KVANTOR-International B2B Settlements on Blockchain

Introduction

As progressive as it sounds, Blockchain really is a system to convey everybody to the most noteworthy level of responsibility. Not any more missed exchanges, human or machine blunders, or even a trade that was not finished with the assent of the gatherings included. Above whatever else, the most basic territory where Blockchain causes is to ensure the legitimacy of an exchange by recording it on a principle enroll as well as an associated dispersed arrangement of registers, which are all associated through a safe approval component.

The blockchain is a morally sound computerized record of monetary exchanges that can be customized to record not simply money related exchanges but rather for all intents and purposes everything of esteem. Blockchain innovation resembles the web in that it has a worked in power. By putting away squares of data that are indistinguishable over its system, the blockchain can't be controlled by any single substance and has no single purpose of disappointment. The web itself has turned out to be tough for just about 30 years. It's a reputation that looks good for blockchain innovation as it keeps on being produced.

OVERVIEW OF KVANTOR

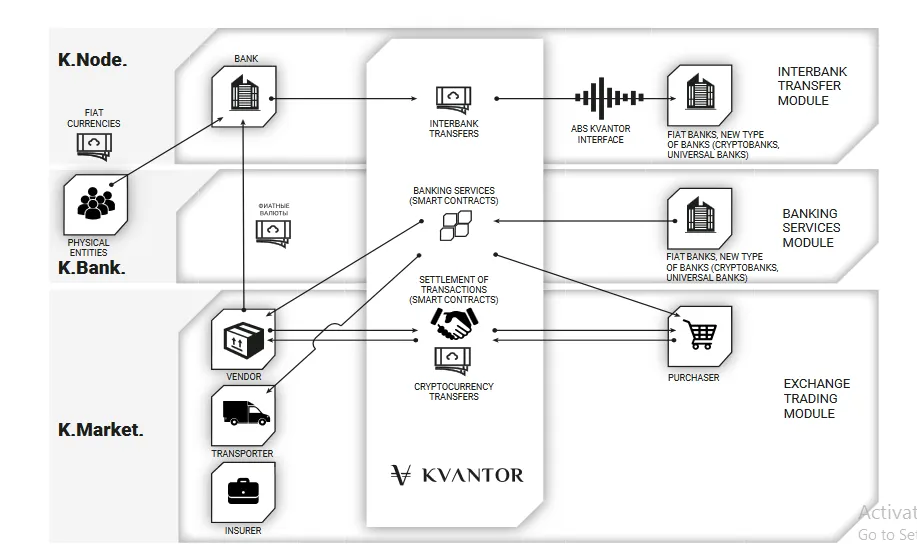

KVANTOR is a decentralized entryway or stage that gives monetary connections colleagues, by opening new installment channels and killing delegates and the KVANTOR Platform plans to redesign the consent to another level and give flexibility of connections between financial elements, past conventional installment channels and dispense with mediators.

Moreover, Kvantor is a money related stage that uses the blockchain innovation to make a decentralized domain in which monetary substances can make exchanges. This stage is pointed particularly at banks, crude material makers and dealers.

The KVANTOR stage raises your arrangements to another level and gives flexibility of relations between financial substances, going past customary installment channels and dispensing with go-betweens. Customers of the KVANTOR stage are banks, crude material makers and dealers.

Aim

Kvantor plans to achieve genuine financial flexibility to the worldwide market, empowering clients to use front line advances for all settlement, lessen exchange speed of trade from days to minor minutes at aggressive and alluring rates. Utilizing Kvantor , cash and product specialist organizations are presently ready to give their customers a best in class benefit conveyance through a straightforward, secure, and carefully designed innovation. Never again do clients need to stress over passage boundaries to saving money benefits because of geological area, legislative issues, or monetary status. All they presently require is a web proficient gadget to getting a charge out of managing an account benefits in a hurry whenever, anyplace.

The KVANTOR venture is to give genuine flexibility to worldwide market monetary specialists or to be another level of opportunity for future financial exchanges.

•To utilize refined private innovation;

•To make snappy exchanges at focused and worthy costs that are not controlled via cartels and organizations;

•To lessen costs for the agents, attorneys, «contract administration specialists» and discharge numerous pointless reports;

•To exchange capital all the while (much of the time, consequently) to those improvement focuses, which give the best favorable position insignificant hazard.

This stage will take into consideration diminished conveyance time to minutes, exchange costs and mistake hazard – nearly to zero, and the volume of required records – down to the barest conceivable.

By utilizing KVANTOR, money and ware trade will have the capacity to give administrations to their customers in view of future innovation, and banks will end up monetary organizations as well as full colleagues. We make instruments for the foundation of a proportionate eco-framework biological system (from physical elements to transnational companies) that have no passage obstruction, give members a win-win work display and eradicate monetary and political breaking points yet do have the most elevated amount of information security.

This stage is intended to give full classification of exchanges (just gatherings engaged with exchanges are enabled access to data), and brisk and secure settlement without SWIFT.

