$7904.1 0.0451 BTC

Top 7 major events in the bitcoin and blockchain-industry (13.11.17 — 19.11.17)

RELATED 19.11.2017

In the traditional Sunday review ForkLog — a new record for the bitcoin news from CME Group, atomic transaction, the success of Ripple and other notable events of the week.

The record price of bitcoin

In spite of many skeptics in the night from Thursday to Friday (16-17 November) the price of the first crypto currency has updated the historical maximum, having overcome a psychological mark in $8000.

It is worth noting that some traders and analysts of the world of traditional Finance after the abolition of SegWit2x predicted a long decline in the price of bitcoin, up to $5000 or even lower. However, the predictions of pessimists were not justified, and in just four days “digital gold” fully recovered after a recent fairly deep dump.

On the chart below, you can see that at the moment the first cryptocurrency was trading around $7770:

Data: Bitfinex team, the four-hour chart

The StochRSI indicator is in the oversold zone, indicating a high probability of a resumption of the uptrend. The thesis of “power bulls” is confirmed by the moving averages.

Current value capitalization of bitcoin of $129.9 billion; the index of dominance of 55.5% (data Coinmarketcap). Bitcoin is still the leader in the daily trading volume ($2.7 billion), its nearest rival on this indicator — Bitcoin Cash ($1.5 billion). The most active “digital gold” is traded at Hong Kong exchange Bitfinex.

The dog barks — the caravan goes

The high price of bitcoin and the growing interest of institutional investors in the cryptocurrency still haunts the “old guard” of the world of traditional Finance. So, one of the world famous pages of The Wall Street Journal (WSJ) was entirely devoted to warnings about the “dangers of bitcoin for capital markets”.

As it turned out, the head of the largest U.S. electronic broker Interactive Brokers Thomas Peterfi took out a full page WSJ to appeal to the head of the Commission on urgent exchange trade (CFTC) and Christopher Giancarlo and to Express concern about the plans of the Chicago Mercantile exchange (CME Group) in respect of futures on bitcoin.

“In this letter I urge the CFTC to require any organization that intends to implement the clearing of crypto-currencies and derivatives based on them, do it separately from other products,” writes Thomas Peterfi.

Thus the head of Interactive Brokers believes that cryptocurrencies are not yet Mature enough for integration with traditional financial market. Also, according to Peterfi, “unbridled volatility” of bitcoin can be dangerous because they can “destabilize the real economy.”

Meanwhile, CME Group has determined the timing of the launch of futures on bitcoin. This should happen in the second week of December.

Technological research team Bitcoin Core

A few days ago it became known that the team of developers of Bitcoin Core considers the possibility of increasing the size of the block of bitcoin in the medium term.

In the course of discussions with the co-founder of Bitmain by Jihan Wu, the CEO Blockstream's Adam Back pointed out that to increase the size of the unit is possible only in the absence of spam in the network and only after thorough testing.

At the same time, a significant part of the community is convinced that increasing the block size is not a long-term solution to scalability issues. “Large blocks” in the end can lead to centralization of the network and the majority of the GBR will leave more time for the validation units than for their generation. As a result, the nodes actually cease to support the network and the cryptocurrency market will reign oligopoly, as it will remain mostly only the big players.

In addition to the “large blocks”, the developers of Bitcoin Core has made significant progress in the development of technologies Confidential Transactions (confidential transaction). So, the proposed Gregory Maxwell approach involves the use CoinJoin method for combining outputs of transactions into one big transaction that will allow to hide the connection between users from third-party observers.

Says Maxwell, in this case, the payment amount will be available only “to the sender, recipient and those to whom they provide special keys to view the information”.

In addition to the increased privacy, the proposed method solves another important problem associated with scaling. In particular, it can significantly optimize the weight confirm the transaction.

Technology itself Confidential Transactions is quite expensive, but Maxwell managed to find a solution for the optimization of some performance. According to him, the size of a typical bitcoin transaction by using improved technology can reduce about 20 times.

