Kel is a brilliant young man in his late 20s. He has gone through the entire educational strata up to college and has worked with a few top corporations. Now, Kel feels it is high time he founded his own startup after seeing most of his colleagues leaving the day job to pursue their entrepreneurial dreams. Kel had the idea and concept. In fact he had a small team he could start with. But he lacked the needed funds required to kick-start his business. Kel has been running from pillar to post looking for capital and going through several means to source for credit so he could finance his project. Banks have turned their backs on him and he is left frustrated not knowing where to get the needed credit loan from.

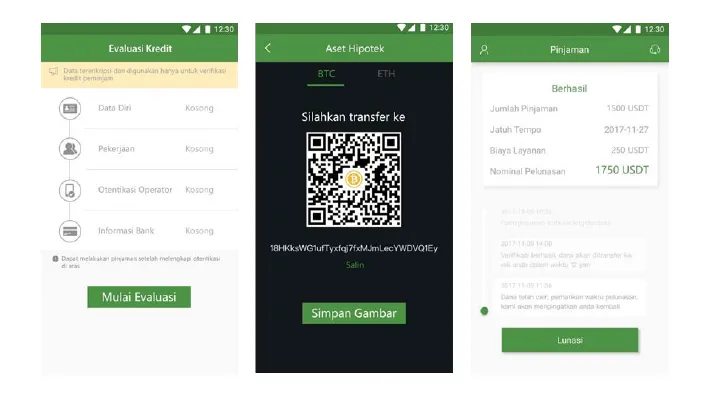

Many people are like poor Kel above. Needing important funds to overcome one project or the other but are left in a hopeless fix due to their inability to find where to access credit loans. Libra Credit is an organization that believe access to credit should be limitless, quick and easy. Difficulties are associated mainly with the mundane and outdated way incumbent systems are set up which in turn causes a myriad of problems like lengthy cycle times, high capital costs and so much more. The future is coming faster than anticipated and traditional financial institutions like banks are struggling to catch up with the trend. They are lost for ideas on how to address future customer needs like getting credit in an instant regardless of wherever they are and whenever they need it. Banks are also groaning under the crunch of cryptocurrency as they lost on concepts needed to attend to emerging crypto asset classes which can serve as collaterals in actuality.

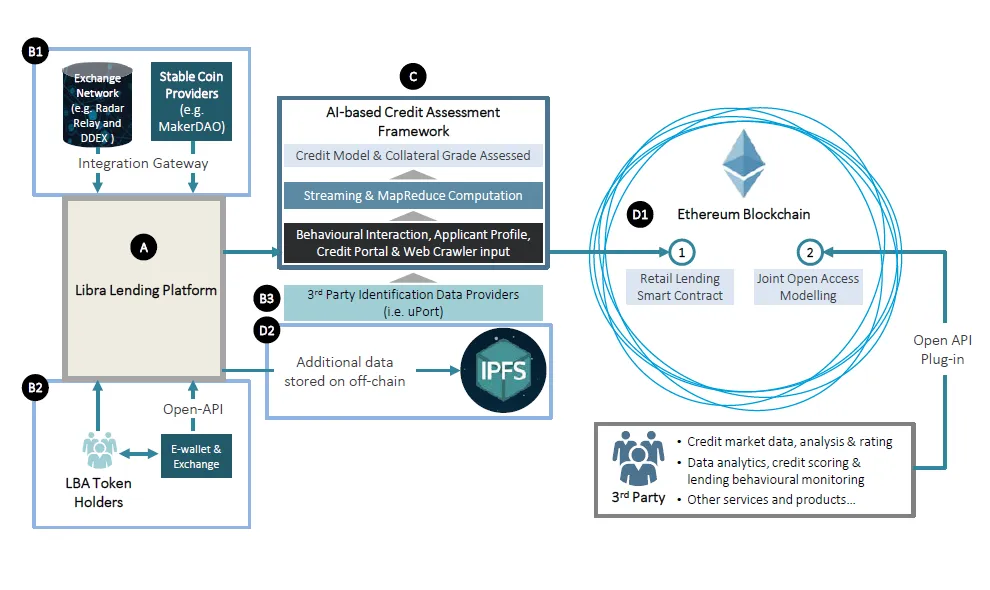

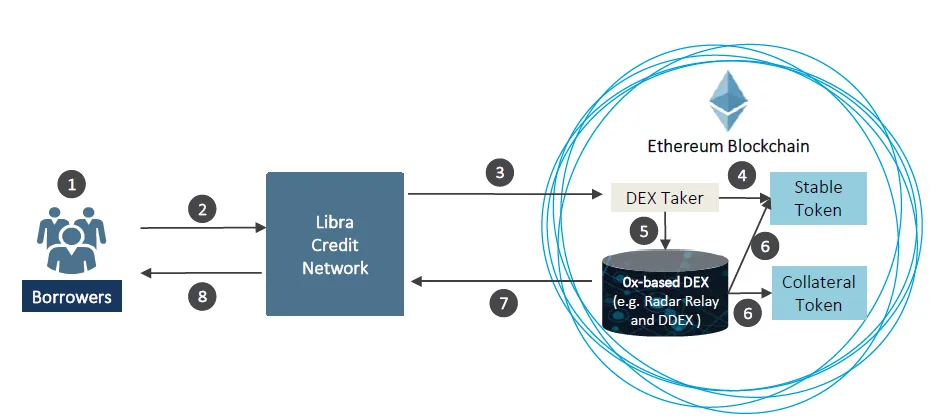

As the world’s lending is predicted to go up by as much as over 14% within the next couple of years, many underbanked regions in the world will require lending more than ever as a result of the rise in technological digital ecosystems. Thus, Libra Credit comes as the number one solution to cater to the growing demand of quality and transparent lending systems. It is an ecosystem built on the ethereum blockchain to support open access to credit from anywhere in the world and at any given time. Libra Credit will have special features on its lending platforms including crypto-to-crypto and crypto-to-fiat lending in a structure covered by its trusted industry-leading credit management capability.

This top notch lending AI-based lending ecosystem from Libra Credit is bent on being the best of its kind with its 4 major partnership networks as it covers:

- In-house Proprietary AI-based Credit Model;

- Customer Acquisition & E-Wallet Partnership Network to drive adoption;

- Lenders & Stablecoin Partnership Network to drive liquidity;

- Extensive Exchange Partnership Network to minimize default;

- Identity Verification Partnership Network to expedite KYC & verification process.

Both Lenders and Borrowers have suffered at the hands of the existing traditional credit system. Libra Credit is here to take control away from these traditional credit operators and give you the service that you have always wanted. The ecosystem will benefit all parties involved and the transactions are safe, secure and transparent on the blockchain network. To learn more about this revolutionary lending ecosystem, you can visit any or all of the links below.

Website – https://www.libracredit.io

Whitepaper – https://www.libracredit.io/page/Libra_Credit_Whitepaper.pdf

Telegram – https://t.me/libraofficial

Twitter – https://twitter.com/LibraCredit

LinkedIn – https://www.linkedin.com/company/18560125/

Writer - Coltpython