The undertaking was produced by a group of experts, in light of their own involvement and the global experience of the authorities. Our assignment is to make items that empower both individual organizations and all nations to free themselves from their reliance on existing outer outside monetary and money related controls, yet not disregarding nearby laws or laws of the accomplice's nation of home.

The stage is actualized as SaaS and as a "case" arrangement. The SaaS design enables framework members to connect unreservedly, make installments momentarily, and guarantee the execution of commitments through shrewd contracts. The crate arrangement is spoken to as a remain solitary framework with the capacity to associate with a worldwide stage by means of an advantageous, wide API.

The Services Provided

Interbank exchanges for outside exchange: Transfer of fiat monetary forms and computerized instruments between the banks from various nations.

Managing an account administrations: Money exchanges, clearing, bank ensures, figuring, and so forth.

Trade exchanging administrations (for Brokers, makers and buyers of products) :

Agrarian trade (meat, angle, corn), wares and crude materials trade (oil, coal, gold) and money trade (fiat monetary standards and advanced instruments).

Interbank exchange

Interbank exchanges give channels to banks to trade messages about current exchanges between taking an interest banks.

All exchange information is put away in the KVANTOR blockchain, which gives the required exchange handling rate and security against consistent assaults coordinated at the system.

The message trade system of the program depends on the lawfully noteworthy usefulness of electronic record administration, which identifies with the enactment of nations in which KVANTOR biological system members live.

The product system is introduced in the bank and interfaces with the ABS bank by means of an exceptional API. The message trade process happens on a scrambled channel.

All cash exchanges are executed utilizing a convention that is perfect with the SWIFT framework, which permits to limit changes in the current ABS.

Ware Exchange

The trading of wares enables clients to execute with crude materials, safeguard them, compose transportation, set up every essential archive, get money related instruments (guarantees, credits, and so on.) and make moment installments with fiscal instruments (fiat or computerized) through helpful channels SWIFT).

Real exchange and execution controls are performed utilizing savvy contracts.

Notwithstanding exchanges with crude material providers, this stage empowers concurrent exchanges with integral administration providers (transport and protection).

Stage innovation permits the acknowledgment of various units at the same time in a solitary framework (ruble, yuan, tenge, and others).

Highlights of the trade are accessible for fiat cash techniques, online exchange security utilizing an eskro account with the accommodation of permitting the trade interface.

The Ecosystem

Security is at the bleeding edge of stage improvement and not only for stores, but rather for each connection and trade in the biological system.

Kvantor improves the most abnormal amount of information insurance including client character, shrewd contract collaborations, and trade of exchanges in light of authoritative contemplations. Its straightforward biological system is bolstered by an instrument of monetary specialists (from physical substances to transnational companies) that have no obstruction to passage, exemplified in the first token.

Advantages

Ware exchanging market: coordinate portions through standard channels, electronic ensures, figuring and distinctive open entryways in light of blockchain development and sharp contracts.

Brisk and secure settlement without SWIFT and involving external controls.

Dealing with a record system with the ability to work with the most present day money related instruments and cryptographic money.

KVANTOR gives different choices for the trade exchanging individuals growing steady quality and straightforwardness

This stage is expected to give full mystery of trades, quick and secure settlement without SWIFT.

Opportunities

•For Companies

Coordinate settlements with temporary workers in national monetary forms (staying away from conventional channels and conventions of money related course)

Helpful commercial center with programmed execution of exchanges, corresponding administrations (coordinations, protection), electronic arbitrage.

Confirmation of the partner — the stage's design permits to check partner's status and notoriety in advance with no infringement of data privacy, which is the high need here

Utilization of budgetary instruments (monetary ensures, calculating, and so forth.) and correlative administrations (protection, and so on.) in view of new advances — consequently executed savvy contracts — for exchange security

Adequate reduction of money related and time uses for execution of exchanges

Exchanging of advantages/liabilities in decentralized mode

Security of secret data from unapproved controllers.

•For Banks

Programmed clearing of shared commitments

Autonomy from unified installment frameworks (arrangement of elective channel, which might be utilized for either all or particular exchanges/customers)

Commitment of new customers by methods for arrangement of creative managing an account administrations requested by little, medium and substantial organizations

Insurance of secret data from unapproved controllers.

•For Government

Insurance from control of temperate activities practiced by IMF, NSA and other antagonistic organizations/controllers

Execution of all tasks based on agreement of the partners

Increment in national money related totals and diminishing of genuine activities in outside cash, increment in the nation's monetary steadiness

In prospect, production of a legislative settlement stage and joining on its premise of intrigued substances and political coalitions.

ICO Details

The initial value of the KVANTOR token token is 1/1,300 of the value of an ounce of gold on the day of the smart contract creation (tokens release) and is determined by the daily exchange rate in the London Interbank Market11 in USD, EUR, GBP with one decimal point. The rate of purchase in other currencies is determined by the cross rate of the currency exchange chosen before the beginning of ITO12 to GBP at the date of the token purchase. After completion of ITO, all transactions with KVANTOR tokens are frozen for 2 months.

