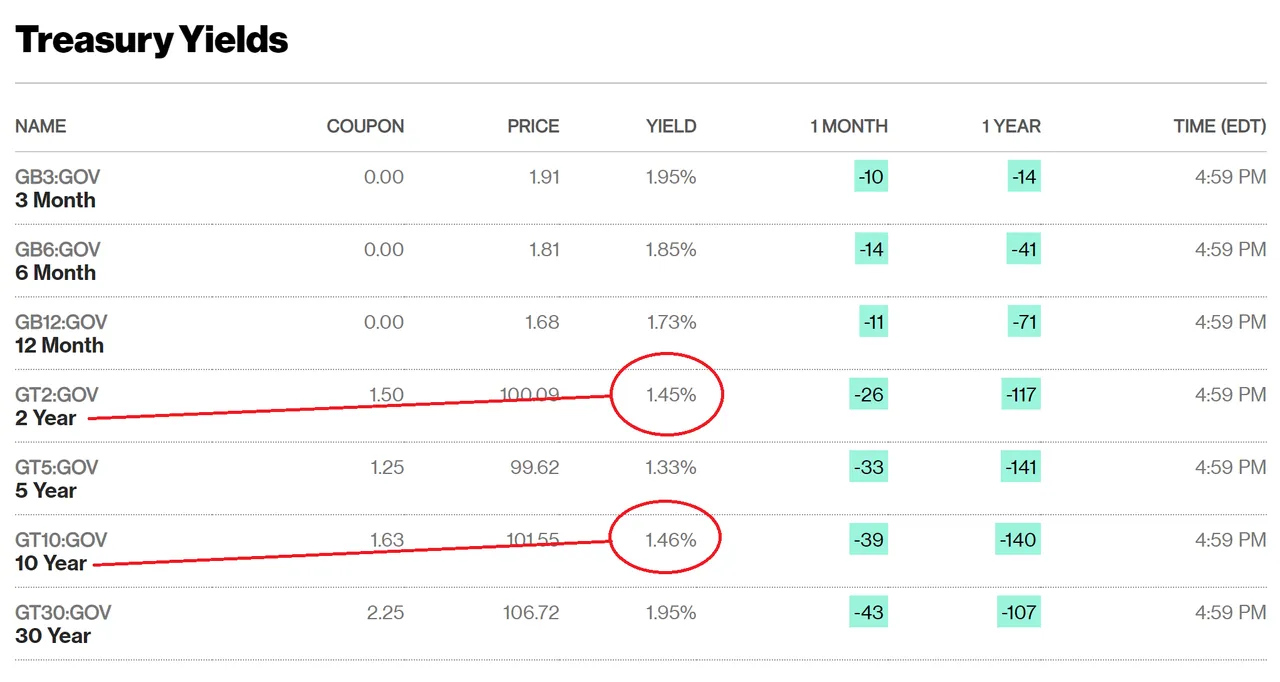

Today, traders and investors witnessed a massive surge of money being poured into the short end of the US Treasury Bond Market, pushing the 2-year Treasury yield down just below the 10-year Bond yield.

Soon after, the Stock market made a rebound in response to the reverted yield curve, regaining most of the losses from this morning.

We can't rule out a coincidence, as there may have been a large rush to safety, but the sheer volume of Bonds that were purchased seems too deliberate.

It is entirely possible that it was the Federal Reserve (the privately owned Central Bank of the US) who purchased all of these Treasuries, as this is what "the Fed" receives as collateral when the US government is borrowing money from them, but it could have been a central bank from a different country buying treasuries, or a noteworthy investment firm gaming the markets as well, or even a large Unicorn company utilizing the mountains of cash in their private treasuries. Heck, it's also possible that it was all of the above.

Regardless of who made all the gigantic Bond purchases today, this is significant and something to keep watching out for. It appears to have momentarily put the stock markets into a lull, but won't last for too long.

Thanks for Reading, and stay safe out there.