculators will eventually stop buying this many new tokens, which will lead to lower returns. However, the successful launch of Yearn’s planned insurance, exchange, leverage, and liquidation products may diversify YFI revenue streams and provide additional value for YFI holders.

At present, YFI remains one of the most exciting experiments in decentralized management. The honest launch of YFI has created a large, diverse, and enthusiastic community of people who are extremely interested in the success of the protocol. Thanks to Cronje’s professionalism and leadership, the pace of Yearn’s new product launches is impressive. There are very few protocols that launch new products as fast as Yearn. However, although Yearn looks relatively smooth at the moment, applicants are entering the market, and Yearn is going to release many new products, the risk is still there. The coming months will show whether this nascent community can continue its magic and benefit all stakeholders.

FARMING YFI

One of the more talked about yield farming strategies of the past year is YFI’s newly launched liquidity mining. At its core, users stake their proof of liquidity in any of the supported ygov finance pools in exchange for YFI rewards. Each pool is capped at 10,000 YFI each until governance adjusts the inflation through onchain voting.

Please note that YFI yield farming is one of the most complex, the industry has seen to date and comes with a large degree of inherent risk. While we will show you how to yield farm, please recognize the risk of the opportunity and that there is an opportunity your funds could be lost forever.

yEarn FINANCE TUTORIAL

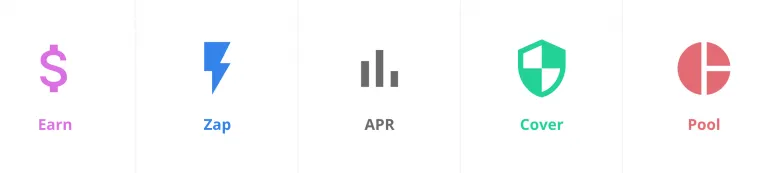

To start using yEarn, visit https://yearn.finance/. Here, users can choose between a number of products.

"Earn" is the powerhouse behind the product and is likely the option users want to choose to seek the best returns on the market.

Zap lets you “zap” into Curve Finance to aggregate stablecoin lending from DAI/USDT/USDC/TUSD with one simple transaction. APY is estimated by showing you the interest rate amongst different protocols compared to yEarn.

"Cover" utilizes Opyn to offer insurance on your holdings, while "Pool" lets users exchange between four stablecoins with minimal slippage, along with adding to larger liquidity pools.

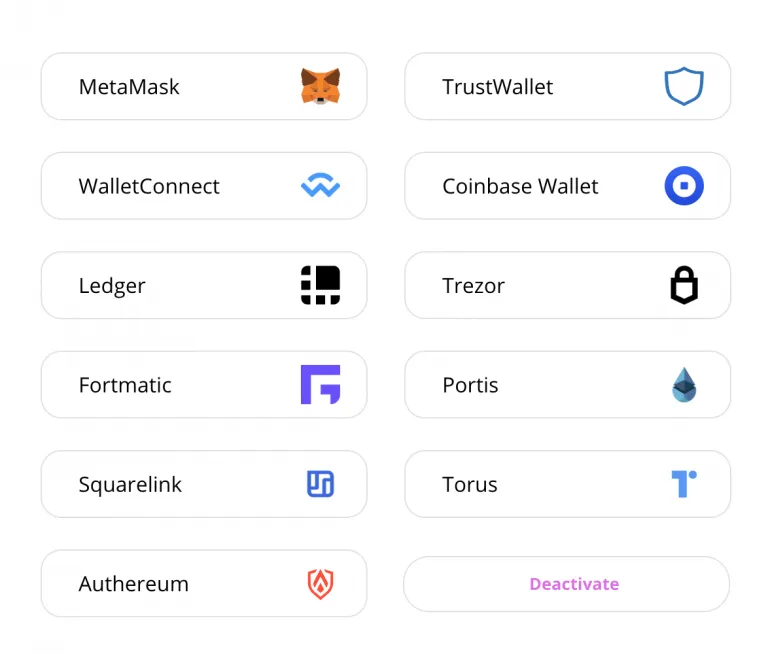

With “Earn”, users will connect with one of the supported web3 wallets ( MyEtherWallet, MetaMask and Coinbase wallet. Etc.)

From there, users are able to interact with trading pairs to start earning interest. Using DAI as an example, the system prompts users to deposit the amount of capital they’re willing to lend.

After the transaction confirms, Dai is converted to yDAI – yEarns’s interest-earning version of Dai. From there, users can even claim the yDAI and lend it on Curve for additional interest.

As of right now, yEarn largely support stablecoins with the intent to add other Ethereum-based assets in the coming months.

yEarn PRE SALE

yEarn project team will he having a public Pre-sale on bounce.finance by September 23rd, 2020. More details to be publish on every yEarn social medias channels.

For more Info, vist:

Website: https://www.yif.finance/

Twitter: https://twitter.com/yiffinance

Medium: https://medium.com/@yif.finance

Telegram: https://t.me/yifofficial

Author's Details:

Bitcointalk Username: Cryptolysm

Bitcointalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=2822410

Proof of Authentication Link: https://bitcointalk.org/index.php?topic=5276747.msg55226554#msg55226554