Good Morning and welcome to our Major Forex Trading Blog for 2019.

Thank you for all your positive feedback with nearly 247,350 subscribers to our trading blogs, we must say thank you so much for your loyal support.

We shall continue to write our financial trading blogs throughout 2019 and bring you the latest fundamental analysis, technical analysis, financial market forecasts, and up to date trading tips on economic releases, as well as which of our forex trading strategies is best to use for the current market climate!

If you are new to trading and would like to see how we traded Brexit 2016 making close to 500k and 1,266 pips using our forex trading strategies. Please check our Forex Blogs here which relay the latest forex analysis and forex news alongside premium forex fundamental analysis on the latest and greatest economic news events. We bring you the opportunity to benefit from Brexit news live alongside our professional traders, so make sure you keep up to date with our Forex Blog and don’t miss out on the possibilities of trading live Brexit news!

Here is the link to our previous live trading video and trading transcript.

In our previous Brexit news blog, we discussed the latest about the Brexit trade talks and Brexit investment opportunities.

Today we are bringing you the trading opportunity of a lifetime with Brexit 2019.

As most of you may know, the UK has been through political and fundamental turmoil, and on the 15th of January 2019, Theresa May the Prime Minister of the United Kingdom had one of the heaviest parliamentary defeats, with a vote of no confidence adding to the wounds of the last two years. This brings further uncertainty to the inflow of investments into the UK and has severely increased the volatility and left us in the land of unknowing until the United Kingdom finally departs from the European Union, which is planned for the 29th of March.

The major trading questions we get are:

How do I trade the market?

Is this the right time to start trading the financial markets?

How do I trade live Brexit news?

Which forex trading strategy is best to use during Brexit?

This is a once in a lifetime trading opportunity, we proved it using our professional forex trading strategies, and we made some serious pips in the last live Brexit news trading event, you do not want to miss this opportunity in 2019.

At Platinum Trading Academy our Core Team of Traders includes:

-Technical Analysts

-Fundamental Analysts

-Financial Strategists

-Risk Managers

-Live News Analysts

-Currency Volume specialists

This Financial Trading Team has helped us put this forex blog together and we will be outlining the major trading events for the year 2019 in relation with Brexit 2019.

There are only six major possibilities that can come from Brexit 2019:

-The UK Leaves without a deal and the EU reserves the right for no re-validation on the 29th of March 2019

-Theresa May could modify the existing Deal and apply for a secondary vote in parliament but after losing the first Brexit -The chances of success are only 5%

-The United Kingdom would place a second referendum in scope, and this would require an extension to article 50 (the law in the Treaty on European Union that begins a member state’s withdrawal from the EU) as it was unable to begin before March 29th. At the current point in time, it seems like the major opinion polls are suggesting that voter would prefer staying in the EU rather than voting for a Hard Brexit.

-Theresa May could hold an early general election just as she did in 2017.

-A Complete renegotiation of the deal with an extension to article 50

Parliamentary control and a chance to pass a new Brexit Bill.

LEARN TO TRADE BREXIT 2019 USING PLATINUM’S FOREX TRADING STRATEGIES: A FUNDAMENTAL & TECHNICAL VIEW

FUNDAMENTAL ANALYSIS:

Brexit latest:

When it comes to Brexit fundamentals, a key part of Brexit news today is the Irish backstop, and in the current withdrawal agreement, there are assurances that there will be no hardening of the Irish border in any instance. However, as the current Brexit deal means that both sides of the border will be in different regulatory jurisdictions unless a Brexit amendment is made to ensure regulatory continuity, hardening of the border could be inevitable. This inevitability is a core reason for the uncertainty surrounding Brexit. It, along with a number of other aspects of Brexit, is causing a large amount of volatility in the market for GBP pairs which we as Forex traders can ultimately benefit from if we trade this volatility correctly and utilise the best forex trading strategies for the situation. This is another reason why it’s important to follow live Brexit news, as a change to any of these large situations can move a currency exponentially.

City headlines:

Financial Times: The UK parliament yesterday backed Theresa May’s plan to reopen the EU divorce agreement she struck last year despite repeated warnings from Brussels it will not countenance such re-negotiations.

The Daily Telegraph: Threats to the world economy risk going unnoticed because of holes in the European and worldwide systems for spotting potential financial disasters, the International Monetary Fund, and the European Systemic Risk Board have warned.

The Times: Apple’s first-quarter profit and sales declined for the first time in more than a decade last night as it laid bare the extent of its struggles in China.

The Guardian: Mike Ashley is in bidding battle with stock market-listed ScS Group to take over the struggling online furniture specialist Sofa.com.

Financial Times: Lloyd’s of London chief executive John Neal has laid out plans to rejuvenate the insurance market, promising to cut costs, increase technology use and win more business.

TECHNICAL ANALYSIS:

Around the markets:

Sterling: US$1.309, up 0.2%

Brent crude: US$61.5 a barrel, up 0.4%

Gold: US$1,315 an ounce, up 0.9%

Bitcoin: US$3,411.6, up 0.64%

Forex Analysis of GBP/USD:

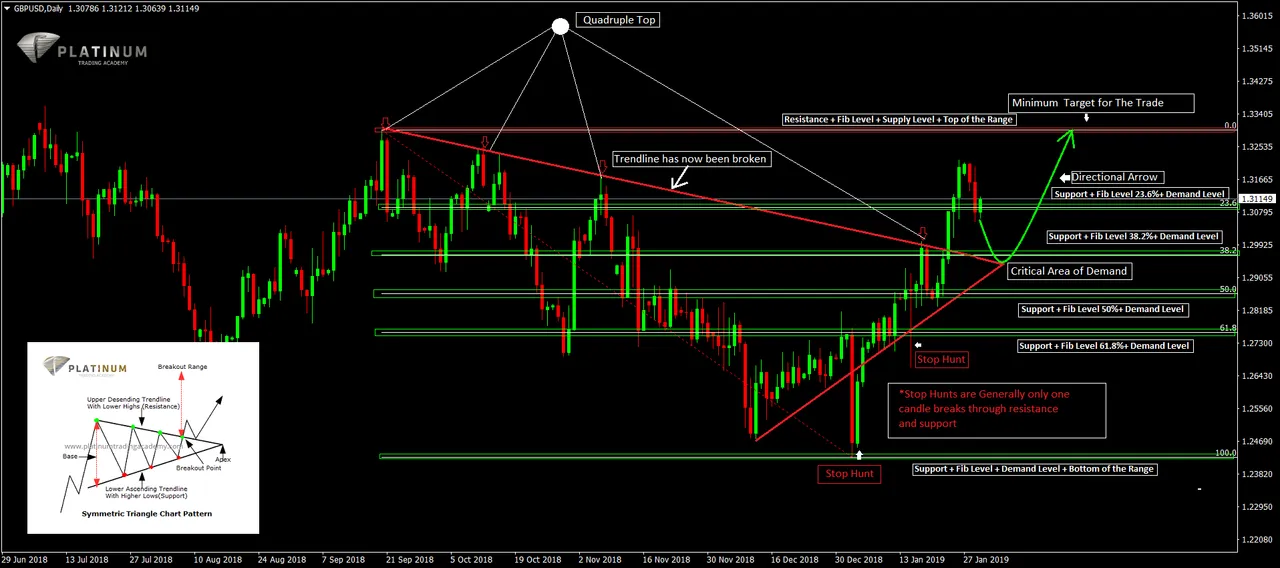

The GBP/USD Currency Pair has been trapped in a range between 1.2425 and 1.3300 since September 2018. As we can see from the chart, we have a symmetrical triangle which formed, the price broke out from this triangle.

We will, therefore, look for a pullback to the symmetrical triangle and look for a long back up to the top of the range 1.3300.

Analysis of FTSE 100:

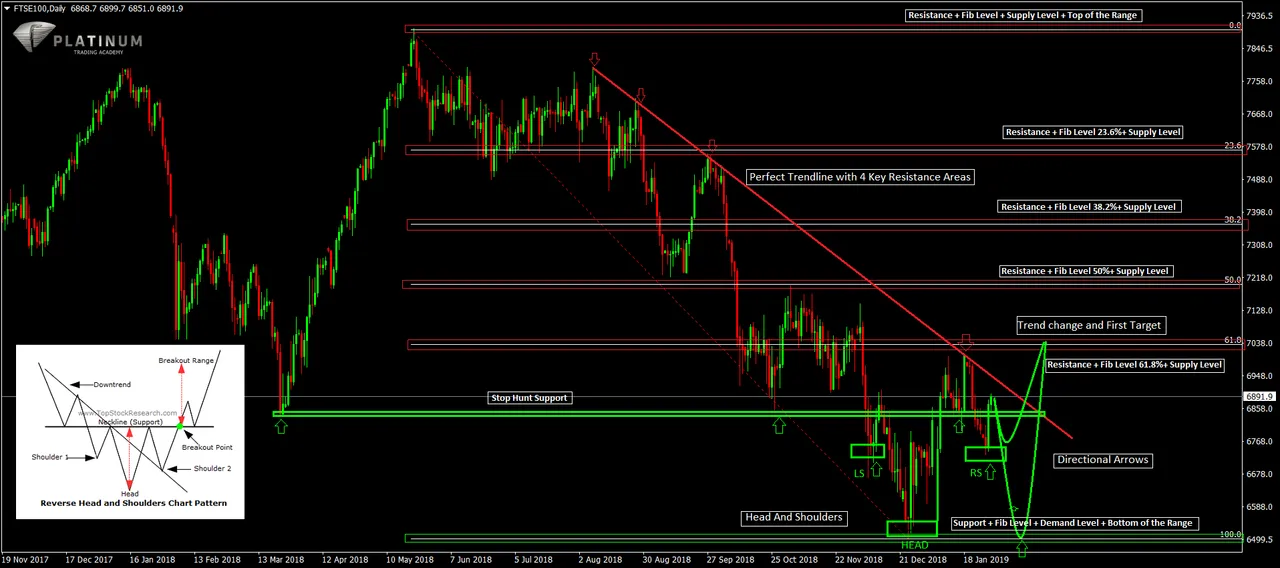

From the FTSE 100 chart provided, you can see we have a multitude of different techniques being used here. Firstly, we have a large descending triangle in which the price was trapped.

Secondly, we have an inverse head and shoulders pattern, the first entry will be taken on the right shoulder support level. Option B will be to trade Long at the bottom of the range at the 100% Fibonacci.

What’s next?

Learn to trade currencies and take advantage of price movements using our professional forex trading strategies. With Brexit on the horizon learn to buy and sell currency pairs such as EUR/USD and GBP/USD. Did you know that you could make a secondary income simply by becoming a forex news trader?

A Forex news trader is one that purely trades fundamental events such as Economic Data Releases and takes advantage of the exchange rate fluctuations using forex trading strategies designed to tackle the extreme volatility of news releases.

There are many announcements on topics such as UK Trade, any upcoming free trade agreement, and the release of financial statements by major economic countries that will make both the currency market and stock market move. Why not learn how to trade and increase your own personal cash flow today with the forex trading strategies that have worked for us for years!

FREE 30-MINUTE BREXIT 2019 TRADING CONSULTATION

Hopefully, you have enjoyed today’s article. Thanks for reading!

Have a fantastic day!

Nisha Patel

Live from the Platinum Trading Floor.