Ripple cryptocurrency that has experienced a huge increase around the new year, is one of the "veterans" among the cryptocurrencies. Ripple has been in existence since April 2013, when it was issued at a price of $ 0.005. Since then, it has risen to a far higher price and has penetrated the 3rd place of all cryptocurrencies according to CoinMarketCap.

Image source: elevenews.com

Ripple (XRP) is a cryptocurrency designed in 2012. Ripple in the narrow sense of the word does not essentially represent a cryptocurrency, but a protocol for transferring money. It is designed as a protocol for international payments between banks. The basic idea is to replace the old principles of work, such as SWIFT (which was developed in 1972, continues to be used). It strives to work with the current financial world, and its goal is to be a global network, a platform that will allow anyone to transfer money in any currency into any currency in a few seconds. Similar to Bitcoin, it uses blocked technology (blockchain). But compared to Bitcoin, transactions in the Ripple network are faster, transaction fees are far lower.

RIPPLE (XRP) and RIPPLE PROTOCOL

Let's start with frequent confusion - mixing the concept of the Ripple protocol with the XRP cryptocurrency (also called Ripple), and released by Ripple Labs. XRP refers exclusively to the encryption used by the Ripple protocol. However, it should be noted that the XRP is not required for the network to function or obligate the company that implements the protocol to use this cryptocurrency.

In order to understand how it works, it's useful to know something about the Real-Time Gross Settlement System (RTGS) and the Ripple Transaction Protocol (RTXP) in real time. For example, when money is sent via Bitcoin, the value is settled in real time (not counting any bitcoin delay), and this is what we mean by RTGS.

Ripple uses something called "gateways". It is basically a digital portal used by financial institutions, companies and governments to join the network. This is called RTXP, formally known as Ripple Network. When a financial institution, company, or government joins RTXP, it can conduct transactions with other gateways with a fraction of the costs and at much higher speeds.

For a more detailed explanation of how the protocol works, we suggest you look at this video:

It should also be noted that the Ripple network also functions as a currency exchange between all types of currency currency (USD, EUR, etc.), but it must be able to guarantee liquidity for this purpose. This is where XRP comes. XRP is a digital value that is made especially for entrepreneurs as a choice on demand for obtaining liquidity in cross-border payments. Banks can use XRP on a real-time liquidity source on demand, while payment service providers use it to reduce costs on foreign stock exchanges, improve the rate of seating payments or reach other markets.

WHAT MAKES RIPPLE (XRP) SPECIAL?

As a cryptocurrency there are several features that make it different from others. It can not be mined - it has a fixed stock of 100 billion XRP tokens. The Ripple network within which XRP is used currently consists of 75 computers owned by private companies. Verification of transactions is based on the "Proof of Work" principle, but due to the small number of computers in the network and the high "mutual trust" between the computers, it is not necessary to use high-algorithms. This leads to very fast transactions, an average of 4 seconds per transaction. The transaction fee also remains extremely low, only 0.00001 XRP, and the number of transactions per second (TPS) for Ripple is as much as 1500.

Such characteristics make the XRP the fastest crypto-shell, but again, it should be recalled that it is a crypto-not intended for the public, but as part of a network of large institutions.

WHO USES RIPPLE?

