Content adapted from this Zerohedge.com article : Source

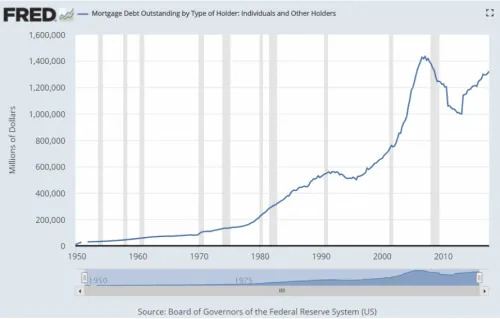

Mortgage backed securities are starting to heat up. With many asset classes at all-time highs, investors are looking for a return. This is causing them to chase meaning MBS, specifically, subprime mortgage backed securies are coming back into favor.

This is a problem since anyone with a FICO score about 500 is getting a home mortgage.

Issuance of securities backed by riskier US mortgages roughly doubled in the first quarter from a year earlier, as investors lapped up assets blamed for bringing the global financial system to the brink of collapse a decade ago. Home loans to people with scratches and dents in their credit histories dwindled to almost nothing in the aftermath of the crisis, as litigation-weary lenders retreated to patch up their balance sheets.

But over the past couple of years a group of specialist firms has begun to bring the loans back, navigating a dense web of new rules drawn up to protect borrowers and investors in the $9.3tn US home-loan market. Last year saw issuance of $4.1bn of securities backed by loans that would have been called “subprime” before the last financial crisis, according to figures from Inside Mortgage Finance, with the pace picking up in the latter half of the year. The momentum has continued into 2018, with deals worth $1.3bn in the first quarter — twice the $666m issued in the same period a year earlier.

After the central banks spent trillions to get the world passed the last crisis, we see investors and buyers behaving like they did in 2006 and 2007.

Hedge fund managers are looking at this like it is just another investment class.

“The market is . . . starting from such a small base that it has a lot of room to grow,” said Jamshed Engineer, a partner at Axonic Capital, a New York hedge fund with more than $2bn in assets under management.

“[Investors] are definitely chasing yields. Whenever these deals come out, for the most part, they are oversubscribed.”

Proposed roll backs in the Dodd Frank bill would restart what happened 10 years ago.

Once again, the rating agencies think everything will be just fine.

"The risk is contained, in our view," said Mr Saha.

Non-adapted content found at zerohedge.com: Source