Week 36 - Sept 6 Investment Moves

- Current US markets

- Sept 6 - Option Trades.

- Next week passive income (Week 37)

- Adding more BTC.

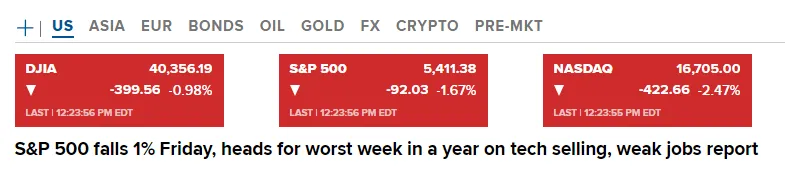

Current US markets

As of 12:25 pm (EST), the market was having a hard time. The markets are back to selling off, especially the NASDAQ down 2.4%

We knew that September had been once of the worst months for the stock market. Next week, we might see more of this "risk-off" trade. Some are selling AI stock and moving that into mid-cap holdings.

Sept 6 - Option Trades.

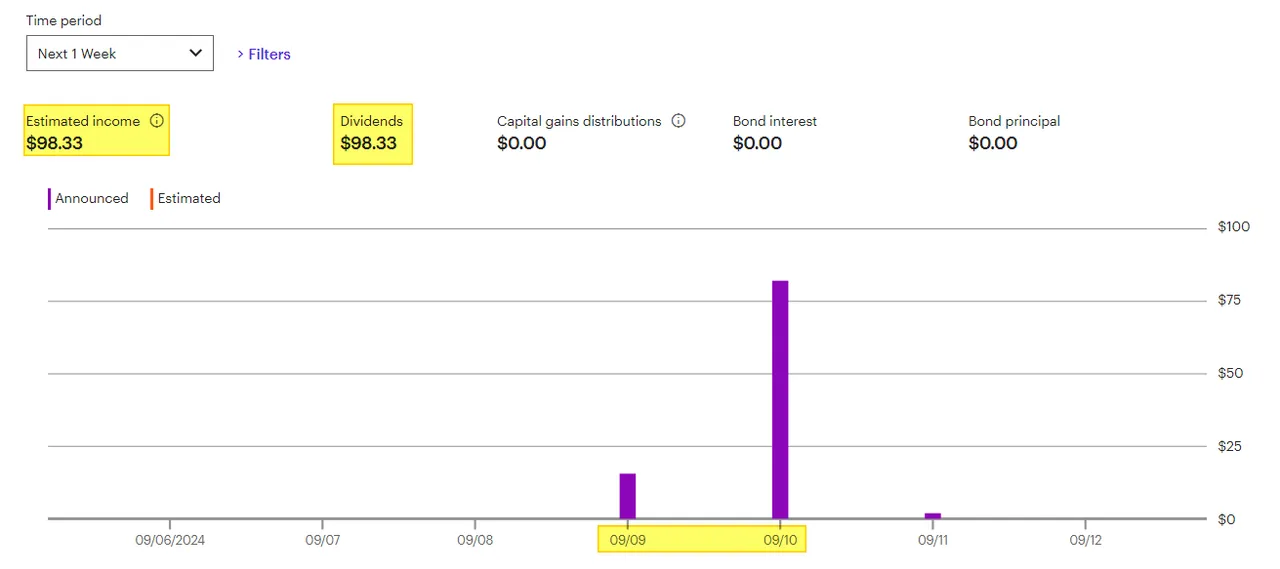

Next week's passive income (Week 37)

If you have been following my previous post, you know I have been selling some boring dividend stock. The goal is for me to switch more to ETF (like QQQM, TMFC, and VHT) with some of them paying a small dividend. I wanted to make sure that I was properly diversified.

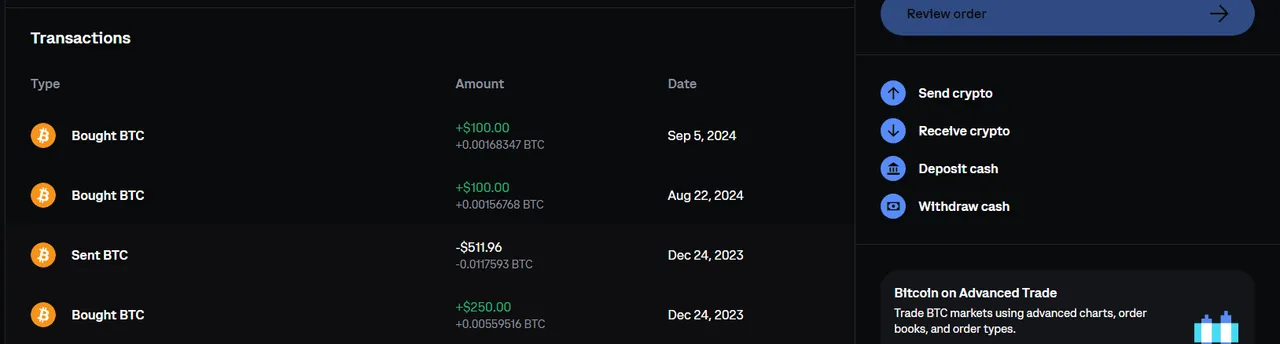

Adding more BTC.

Recently, I added $100 in August and September by buying BTC. I don't care if BTC is at $57K or $61K. I'm dollar cost averaging into the position and need five or ten more years to build my position size. Because my position size is small compared to what I have in Stocks, or cash for option trading, these trades in BTC will not move the needle.

Do I care if BTC is $40K or $100K? The answer is no. I prefer if BTC is under $60K, so I can continue to add BTC into my bags. Ultimately, if BTC trades at $500K it wouldn't change my life. The reason is that I don't have enough BTC to matter. To make a difference, I need to continue to add more at reasonable prices (say under $100K BTC) and when I cash out, it will trade between $500k-$1M each). That would mean I will make about 5x return or more. If I used the STOCK market that might mean waiting between 15-22 years for me to reap the same type of returns.

This is why I believe BTC and ETH can get these types of returns faster than the stock market.