Throughout history we have seen different bubbles there were the tulip mania, railroad mania, housing bubble and one after another economic bubble. They all have one thing in common when they burst it was not the end of the world and it the respective markets recovers in one way or another and has given birth to innovations. To understand the great thing about bubbles you need to look long term so we will dive into some of the bubbles which cryptocurrencies are being compared to and some of them they should be compared to.

Tulip Mania

We often hear of bitcoin being compared to the tulip mania of the 1600's but as I researched it I found out nothing is as it seems. And the real tulip bubble was not as big as we are lead to believe. But we first of all have to think about the time when that happens. It was the time of exploration were Europeans took home new things from around the world. Just like if we today took a spaceship to Alpha Centauri and brought back alien plants and life, we would be ecstatic and the product that they come home with would be scares and price would rise.

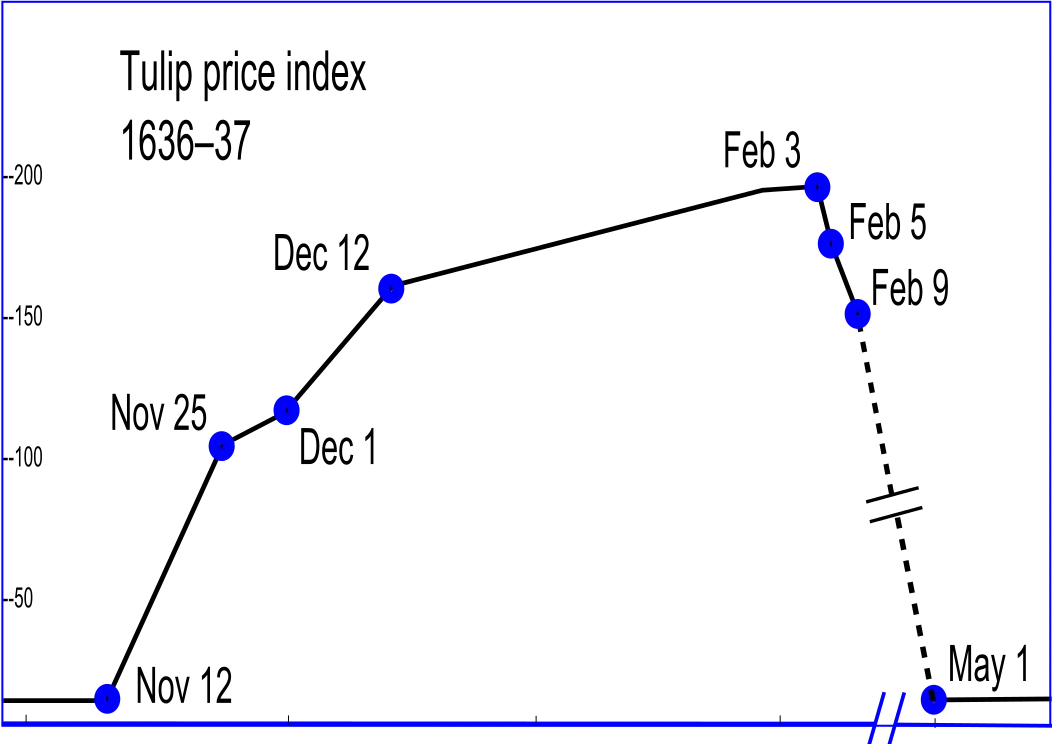

The tulip was a new flower introduced into to Europe around 1593 and was a hard flower to grow, and as it became more and more popular the price did rice but the bubble came in 1636-37 as the figure below shows and what we are interested in is the aftermath.

Source: https://en.wikipedia.org/wiki/Tulip_mania

No doubt the tulip market did crash and were a long time to recover, and it left a lot of people poor and out of credit. But today in the Netherlands, agriculture and horticulture represent a small share of the total economy. Despite this fact, the tulip has been the most exported flower bulb for many years now. In 2014, 2 billion tulips were exported worldwide. A distant second, 1.1 billion lilies were shipped throughout the world.

So yes the tulip market has recovered but is instead of making back its price the tulip industry has bloomed with mass production of tulips and is giving a great export product that is in use all around the world.

The main difference between tulips and cryptocurrencies is that tulip has little to no innovation where cryptocurrencies as all electronics are ever evolving.

Railroad mania

A better bubble for comparison is the time of railroad mania a bubble with a technology there is evolving to this day. But what was railroad mania.

