It has often been said that “like begets like” and just like the cliché “show me your friend and I’ll tell you who you’re”. The coming of the blockchain technology led to the introduction of many technological innovations.

It has often been said that “like begets like” and just like the cliché “show me your friend and I’ll tell you who you’re”. The coming of the blockchain technology led to the introduction of many technological innovations.

The most utilized and efficient platform that is powered by the blockchain is digital assets otherwise called cryptocurrencies. Both the blockchain and crypotcurrencies work hand-in-hand with the latter being used in the implementation of the former.

Cryptocurrencies are gradually taking over the financial space and are set to replace fiat currencies. Recently,CoinMarketCap conducted a research on cryptocurrencies and the result of the research showed that there are over 900 cryptocurrencies and are valued at $290 billion.

In a related development, crypto investors are of the opinion that cryptocurrencies will hit an all-time value of $1 trillion USD by the end of 2022. From another perceptive, there was massive improvement in crypto transactions. The transaction value moved from the previous value of $100 million USD in 2017 to its current estimated value pegged at $6.6 billion USD.

Despite its high volatility and positive prospects for the future, cryptocurrencies are no way close to fiat currencies. Though some crypto investors believe it can be used as collateral, the application of this in reality seems daunting.

Existing Problem

Cryptocurrencies are viable assets and are good for business transactions. Investors are smiling to the bank when the chips are up but when the value of cryptos take a downturn, they tend to run into debts and eventual bankruptcy.

Most times, investors seek for loans to top up their trades. Typical with every volatile business, crypto traders and investors often run to financial institutions such as banks to lay tender for loans.

You might be familiar with the stringent modalities you get to undergo when applying for loans using physical items such as houses and cars. Then imagine how the scenario will be when banks cannot see the asset you want to present as collateral.

That is the situation with crypto. Since they’re not physical assets (but rather digital) and having no centralized base or location, it will be foolhardy for any financial institution issuing loans in such situations.

So since cryptocurrencies cannot be collateralized, investors cannot obtain loans that will help them in their trades. Cryptocurrencies have high volatility and their value shoots up to the sky almost at hourly intervals. So if an investor seeks for loan to invest aduring such crucial moment, it won’t be possible as cryptos won’t be accepted as collaterals neither can they be withdrawn as fiat currencies.

The only option open to crypto investors is trading off part of their cryptos. In this light, a solution has to be developed and immediately too.

A Light at the Tunnels’ End

The solution to these problems would be in form of a platform that will accept crypto-collateralization or any other digital asset as collateral. The platform that was found worthy of this is known as ECoinomic.

The Solution called Ecoinomic

#Ecoinomic is here to solve problems associate with the acceptance of crypto as collateral. The Ecoinomic platform will accept cryptocurrencies and other digital assets as collaterals and in turn, issue fiat currencies to prospective crypto investors and start-up companies.

With the platform offered by Ecoinomic, the gap that existed between traditional financial platforms and borrowers will be bridged. If you’ve been contemplating trading off part of your cryptos to third-parties in exchange for fiat currency, I’ll advise you extend the same act to the Ecoinomic platform.

Ecoinomic will hold your collateralized crypto in place pending when you settle the loan issued to you. Cryptocurrencies are very volatile and because of this, Ecoinomic is offering its users short-term loans that can be repaid in 30 days interval.

If you opt for short-term loans, you’re indebted to the sum of 50% loan-to-value ratio and 10% interest per year on the loan issued to you. Ecoinomic will be responsible for any risk that arose from the transaction. Your part is to submit valuable portion of your digital asset (cryptocurrency) that will be commensurate to the loan applied for.

Ecoinomic keeps your cryptos in good stead and refunds them to you after you might have repaid the loan and its accrued interests.

Conclusion

If you’re looking for a way to obtain fiat currency loans using your digital assets, Ecoinomic is here to offer you the needed service. You can sell your cryptocurrency to the platform and get fiat loans to solve your pressing need.

If you however want to get your crypto back when repaying the loan, the Ecoinomic platform offers you the same value of crypto you used for collateral at the same rate you sold it notwithstanding the market volatility. The Ecoinomic platform offers both short-term and long-term loans to suit your needs.

