Here is an infographic that explains how HIVE tokens work and how they enable the holder to be rewarded for supporting our ecosystem.

Dear blockhive community,

With the second round of our Initial Loan Procurement underway, we’ve created an infographic to explain how our HIVE tokens work and how they enable the holder to be rewarded for supporting our ecosystem.

blockhive’s creditors receive HIVE tokens that they can use to sign digital loan agreements. HIVE utilizes smart contracts to handle KYC and other necessary procedures that make it possible to enter into a legally binding loan agreement without the need for intermediaries.

When a token holder signs an agreement, they will have a loan balance separate from their HIVE balance. Creditors are paid interest based on their loan balance — not their HIVE balance. This makes it important for our token holders to sign their loans agreements quickly to avoid missing payments.

Blockhive creditors will pay ETH (though all transactions will be based on Euros) directly to the contract address and based on the amount of their loan, and creditors will receive 20% of the operating profits generated by the blockhive community. The loan period is ten years, and they can be renewed if both creditors and blockhive agree. blockhive has the right to recall the loan. During the loan period, creditors will be able to transfer some or all of their loan rights to others.

How loan rights are transferred

HIVE tokens grant access to our loan agreements in the same way a key grants access to a house. Without a key, you can’t enter the house, and without signing the loan agreement using your HIVE, you can’t be paid.

Our infographic will help explain.

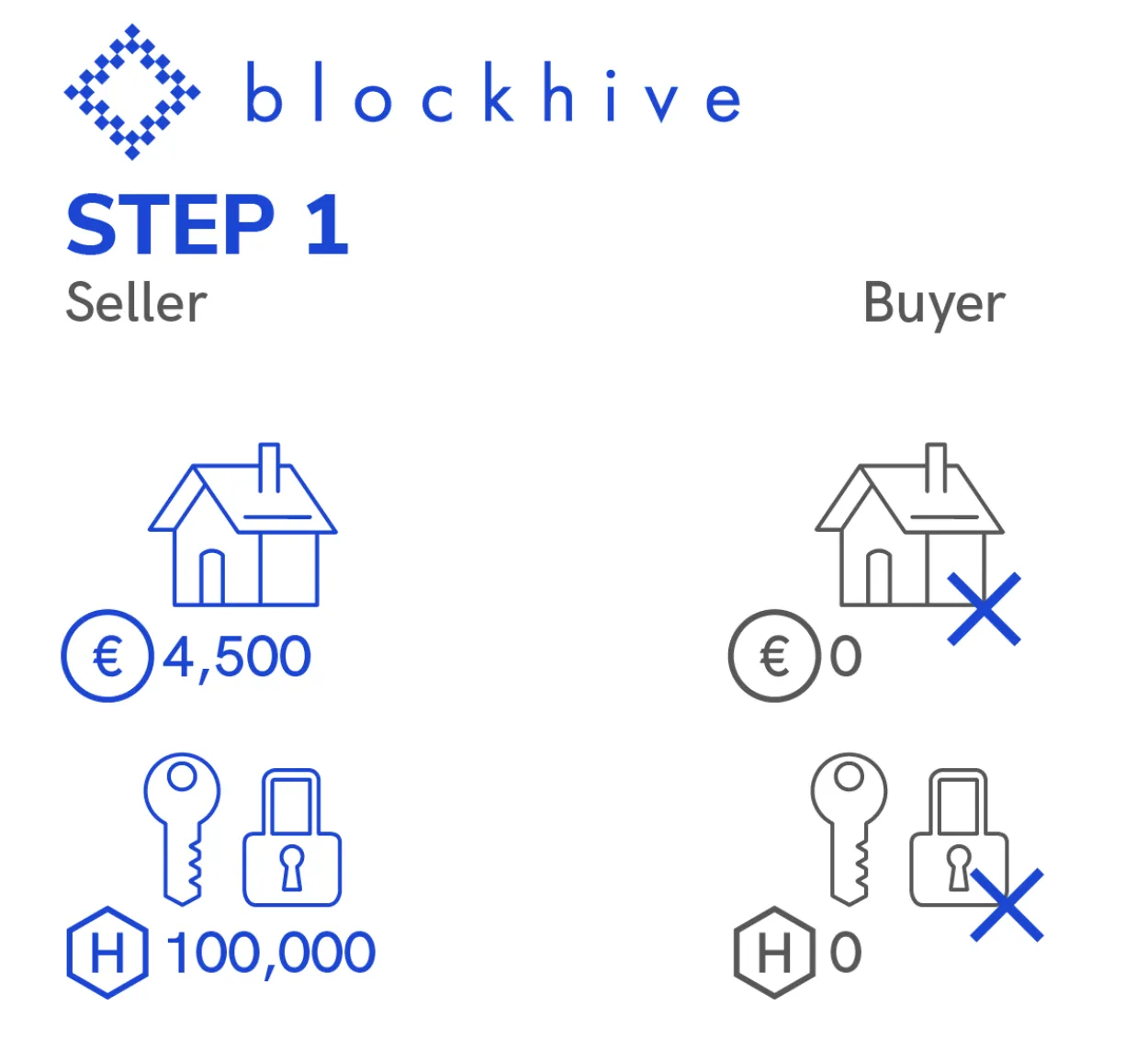

Step 1 Seller starts with a loan balance worth €4,500 (100,000 HIVE)

The creditor is preparing to transfer HIVE to a buyer. Before the transaction, their loan balance is €4,500 and their HIVE balance is 100,000.