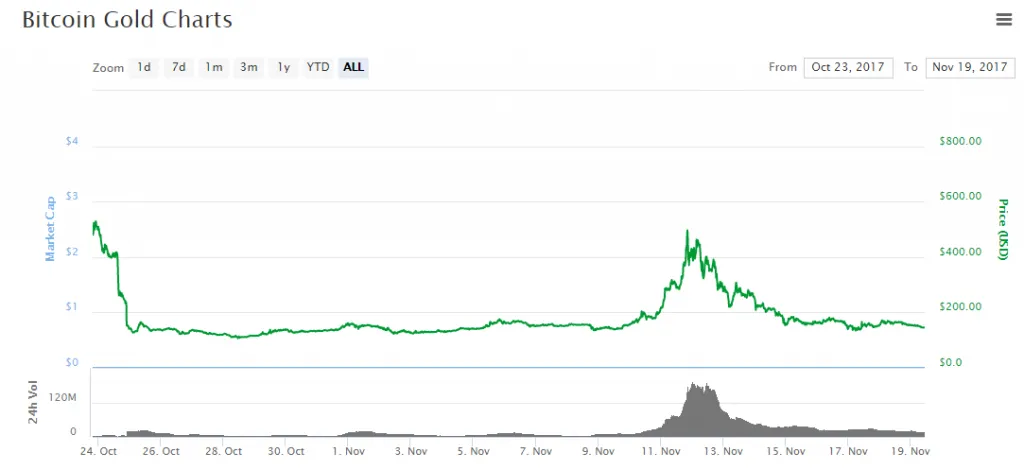

Closing pools to Bitcoin Gold

The start of mining a new Bitcoin Gold was not as successful as many would like. So, on Wednesday, November 15, due to significant losses announced the termination of production of “new digital gold” mining pools MinerTopia and BTG Mine.

“We close BTG-pool forever. We've lost too much money, time and resources to this project. You can join us for mining more profitable and really work coins,” wrote on Twitter the team MinerTopia.

According to representatives of BTG, Mine pool, Bitcoin mining Gold proved unprofitable because the operational costs exceeded revenues. According to representatives of BTGPOOL.PRO some of their colleagues could not compete because of the associated costs. In addition, the attack 51% some pools continued mining the wrong chain that led to the dissatisfaction of the users after zeroing their statistics. Also on the new cryptocurrency complained by many users dissatisfied with the low transaction rate and problems with wallets.

In addition, the course Bitcoin Gold probably upset some optimistic investors. BTG continues to fall, trading currently slightly above $140.

Data: Coinmarketcap

The next step in the development of atomic transactions

Blockchain company Lightning Labs has successfully performed atomically swap test between networks of bitcoin and Litecoin without registering the transaction on both blockchains.

https://pbs.twimg.com/card_img/931277113251868672/XFXY6ivR?format=jpg&name=280x280

The success of the team Lightning Labs has not gone unnoticed — the developments closely watched by the Creator of Litecoin Charlie Lee.

"The earlier atomically swaps acted oncein-constraints that delayed transactions and increased Commission," he commented.

Lee added that ofcan solutions only work effectively with the transactional Protocol Segregated Witness. Also, in his opinion, crosscan-swaps are the next step in the development of cryptocurrency technology which cryptocurrency “will start to use 7 billion people”.

Not going to give the competitors and team decentralized Altcoin site.io, which is a few days ago presented the alpha version of Atomic Swap Wallet.

Until the wallet allows only in the test mode to exchange between bitcoin and Ethereum. However, in the future the project team plans not only to modify the functionality of the wallet, but also to add support for other cryptocurrencies.

The Success Of Ripple

Thursday, November 16, came the news that a new member of the network RippleNet has become a major financial services company American Express.

At first American Express FX International Payments (FXIP) will work closely with Santander UK to create a channel commercial payments between the US and the UK.

According to representatives of the Ripple, payments based on blockchain optimize the interaction of the organizations, provide a high level of transparency, significantly reduce costs and have a number of other significant advantages compared with traditional financial solutions.

The irony of fate or Jamie Dimon

This week was marked by another interesting event — Service for financial market supervision (FINMA), has imposed sanctions in respect of the units of JPMorgan in Switzerland in connection with violations of the standards of combating money laundering.

The regulator's decision was made on 30 June and was published in the following week, however, JPMorgan has taken action to prevent the publication of decisions and prevent the proliferation of undesirable for the reputation of your company.

The Federal Administrative Court of Switzerland has rejected the petition of the Bank, and now the FINMA decision became known to the General public. At the same time, neither the regulator nor the Bank has not provided detailed information regarding the nature of the violations.

The comic situation is that until recently the head of the largest financial holding harshly criticized bitcoin, calling cryptocurrency a tool for money laundering.

Subscribe to the news ForkLog on Twitter!

FOLLOWE @KRASOTKA