The opportunities which blockchain-projects can bring to us are represented in a wide diversity. This technology shows another side of the existence, experience, and future which is so close. Distributed Credit Chain (DCC) decided to pick banking as the lead sector of work. With their ideas and desire to change this world, the project offers new way people can interact with money.

What is the problem

Banks all over the world created their own world with blackjack and…doesn’t matter. Power is a money and people who got them pretty fast understood that they can rule the world. When someone needs money, he is trying to find an opportunity to get a loan, but here are a lot of details of the deal:

- the agreement should be protected by law;

- payment should be fixed;

- relationships between sides should be flexible.

This is how banks appeared. But let us ask you some questions about the modern system:

- is it honest?

- is it possible to say that banks work to make people’s lives better?

The main answer is “no”. Just realize how high credit percentages are. People still forced to work with banks just because it is the only one legalized form of a loan. Of course it is possible to work with loan sharks, but in this case, there is no protection at all. So, the safest way is the bank. That is how monopoly was born.

Distributed Credit Chain (DCC) solution

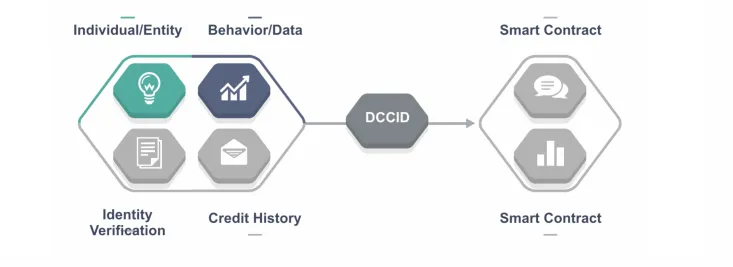

The project chose Ethereum as the basis. Someone who knows main principles of how it works already understood that the main attention is concentrated on smart-contracts. Here are some advantages of blockchain in banking:

- It is possible to create open source. It means that no more third person and expenses.

- Every detail will be fixed on the blockchain. It means that contract between sides is going to be regulated by technology.

- No more monopoly. It means that now relationships between sides are going to be created by healthy competitions (low prices and better conditions).

By the way, everything is going to be regulated by fixed rules and blockchain with available access to the information about deals. It means that no more violation of the trust and problems with fees.

Yes, Distributed Credit Chain (DCC) should be patient, because classic banking will die slowly, but as the result, humanity will get perfect opportunity to use the money for their profit.

Future with Distributed Credit Chain (DCC)

So, imagine that all banks already were replaced with profitable Distributed Credit Chain. It means that loan already doesn’t mean a long difficult process with high risks of being cheated – it is just the situation like “when someone needs money – it is not a problem to get them wherever you want with perfect conditions”. It is the future when money can help to build the life and keep relationships with someone who want to loan money and someone who have money clear.So, Distributed Credit Chain (DCC) creates the conditions to ruin outdated banking system by its replacement with new effective blockchain decision.

WEB-SITE - http://www.dcc.finance/

WHITE PAPER - http://www.dcc.finance/file/DCCwhitepaper.pdf

https://www.facebook.com/DccOfficial2018/

https://medium.com/@dcc.finance2018

https://twitter.com/DccOfficial2018/

https://github.com/DistributedBanking/DCC

--------------

Bitcointalk username: Andryukha

Profile link: https://bitcointalk.org/index.php?action=profile;u=1156334