Token Information

Token: KVT

Token Price: 1 USD

Tokens for sale: 80,000,000 KVT (80%)

Supply of Token: 100,000,000 KVT

Hard cap: 42,500,000 USD

Accepts: ETH, BTC, LTC, FIAT

Restricted country: United States

TOKEN DISTRIBUTION

5% Partners of the project

15% Founders, team, initial investor

80% Beneficiaries of the KVANTOR project

Pre-ITO and ITO

Distribution of released tokens:

15% – founders, team, initial beneficiary

5% – partners of the project

80% – beneficiaries of the KVANTOR project, including:

20% of released tokens are intended for sale in the 1st round of sales;

40% of released tokens are intended for sale in the 2nd round of sales;

The remaining 20% of issued tokens are reserved for subsequent sale (the possibility of exchange trading or selling to a strategic beneficiary will be considered).

Soft Cap – The Soft Cap is 3,000,000.00 GBP. Alongside with the ITO activities, the company is seeking to raise money from venture funds and individual investors.

Hard Cap – equivalent of 32 million GBP. According to our current business plan, this amount (taking into account the costs of system development, marketing, promotion, etc.) will allow the project to recoup the borrowed funds within the required period and start making profits.

1st round of sales

From 26.04.2018 to 25.05.2018 – 20% of KVANTOR tokens are sold. Within this phase, the tokens are sold under a private pre-order (Private Token Sale). Tokens can be purchased by sending an e-mail to ceo@kvantor.com.

Based on the analysis of interest in the project by potential beneficiaries, the project team either continues the main sale in the Private Token Sale format or begins an open subscription to the tokens.

2nd round of sales

From 25.06.2018 to 24.07.2018 – 40% of KVANTOR tokens are sold.

3rd (additional) round of sales It is held not earlier than 3 months after the end of the 2nd round.

Discounts

A 40% discount on the nominal value of the token is provided in the 1st round of sales.

A 20% discount on the nominal value of the token is provided in the 2nd round of sales.

Discounts are provided in case of high volume purchase:

5,000 – 24,999 KVT (25% of token nominal value)

25,000 – 49,999 KVT (27% of token nominal value)

50,000 – 249,999 KVT (30% of token nominal value)

250,000 – 499,999 KVT (35% of token nominal value)

500,000 KVT (40% of token nominal value)

Discounts are not provided in the 3rd round of sales on a regular basis.

Minimal purchase package is 100 tokens.

ROADMAP

•Q2 2018

The selection of higher- and middle management has been completed, the backbone of the development- and sales teams has been formed.

•Q3 2018

Team formation completed.

The key technology partners are identified.

The technological and methodological basis of the developing platform have been finalized.

•Q4 2018

The key regional partners for the platform’s promotion have been identified.

The Beta-version of «Interbank transfers» functionality has been released.

•Q1 2019

Commercial version of Interbank Settlement Service is released.

Agreements with strategic regional partners are sealed.

Support infrastructure is formed

•Q2 2019

First contracts for the provision of Interbank Settlement Service are signed

•Q3 2019

Beta of Bank Services Package is released

•Q4, 2019

Regional key clients are defined.

Beta of Services of Exchange Trade is released.

Commercial version of Bank Services Package is released.

•Q1 2020

Commercial version of Bank Services Package is released.

First contracts for the provision of Bank Services (from the Bank Services Package) are signed.

Consortium of Clients with the aim of getting customer feedback and facilitating strategic planning for the development of the platform is formed.

•Q2 2020

Beta of Services of Exchange Trade is released

•Q3 2020

Commercial version of Services of Exchange Trade is released.

First contracts for the provision of Services of Exchange Trade are signed.

TEAM

Arsen Bakhshiyan – CFO

Mikhail Chekanov – Product Development

Stas Sorokin – CTO

Mikhail Petrov – CIO

Aleksey Losev – CEO

Valentin Esipov – Legal

Ivan Anisimov – Business Development (EMEA region)

Elena Kartseva – Business Development (CIS region)

Alexandr Bishnev – Business Development (Eastern Europe)

Artem Timonin – CMO

Alexander Vasilyev – Business Development

Nikita Zuev – Financial Analyst

Kirill Belkin – Lead developer

Nikita Lukhmenev – UX/UI Designer

Vitlaliy Levashov – Back-end developer

Tatyana Gudyma – Frontend developer

Kseniia Fedosova – Project Administrator

Stanislav Drozdov – IT Support

Pavel Shalaginov – IT Support

For more information, please visit:

Website :https://kvantor.com/

Whitepaper :https://kvantor.com/docs/whitepaper_en.pdf

Facebook :https://www.facebook.com/kvantorcom

Twitter :https://twitter.com/kvantor_com

Telegram :https://t.me/kvantorcom

Reddit :https://www.reddit.com/r/kvantor/

Author TheJohnMatch

Mybitcointalkprofile:https://bitcointalk.org/index.php?action=profile;u=1673694