Railway Mania was an economic bubble in the United Kingdom in the 1840s that involved a railroad development frenzy and a speculative bubble in the shares of railroad companies. Like the Dot-com bubble of the late 1990s, the British Railway Mania was the result of overexuberance toward the business prospects of disruptive innovation; though railroads are now a part of everyday life, they were once every bit as revolutionary as the internet was when it was first introduced. As railroad stocks soared to astounding heights, railroad companies massively overbuilt thousands of kilometres of railway lines throughout the UK. When the Railway Mania bubble eventually popped, many railroad companies went out of business, railway stock investors were ruined, and enormous debts were left throughout the country.

Unlike most bubbles, where little value tends to remain after the bubble pops (such as the Dutch Tulip Mania), Railway Mania helped to spur significantly the development of the UK’s railroad system, which became one of the most advanced in the world. In this regard, the UK’s Railway Mania is often compared to the telecommunications bubble of the late 1990s, in which large amounts of fibre-optic cable was laid throughout the world, including deep under the ocean. Although the telecom bubble popped, it left behind valuable communications infrastructure similar to how the Railway Mania left behind valuable transportation infrastructure. In the years between 1844 and 1846, 6,220 miles of railway were built, which remains an integral part of the total 11,000 miles that currently exist in the United Kingdom. Many of the routes that failed after the railroad bubble popped eventually became viable and profitable after sizeable well-managed railroad companies purchased them.

DOT-Com bubble

To take a more recent bubble for comparison, we have the DOT-com bubble which left a wake that you might remember.

By the early 1990s, personal computers were becoming increasingly common for both business and personal use. Now that computers were finally becoming reasonably priced and relatively user-friendly, they were no longer relegated to being the domain of geeky hobbyists.

In the 90's the industry shifted its focus from developing newer and more powerful hardware to software development. The reason for this shift in focus was because computer software had a very high-profit margin, unlike the margins on computer hardware. This was one of the reasons funding to companies increased this forced up the price of stocks to an all-time high, at one point it was said that Silicon Vally turned out a new millionaire every 60 seconds. And now we got the recipe for a bubble. When the bubble burst there were a lot of companies going bankrupt and people losing all their millions. And if we look at the aftermath of the dot-com bubble, we will be surprised at how good it was for the industry.

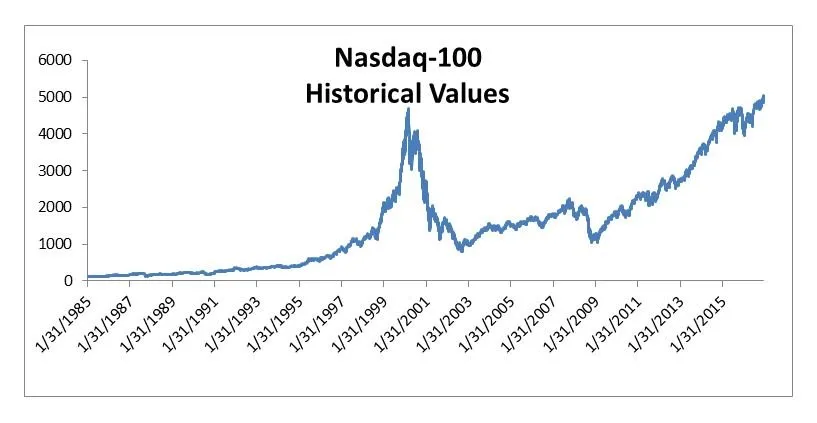

Looking at our world as it is today and looking at the Nasdaq index we are much depending on information technology that it has pushed the Nasdaq index to highs seen back in the dot-com bubble, and this shows that the bubble was bursting cleared the way and allowed the industry to see what has long-term promise. And weed out the companies that were more show than business.

Source: theredish.com

Cryptocurrencies

I have chosen to highlight the bubbles I often hear when people talk about the bitcoin bubble but I could take on of the bubbles I have researched such as The South Sea Bubble (1720), The Mississippi Bubble (1718-1720), Stock Market Crash of 1929, Kuwait’s Souk al-Manakh stock bubble (the 1980's) or Stock Market Crash of 1987 or "Black Monday". But the conclusion will end up the same were the bubbles end up weeding out the companies/currencies/products that are not viable in the, but the strongest companies/currencies/products end up getting even stronger. And once we see a real cryptocurrency bubble we will also see an increase in the number of ICO's and forks we saw it in late 2017, but I didn't reach right devastating bubble hights, and this survival of the cryptocurrency market has made more people confident in investing once we turn to a bull market.

In the aftermath of a cryptocurrency bubble, we will see the coins with most longe term viability survive it may not be the those with the most superior tech, but I will most likely be the coins with the most adoption.

Posted from my blog with SteemPress : https://cryptoms.online/2018/04/25/are-economic-bobbls-a-good-thing/