Starting in 2016 all salary employees, including myself, for the company I worked for were switched over to High Deductible Health Plans. Most people weren't happy with the change and up until this point I hadn't found a good way to track my HSA account to determine it's performance. Yesterday, I came across some information that allowed me to do a high-level overview that I could use to determine how much money I was paying out of pocket for my medical expenses after insurance.

HSA Overview for the Past 3 Years

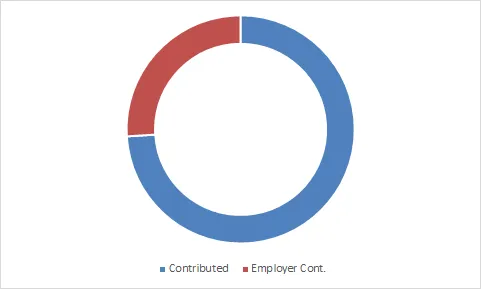

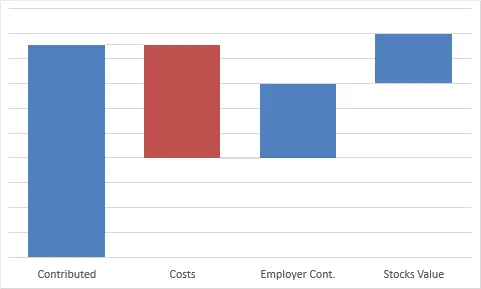

One of the perks that were sold to employees for having to switch over to HDHP was the company would contribute $1000 of "free money" at the beginning of every year into your HSA. Then employees could contribute up to $5,800 pre-tax money into the account every year to help offset the cost of medical expenses.

I'm not able to hit the max contribution every year and am only contributing about 75% of what goes into the HSA, so the $1,000 that the company gives makes up the remaining 25ish%

Source

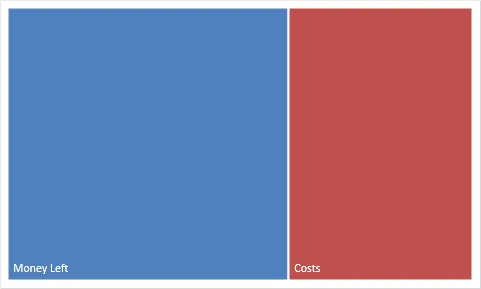

At the end of 2018 40% of the money that was put into the account was used for medical expenses. This isn't all that bad considering that we welcomed my daughter into the world April 2018. If you were to use the "free money" that my employer gives me at the beginning of each year then technically only 20% of the funds that I have contributed to the HSA has been used for medical expenses over the past 3 years.

At the end of 2018, I came in about $500 ahead thanks to my investments and the performance of the stock markets. After some calculations, and assuming a yearly inflation of 2%, I've determined my account has pretty much broken even.

Final Thoughts

I haven't paid a single dollar in medical expenses for the past 3 years. This is pretty incredible considering that even with the expensive insurance plans that were previously offered I would have had to pay something out of pocket for the birth of my little girl. I have to admit, I was not expecting this.

With that said, however; my family has been lucky enough to not have had to pay for any major medical events like cancer treatments or major surgeries, nor do we have any expensive prescriptions that we have to take on a regular basis.

Source

HDHP aren't all good news though:

The way stocks have performed over the past 3 years isn't sustainable. While I've been able to count on returns from the stock market to offset some medical expenses, we're bound to see a correction/depression eventually.

HDHPs, in my opinion, are built around being able to contribute to a tax free HSA account which is great in a bull market, but if you're in a bear market you could see some of the money that you've set aside to pay for medical emergencies get eaten away due to poor market performance. This isn't a huge issue when you're young and investing money for retirement in 20-30 years in something like a 401k, but when it's money you may need tomorrow, investing it might not be the best idea.

HSA's are great for good health to average health families and individuals. I shutter to think what it would cost for my wife or kids to have a major surgery or disease with the high deductable that somes with these plans.

I hope this helps anyone who is interested in HDHP and HSAs. I'm trying to keep better track of my expenses/net worth this year and this has been the first place I started. If you have any questions let me know in the comments down below as this was supposed to be a high-level overview of how my HSA and HDHP has performed.