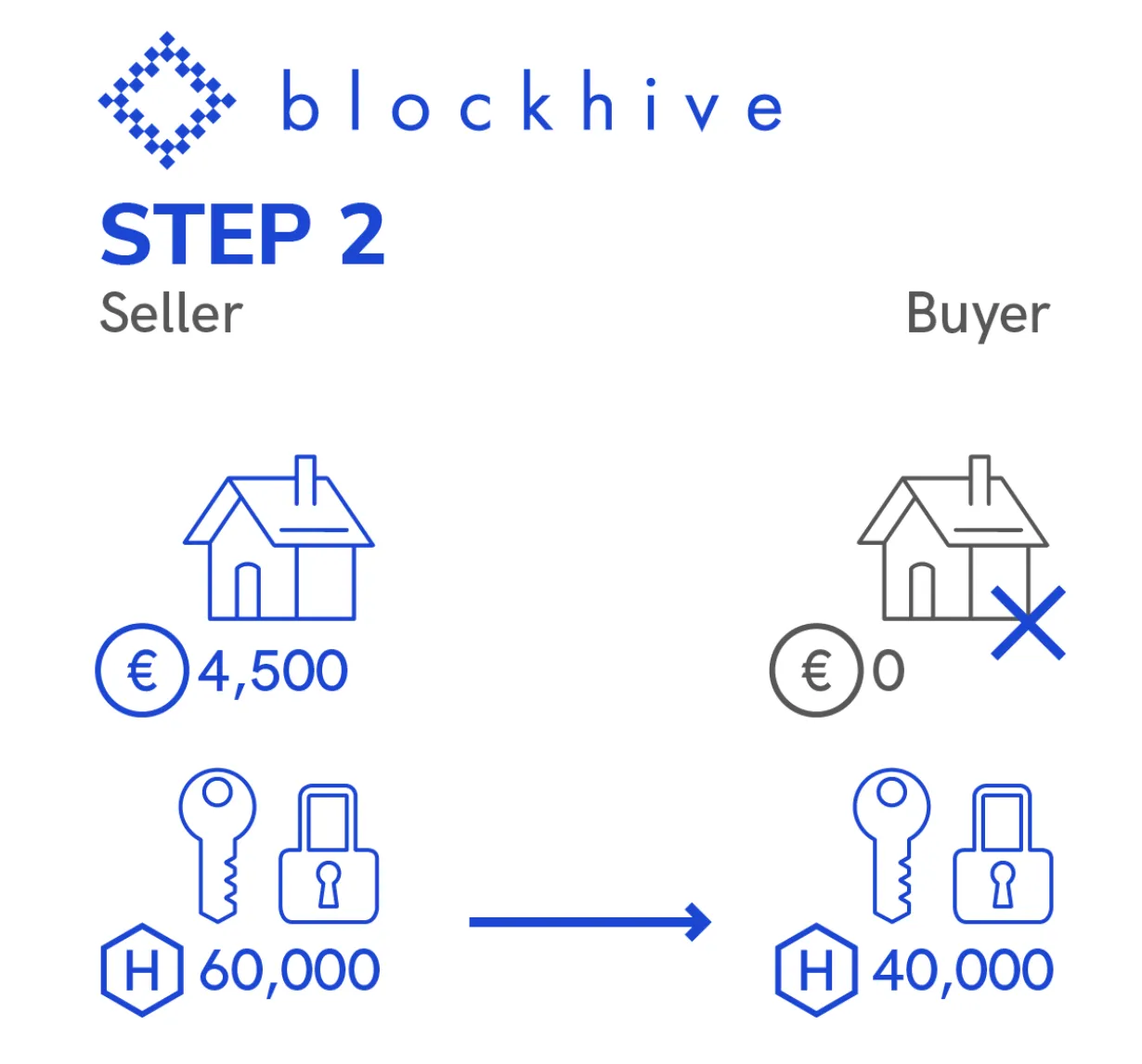

Step 2 The seller transfers 40,000 HIVE to the buyer

)

)

The buyer has 40,000 HIVE tokens, but as they have not used their HIVE to sign a loan agreement yet, their loan balance does not change. Until the buyer uses their HIVE to sign the loan agreement, interest payments will still be paid to the seller. The buyer has the “keys”, but they have yet to unlock the door.

