CRYPTO VOLATILITY WATCH - OCTOBER 2022

This week marks the 35th anniversary of Black Monday (or Tuesday if you’re in the Antipodean’s), the massive stock market crash of the late '80s which saw pretty much all of the world’s markets experience a gargantuan one-day decline in history, and the most impactful market puke since the Wall Street Crash.

On October 19, 1987, around $1.7 trillion (that’s right, not million, or even billion, but trillion…) was wiped out as the Dow Jones (DJIA) dropped over 22% and the benchmark S&P 500 index shed over 20% - in a single day.

To put that into perspective, during the stock market crash of 1929, the Dow lost just over 12% – less than half of the decline that occurred Black Monday in 1987.

Coming back to the modern day, the lessons which should have been learned the hard way thirty five years ago seem not to have gone in at all.

The financial landscape shares some commonalities with the markets back in 1987. Today, we have the highest inflation in decades and rising interest rates, all exacerbated by unchecked sabre rattling between superpowers, and an energy and logistics crisis in Western countries.

It’s tempting for crypto-hodlers to pretend that what happens in the traditional stock market doesn’t affect the crypto markets, but the fact remains that what happens on Wall Street absolutely matters to the cryptoverse.

As always, there’s a Bull case and a Bear thesis to weigh up, and both camps have the conviction that they are right - and ultimately, the market will eventually decide…

The Bear Case

The bear case is straightforward. The world is currently facing a liquidity crisis, as ‘cheap’ money is becoming increasingly scarce.

Perhaps it’s just the month - whilst September is often referred to as “spooky September” for its poor returns performance historically, all of the world’s major crashes during the 20th century took place in October.

But Bitcoin has tended to do quite well in the last quarter of the year, with October through December seeing some of the best months for BTC throughout its short lifespan.

The fact that the crypto markets haven’t continued this trend tends to suggest that the velocity and sentiment which could push the price above the current range just isn’t there.

Should Bitcoin break to the downside out of the range it’s been sitting in for a while, we could see a retest of minor support at around $17,000 followed by a potential return to major support levels at $12,500 and then potentially even $10,500.

The Bull Case

Despite the protestations of world leaders frantically trying to redefine ‘recession’ and gaslight the public with a mainstream media narrative that inflation is good for you, whilst simultaneously claiming it’s also transitory, ordinary citizens can see for themselves the effect of years (decade, maybe even centuries?) of money printers going brrr.

You might think that the psychological impact of this is fear and uncertainty - and it's arguable that today we are living through the epitome of peak fear - can only be Bearish as people move into cash, but we’re not really seeing this happen.

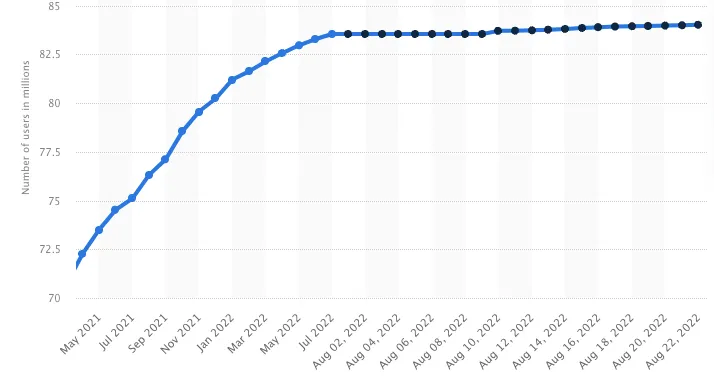

We aren’t seeing a decline in the number of wallets holding Bitcoin - in fact this important real world metric has pretty much flatlined, which tends to suggest one thing - users are HODLING not selling.

The other good news is that peak fear is when accumulation happens, and that tends to mark the point that the bottom is in.

This appears to be suggested by the technicals, which show Bitcoin winding into a tight wedge. If BTC can climb and close above this wedge, and it sure looks like its coming to a pivot point somewhere between now and the first part of November, then this could be a signal for a bullish market reversal.

It’s also worth looking again at the longer term chart to get a wider perspective, and Bitcoin does look like it’s already formed a double bottom (AKA an inverse head and shoulders pattern) and this can be a signal that a huge rip is about to take place.

Conclusion

As always, it’s impossible to say with certainty which thesis - the Bulls or the Bears - will win out, but the good news is that the world of decentralised finance is riding to the rescue thanks to it’s ability to enable novel financial products and services for the crypto-savvy.

Bumper is one such DeFi protocol currently under development, which seeks to protect crypto from market dumps in a completely new way - which not only softens the impact of the downside but doesn’t restrict gains from the upside either.

For crypto-hodlers, traders, Degens and even fund managers, Bumper’s innovative crypto price protection has something for every outlook and strategy, from insulating yourself from further downside to preserving profits after a run.

Want to know how? Check out the Bumper flashpaper for a simple overview of how you can protect your wallet's value like a Boss!

Disclaimer: Any information provided on this website/publication is for general information purposes only, and does not constitute investment advice, financial advice, trading advice, recommendations, or any form of solicitation. No reliance can be placed on any information, content, or material stated on this website/publication. Accordingly, you must verify all information independently before utilising the Bumper protocol, and all decisions based on any information are your sole responsibility, and we shall have no liability for such decisions. Conduct your own due diligence and consult your financial advisor before making any investment decisions. Visit our website for full terms and conditions.