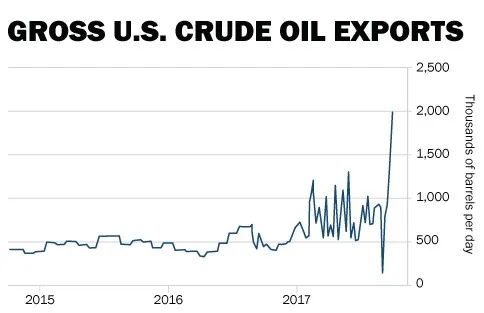

U.S. crude-oil exports are soaring. As you can see in the following chart, they have more than doubled to nearly 2 million barrels per day ("bpd") over the past few weeks...

This is particularly impressive when you consider that the 40-year ban on U.S. oil exports was lifted less than two years ago.

The government finally repealed this law in December 2015. Prior to that, U.S. producers could export only to Canada, and rarely shipped more than 500,000 bpd.

This trend is likely being driven by the growing "spread" between the two major oil markets. U.S. oil (known as West Texas Intermediate crude oil, or "WTI") is trading at its biggest discount to Brent crude (the international benchmark) in more than two years. As the Financial Times reported...

On Wednesday Brent crude settled at $55.80 a barrel, while West Texas Intermediate crude was $49.98 a barrel.

Production cuts from OPEC, whose members are concentrated in the eastern hemisphere, has helped push up the Brent price. Hurricane Harvey also slowed US refineries' intake of domestic oil, causing supplies to build up and prices to fall.

"This is classic Oil Markets 101: too much crude in the US and too little crude elsewhere means that US prices weaken relative to global prices, and exports increase to address the imbalance," Société Générale said in a note.

The move may be overdone in the near term. U.S. refining activity is already recovering from Hurricane Harvey. But the larger trend could be just getting started...

If OPEC maintains its cuts – and the latest news suggests it's now looking to extend them through 2018 – while U.S. production rises, exports should continue to move higher.

'Oil's next leg higher could be starting'...

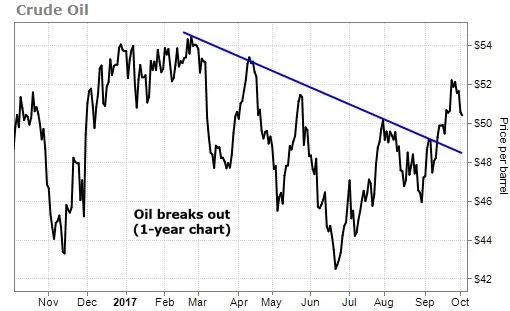

While the spread between Brent and WTI has been growing, both benchmarks have been moving higher over the past few months.

Since bottoming near $45 in July, both are trading back above $50 per barrel today. We could see an even bigger move higher shortly.

The price of oil is up more than 80% since 2016... But the rally may not be over... If this time is anything like the past, the price could still run another 57% or more.

The proof is in the numbers... Following its four prior busts of 50% or more, oil soared an average of 327%. And even if you take out the biggest boom – a massive 733% rise – the average is still 191%.

Oil's most recent bust was its biggest in 30 years... a 77% drop from peak to trough. But oil hasn't seen anywhere near an "average" 191% gain off its February 2016 low... yet.

Of course, we can't know for certain...

Many factors influence oil prices.

But history has shown that most of the time, "this time" isn't different. And there are fundamental reasons to believe prices could be headed higher still.

Since August 30, oil prices have jumped up 9%.

OPEC and Russia have cut back daily oil production by nearly 1.8 million barrels this year. And even though U.S. oil companies have increased production, these cuts have reduced supply.

Also, China's oil demand has picked up. Its crude oil inventories fell by 3.4% from July to August. And its total fuel stocks fell nearly 1%, to their lowest level since December 2016. China is a major global driver for growth. And it is primarily a crude-oil importer. So when its economy expands, it uses more oil and inventories fall.

As you can see below, these factors contributed to oil breaking out of its short-term downtrend...

This is a sign of strength for oil...

The level to watch here is $53 per barrel. If oil can push through this multiyear downtrend and hold above the $53 level, oil's next leg higher may be starting.

Consider buying UWT, which is a 3x leverage oil ETF.