Celebrating the end of our 2017 tax return nightmare

I’m happy to say that my partner and I just completed and filed our personal tax returns for 2017, just in front of the Oct 15 deadline. April 15th is the regular deadline in the US for calendar year filers, but you can get an extension for 6 months, and we really needed it this year due to the drastic changes made to the US tax code very late in 2017!

Note: As a way of celebrating the successful completion of the forms, we'll be upvoting the scariest and most interesting tax horror stories people leave as comments on this post.

New Tax Rules, New Headaches

These 2017 tax changes are formally known as the “Tax Cuts and Jobs Act” or TCJA for short, but are also referred to as the Trump Tax Plan although the plan was most written by corporate lobbyists rather than by Trump himself. There were moderate changes for most everyone in America, but the primary direct beneficiaries were companies, since the corporate tax rate was significantly lowered.

So for most Americans, I don’t think the new rules caused many headaches, but if you owned over 10% of a foreign company like we do, your tax computation got super complicated due to a new tax that our humorous overlords (or maybe their mischevious vassals) decided to call the “GILTI” (pronounced “guilty”) tax and another related tax generally referred to as a "Toll Charge". Despite the threatening names, the tax rates aren't that bad, but the computation of these new taxes can be enormously complicated, especially because, even as of this date, there aren’t clear guidelines for many of the implications of the new taxes.

Ambiguous new tax rules: tax accountants to the rescue...

All of this meant that for the first time we decided to hire an outside accounting firm to help us do our taxes and I can say with certainty it was the right decision. I’m sure I would have been tripped up on several subtle points associated with the new rules: to get these rules right, you really need someone who is full-time focused on tax accounting.

Even with an outside accounting firm helping out, we still had an enormous burden to compute our taxes properly, just processing the accounting books themselves to hand off the final data to the accountants (this wasn’t something that it was feasible to outsource to the accountants as the data is in a proprietary database and consists of millions of financial transactions spread across multiple database tables, plus their's crypto-specific issues to account for).

Steem accounting problems: computers to the rescue...

To process all the transactions from our service, we first reviewed the automated crypto-accounting system that I posted about earlier and then spent a few more man-months making further improvements to it, including speeding up the calculations by about a factor of 10, as it was starting take quite a few hours to run a report with all the transactions we have to handle.

We also had to make updates to the software based on changes to the way the most recent Steem wallet generates info about blockchain operations (e.g. reward operations, etc). As I think I mentioned in my previous post about our automated accounting system, Steem generates a lot of different forms of income (author rewards, curation rewards, power downs, SBD interest, SBD->Steem conversions, SBD/Steem trades, to name a few), and while that is good per se, it also increases tax complexity. Our accounting system was invaluable in tracking all those income streams.

Another thing we did was improve automated matching of transactions in our crypto wallets versus deposits and withdrawals from exchanges, because exchanges often don’t give you transaction hashes for your deposits and withdrawals that you can match against. Once we get a chance to analyze that data, I suspect we’ll be contacting some more exchanges for failed payments, if past history is any indicator.

The final product of our labor

So how complicated were our personal taxes this year? Around 80 pages each (that’s not counting worksheets, that’s just actual forms being sent to the IRS). Note these are not corporate taxes (those have always been complicated), this is personal taxes! If you are wondering how it can be so many pages, consider that in one case where we sent ~$150 to a foreign company we own to pay for some legal expenses, we had to file a 2 page form to declare it. Trees are probably screaming somewhere (yes, we electronically filed, but we also needed paper copies for other purposes)…

Lesson learned

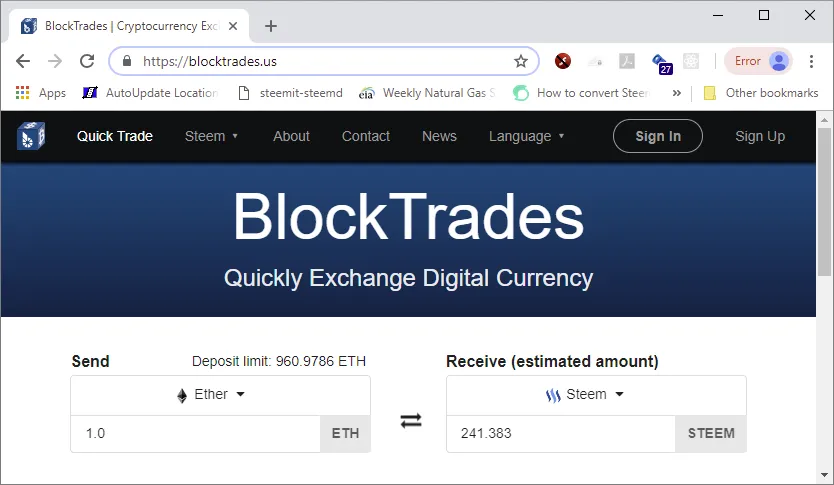

The clear lesson the US government seems to be teaching via the tax code is that it doesn't want US citizens owning 10% or more of a foreign company (the rules are quite different for companies owning foreign subsidiaries, at least in terms of the effective tax rates). If my partner and I had each owned under 10% of BlockTrades, none of these taxes would apply. I had been planning to do an IPO for BlockTrades for a couple of years now (in retrospect, I'm glad I waited), but going thru this latest tax nightmare has convinced me that it's time to diversify our holdings, so we're going to start actively moving towards an IPO within the next year.

Share your Tax Horror Story

Now despite the time spent on this year’s taxes, I’m not sure this was the biggest “tax horror” I ever experienced, because there weren’t many moments of actual terror (there was a brief moment when I made an error in a spreadsheet and some numbers looked pretty ugly). So I guess the biggest scare I got was much earlier in my career when I got a letter from the IRS telling me I owed them $30K (which wasn’t too far from my total yearly salary at that time). Fortunately, that turned out to be I had added one too many zeros to a number on the form, so I just filed an amended tax return (one of the easier things to do in the US tax system as it turns out) and all was right in the world again.

If you made it thru this long post on our tax problems, then I'm guessing it's possible you probably have one or more of your own tax horror stories to tell. Share them below in the comments and I’ll upvote the best ones to combat the pain and suffering you went through.

EDIT: Shout-out to our accountant here on Steemit

I didn't want to mention him previously without his express permission, but we met our accountant (@cryptotax) here on Steemit. After some back-and-forth here, I became convinced he was our best choice to help us through the new tax regulations. If you're in the market for a crypto-savvy accountant, especially one who knows the ends-and-outs of Steem, I highly recommend him! Very competent and pleasant to work with as well.