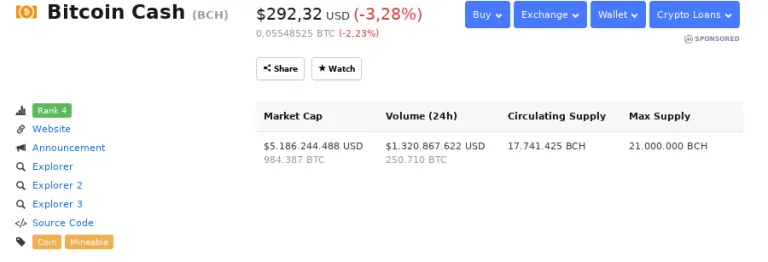

The cryptocurrency market started the last week of April with a strong bearish trend, which has painted the main cryptocoins of the ecosystem in red. For some it is just a sign of correction before a new bullish rally that has been predicted by many analysts that will happen after the weekend. The ecosystem maintains good levels even during the storm, of market volume, around $ 177 billion dollars, with a BTC dominating the scene with more than 52%. The big winners of the week as they were BCH, have seen their prices fall by lower levels of the psychological barrier of three hundred dollars. At the time of writing, BCH traded at a spot price of $ 292.32 per unit, a contraction of at least -3.28% in the last 24 hours.

However, its volume has increased to $ 1.32 billion and its capitalization market now stands at $ 5.18 billion, which allows it to anchor itself in the 4th position with a great advantage over EOS and LTC, its most immediate competitors. In the short term, Bitcoin Cash (BCH) is listed on BINANCE in the 1H chart with a slightly bearish trend, in a descending channel that peaked on April 15, when it even reached the price levels after last year's fork.

The Parabolic SAR indicator is bullish, with a well-marked path below the candelabra. The Bollinger Bands have begun to take bullish momentum, with a convergence indicating the end of the volatility of the altcoin and a few Japanese sails ready to break above the upper band, synonymous with entry to invest and collect fruits in short. As if that were not enough, the RSI indicator shows bullish symptoms, with higher buying pressure on the sale, although still at far overbought levels. In the medium-long-term scenario, BCH does not present a different scenario than the 1H chart. In this case, the Cypher pattern has an upward trend, with a momentary price correction that suggests that BCH will soon reach maximum levels of R1 close to $ 350 per unit. Your key support point is at the $ 240 level.

The Aroon indicator presents a parallel crossing of its two tendencies, but with greater emphasis on the Aroon Downtrend (red) heading to the fund, synonymous with the next bullish wave is on the way. The Stochastic has nevertheless come down sharply, due to the higher selling pressure on investors who have taken profits from open positions at the maximums achieved by BCH days ago. To finish Chaikin Money Flow (CMF) is shown with great outflow of capital, product of the withdrawal of profits from the ecosystem. In conclusion, Bitcoin Cash has undoubtedly positioned itself as the most important altcoin derived from its Bitcoin genesis within the cryptocurrency ecosystem. If something Roger Ver team has achieved, is to catapult each of the improvements of the BCH ecosystem as low fees, fast transactions and greater adoption thanks to the proposed scalability raised by its developer team that improved and differentiated from the beginning of the original proposal of Satoshi Nakamoto.

Now it remains to wait, if BCH will manage to stay on top of the ladder and be able to catapult more adoption that will allow him in the medium term to dethrone his next stone on the road: XRP. For now, the task seems quite uphill, to take into account that XRP has almost x3 the volume of BCH of stock market capitalization. Already rising in less than a month, from the seventh box to the fourth place, is much that any investor could have imagined in the medium term.