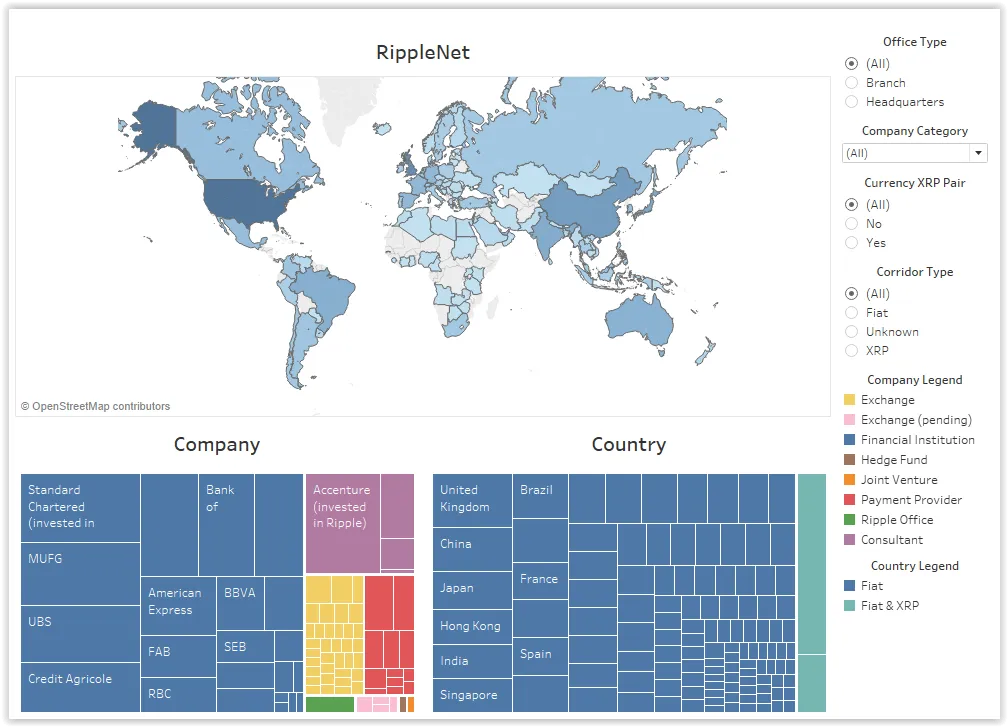

Over the past couple of years, Ripple has formed an experienced team with offices around the world thanks to an experienced team - New York, San Francisco, London, Luxsembourg, Singapore, India and Sydney. The list of companies using the Ripple network includes a number of financial institutions: SBI Remit, UniCredit, Axis Bank, SEB, UBS, Credit Agricole, Westpac, Santander ... According to CNBC, more than 100 companies cooperate with the Ripple team.

CENTRALIZATION PROBLEM

Although all this sounds great, there is a reason why Ripple is so fast. Lack of decentralization. This network is a closed network that can not easily connect new computers. This means that there is a large amount of centralization, which many pose as the basic problem of this cryptocurrency.

Ripple is not just centralized in the sense that computers that make up the network are actually owned by private companies. That's what's expected. This is not a public cryptocurrency, but a strictly specialized one. But what most troubles cause you to doubt about Ripple is distributing XRP tokens. We mentioned that the XRP can not be mined and that there is a fixed maximum amount of Ripple, 100 billion. But if you go to coinmarketcap.com you will see that at present there are 39 billion Ripple in circulation.

WHAT IS WITH REMAINING 61 BILLION?

When Ripple was launched, it was agreed that the maximum amount would be 100 billion. The founders retained 20 billion, 18 billion were put into circulation, and 61.4 billion were retained by Ripple Labs. The rest was shared with charity associations in March 2013, such as Computing for Good.

This caused great concern from the investors because of the fear of the sudden sale of those 61 billion tokens and hence the sudden collapse of value. In order to address this concern, Ripple set up 55 billion XRP tokens in a cryptographically safe escrow account in May 2017. Each month, 1 billion XRP tokens are released from that account, and the status and distribution is publicly available on the official Ripple Charts website. Also, for every 2 new private computers of some company in the node, Ripple will remove from the network 1 their own computer. This also seeks to achieve greater decentralization. On the whole, on the one hand, it could be said that the system is centralized, but should also take into account the particularity of the system as well as the transparency and experience of the company.

IS IT WORTH INVESTING IN?

As much as the recent centralization story is current, several key factors need to be considered:

- It is an experienced team that has been successfully running this project since 2012

- For a few years, they have made more than 100 partnerships with various financial institutions

- RTXP protocol is still actively improving and a lot of money is investing in its development

Do you HODL any Ripple? Let me know in the comments below: