*image from richdad.com

Hi there hivers,

I have something on my mind that I want to share here..

I was having a good and interesting back and forth with fellow hiver @patriciaang

about finances and it led me to ask if she ever read this book

Rich Dad, Poor Dad by Robert Kiyosaki. (He's from Hawaii too)

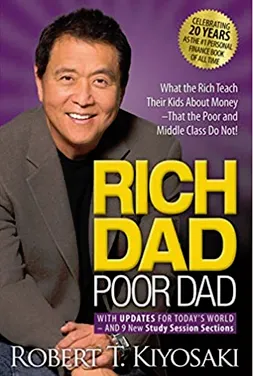

*image from amazon.com

This book had the biggest impact on how I think about finances. In fact, I joined a club that met once a week just to talk about Rich Dad stuff (there was a whole course) and we also would play the game CASHFLOW..

This game (there is a boardgame version as well as a e-game) has each player take turns moving on the board, collecting various deals and doodads, trying to get out of the rat race. Ultimately trying to achieve a dream and amass enough passive income (income that keeps coming from something you did only 1 time.. such as buying a house that you collect rent on)

The main thing I learned and took away from this game was the two tables that are combined to make the cashflow sheet. The two things are the Income statement

Income

-------

Expenses

and under it is a Balance sheet

Liabilities | Assets

The goal is to have our Income (anything that puts money in your wallet) equal to or more that your expense. (anything that takes money out your wallet). I remembered that to get out of the rat race, I had to have enough income to cover my expenses.

What about the Liabilities and Assets? Well, they affect your income and expenses greatly. A liability (the biggest one I remember was having to pay $1000 a month, every month, just to belong to a country club where I play golf!) is anything you own or have that adds to your expenses. An asset, on the other hand, is anything that adds to your income or is held for capital gains, such as having gold coins that you can sell later on for cash)

*pic from pixabay

Another lesson, almost as important (and in the long run, maybe much more important) is to Increase your Assets, and limit/decrease your Liabilities.

Here are my current assets/Income:

- HP and hive account

- Crypto holdings

- Stock trading account

- Real estate

- Online Gaming (Alien Worlds)

My expenses/Liabilities:

- Housing (rent)

- Utils

- Food

- 2 kids

- Misc (uber, entertainment, clothes, etc)

As you can tell, my current income/assets to expenses/liabilies ratio is about even. Of course I would want to greatly increase my Assets, thereby increasing my income, but as I slowly work on that, I am pretty contented.

*pic from pixabay

ps. I don't plan on getting rid of my kids or to stop eating, so I guess that's about as small for expenses as I can get it. I do look forward to living on my own land in the near future and NOT having to pay rent. Who knows, one or both of the kids might also get married or make millions and give me stuff for a change. :P