Cryptocurrency markets are highly volatile, regardless of a bull or bear cycle. While many may not admit it, it is this volatility that brings opportunities and attracts investors. Several cryptocurrencies experienced a bull run in March, though the BTMX token outperformed most. The token managed to go from approximately 1 cent to over 30 cents in a matter of weeks; this heavy boost was partially influenced by margin traders who had opened 10x long positions on the BTMX token.

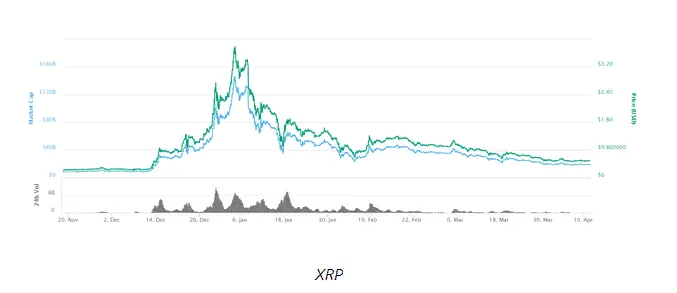

Due to the sharp rise in token value, some traders sold their leveraged positions which added deep sell pressure to the order book, driving down the price. This is common behavior in every market: as an asset experiences an incredibly sharp increase in value, traders face sell pressure which causes the price to drop again. This is not a story unique to BTMX. Even highly liquid assets have had similar experiences. The price chart of XRP from November 2017 to March 2018 serves as a vivid example. From November 2017 to early January 2018, XRP rose nearly 2000%. This sharp increase was followed by a sharp decrease as a large number of traders sold their holdings to take advantage of the gains.

Markets are naturally volatile—even more so in cryptocurrency. The example above is not the only case in which an established coin with high liquidity can also face extreme turbulence.

Below is another example of XRP’s turbulent movements:

In mid-September 2018, the XRP token experienced record gains as its value nearly tripled in a matter of days. However, this was followed by a steady decline soon after. It is clear that this asset is highly volatile, though this does not necessarily reflect the long-term potential of XRP.

Volatility is not unique to cryptocurrency. Real estate, the largest asset class in the world, has experienced sharp movements in both directions. Prior to the 2008 financial crisis, the US housing market diverted from its natural inflationary rate and rose at an increasingly accelerated pace up until the financial crisis. The market experienced a sharp pull-back and prices dropped drastically. However, the pull-back did not completely erode the value of real estate. Once the financial crisis passed, the price of homes in the US retraced to their natural inflationary rate.

One of the key reasons for volatility in a market as big as real estate is the fact that much of the buying and selling is done with credit, which is essentially margin. Leveraged markets are more prone to volatility but they give traders and investors greater opportunities to profit. Similarly, leveraged order books in the cryptocurrency market lead to increased volatility of the asset, but margin ensures that traders are able to take amplified advantage of any opportunity that presents itself.

Like the rest of the cryptocurrency market—and even the RE market—the BTMX token faced a sharp drop after an extreme rise. This is not an anomaly, especially given that the price of BTMX is still up more than 10x. The exchange’s reward pool is still growing; and new high-quality projects continue to receive a primary listing on BitMax. The fundamental value of the exchange is represented in the token’s meteoric rise, which has been largely sustained. With the increase in price, the market cap is now high enough for the token to appreciate at a more moderate and sustainable rate.

Whether it is an established crypto asset or the housing market, it is important to remember that a partial pull-back in price after an extreme rise is part of the market cycle of most assets. Margin trading can accelerate the movements, but assets eventually trace back to their true value in time.