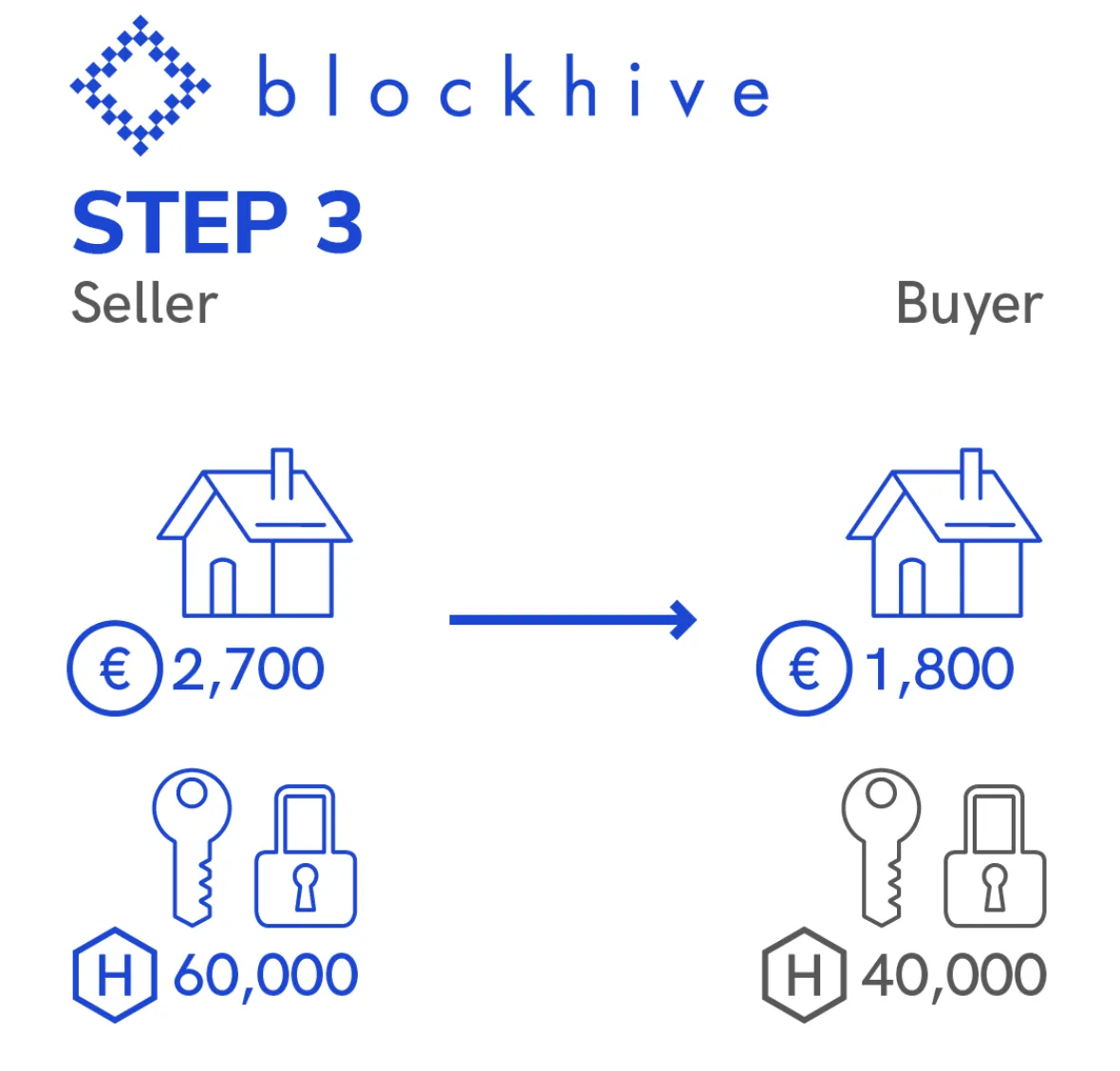

Step 3 The buyer signs the loan agreement and loan rights are transferred

The buyer uses their HIVE to access the loan agreement, their KYC is verified, and the transfer of loan rights is completed and recorded using smart contracts. Having used their “keys,” the buyer can be repaid based on the value of their loan balance.

If you have any questions about our new fundraising method, our team members are standing by to answer them in our Telegram community.

Warm regards,

The blockhive team

About us:

blockhive is an Estonia-based blockchain company with roots in Japan. We use blockchain technology to create practical and innovative solutions for companies, helping them unlock new markets. blockhive is developing an ecosystem for the incubation of projects that have the potential to benefit from blockchain technology.

Our team of programmers, engineers, designers, mining experts, and financial specialists has a diverse and multicultural background. We work alongside natural-language-processing scientists through our partnership with Tokyo-based artificial intelligence company IMAY, as well as the founding team from Agrello, an Estonia-based legal technology startup. blockhive and its partners share the goal of making technology work for the people.

blockhive’s four core businesses include a smart wallet called eesty, a mining operation in Estonia, ILP fundraising solution that is under Tokenote, and e-Best Ventures, an investment arm.

Join our Telegram channel today to show your support! Please also follow and like us on Medium, Twitter, and Facebook.

Copyright ©2018 blockhive OÜ. All Rights Reserved.