Token Distribution

- Token Sale: 72%

- Team: 13%

- Advisors: 12%

- Pre-Sale and Development Stages: 2%

- Bounty: 1%

Token Specifications

Ticker: CNC

Token Standard: ERC20

Platform: Ethereum

Price: 1 CNC=$0.12 USD

Soft Cap: 6 million USD

Hard Cap: 106 million USD

Accepted: LTC, ZEC, BTC, NEO, BCH, XRP and XMR

Country: Estonia

Restricted Areas: China, Singapore and USA

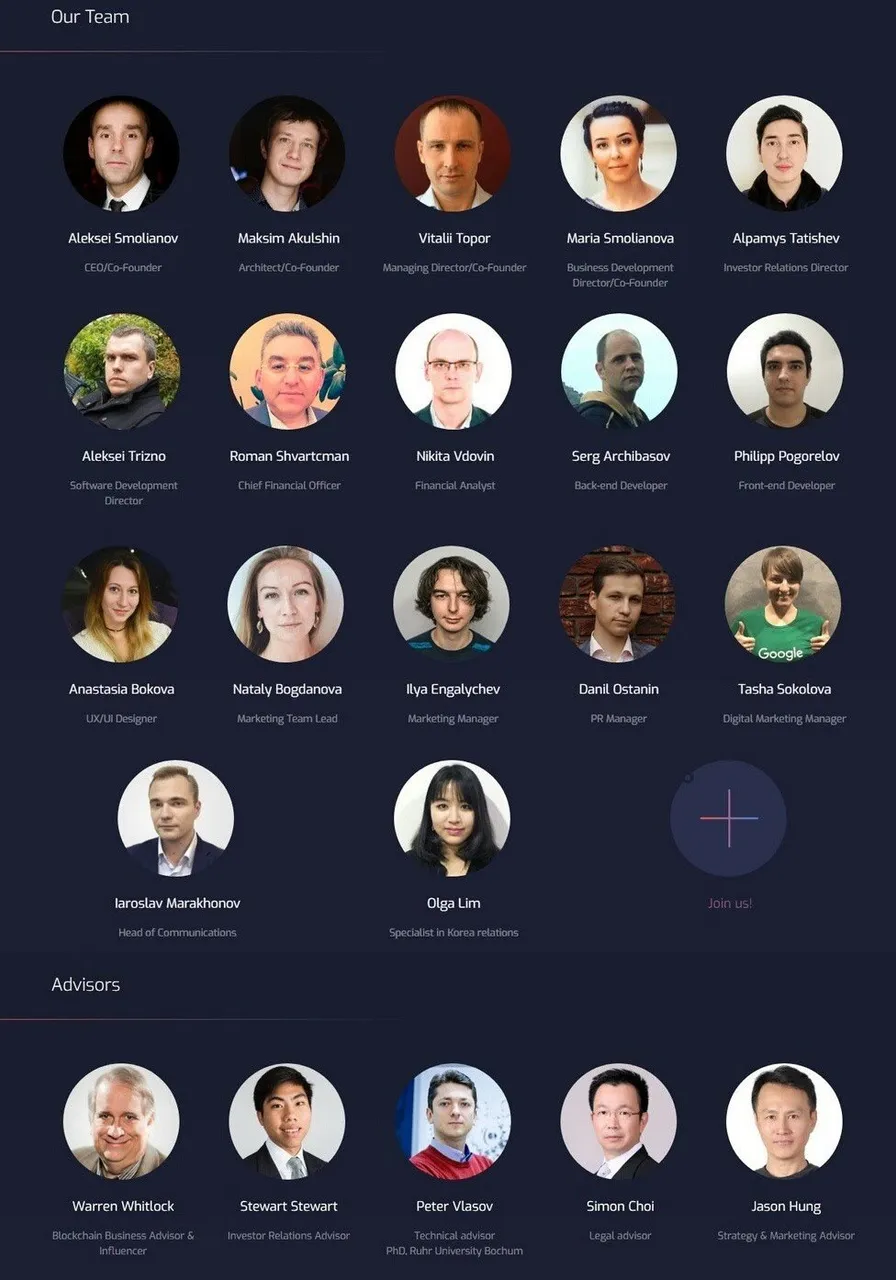

The Team

Partners

For more information about the project following the links below;

Website: https://ecoinomic.net/

Whitepaper: https://ecoinomic.net/docs/WP

Telegram: https://t.me/joinchat/AAAAAEr4kO0ZRm92LNGwLA

Twitter: https://twitter.com/Ecoinomicnet

Facebook: https://www.facebook.com/ecoinomic

Writer: PLMovs

Bitcointalk Profile URL: https://bitcointalk.org/index.php?action=profile;u=2035939