While the media is reporting that Coronavirus fear is causing a sell-off in the markets and this is the reason for the historic 3600 point loss in one week, but the facts do not spin tales of Coronavirus, they tell a whole different story. The story begins way back in 2008, with a little boy kicking a can down the road, the little boy I'm referring to is the United States government who bailed out the biggest bunch of crooks in the history of the world, The Central Bankers.

You remember those guys, the ones who stole a whole generation's worth of wealth during the 2008 financial crisis. The Federal Reserve started printing money out of thin air, padding their buddies pockets, Quantitative easing, simply said " Give the money to the rich and it will trickle down, ( Trickel Down Economics)" In 2009 all the CEO's at all the major banks got record dividends and bonuses whilst the American citizen lost retirements and millions of homes.

This caused more people and companies to use more credit and this pumped the stock market to historic highs.

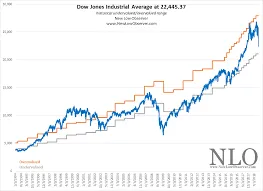

The two humps you see are the "Dot Com bubble" and the next is the 2008 financial crisis and then you see artificial inflation of the economy to the point we are at today.

Like every Ponzi scheme, the house of cards is collapsing. The catalyst for this is the Corona Virus, but not the cause. As I'm writing this it is Friday, February 28th and I know that historically Monday could be Black Monday depending on the Coronavirus news but the facts don't lie as the media does. We could be on the precipice of the largest global meltdown in the history of mankind.