Official site:

Hello friends! Today I will tell you about the amazing project called Crypto Credit Card!

This project is a multi-functional platform based on the Etherium blockchain with its own crypto exchange, which will allow each participant to store money in a multi-currency online wallet, trade in crypto and traditional assets, invest or borrow in a user-friendly currency around the world.

The purpose of the Crypto Credit Card project is to create a convenient investment and credit tool that would be accessible to everyone. The project team wants to solve the issue of financial freedom for each participant of financial relations, seeks to create a single place, using which the user will receive profit.

Traditional banks have long been unhappy with their customers. People who are trying to figure out instead of storing money in the bank prefer to invest in a cryptocurrency, the capitalization of which is constantly growing.

Many users of financial institutions sometimes need to carry out such operations as replenishment, transfer, withdrawal of currency in other countries of the world. At the moment the most common methods of sending money to another country are such systems as Western Union, Transfergo. However, Western Union system takes a high commission for its services, and the Transfergo platform, unlike its competitor, takes a commission less, with the possibility of making the first transfer free of charge, but it is limited to a certain list of countries where the transfer can be sent. And being in Poland, I faced the problem of sending money to the Republic of Belarus. But all that we translate is nothing more than information. Therefore, it should not cost more than sending a letter to an email or text message.

Large interest rates on loans. We all know that the size of the rate depends on the level of expected inflation. The bank will not be able to provide a loan to a client for a lower loan rate than inflation, or rather, but will try to avoid such a situation with all the forces. Suppose there is only one kind of goods. Let it be kilograms of flour, then with inflation of 10 percent per annum, in a year the flour will cost more by 10 percent. If the bank gives a loan of 5 percent per annum, then in a year, even if you return the debt, the bank will be at a loss, since now it can buy even less flour than a year ago. So the bank, realizing this, will either buy flour, or give a loan of at least 10 percent per annum, or invest in something else, but will not give credits below inflation. In Russia, inflation is currently high. And while it does not change to talk about low rates is not necessary.

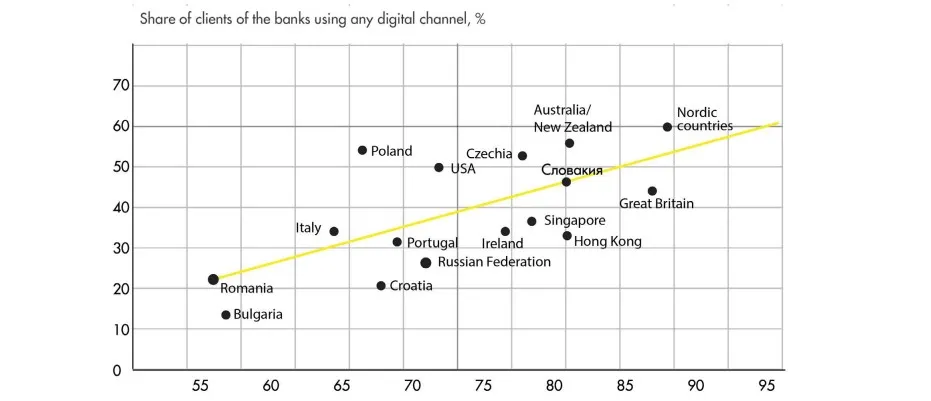

Weak confidence in existing financial institutions. According to a study conducted by the World Bank of Finalta, about 60% of customers in the countries of the Northern Europe, Australia and the USA use distance banking services, in Russia no more than 30%, in the UK and Singapore about 40%.

Low interest on deposits. Rates on deposits in Russian banks according to the conducted statistics of the Central Bank have updated the historical minimum. Leading Russian banks have reduced interest on ruble deposits to a record level - an average of 7% per annum. Until the end of the year, this figure may decrease to 6%, and even 5%. And this means that interest on deposits will inevitably be pulled down.

Inefficient financial management within the bank.

Long service. This is a large stream of people who want to make a payment, and for this they will need to stand in line, and use the bank a lot of time, necessary to verify information about customers.

In addition to the weakness of traditional financial systems, there are also security problems in the cryptocurrency market and the emerging need to convert cryptocurrency from one to another, as well as exchange it for fiat money.

Security issue:

Nowadays, the cryptocurrency market is developing at a rapid pace, and various startups have started to gain popularity, which use this asset, which supports the technology of blockchain. Simultaneously with the emergence of new start-ups, interest in the digital asset begins to arise in ordinary citizens. However, most of them have not yet encountered the problems that surround a complex but now profitable sphere. As a result, citizens become targets for thieves and cybercriminals. To solve this problem, you need a convenient and easy-to-use system that can safely store assets. This solution is offered by CRYPTO CREDIT CARD.

Inconvenience of use:

Since the digital assets market is quite new, it does not yet have simple technological solutions that would allow it to make exchange transactions. And for the conversion of currencies with the lowest commission, people sometimes need to use several exchange sites. For example, in order to convert money from fiat money to some kind of cryptocurrency, you first need to exchange cash for bitcoin on one exchanger, then go to another resource for later exchange of bitcoin for another cryptocurrency. The situation with the reverse exchange operation looks the same. In addition, about 15% of the amount will go to the commission of exchangers.

The CRYPTO CREDIT CARD project will be able to work through all the existing problems in the banking sector and will be interested in its innovative product not only for private clients, but also for investors and traders. The project has so many plans for the future that it is very difficult to list all of them.

The project is built on the basis of blockchain technology. The world is so tired of deception that the technology of blockchain has become for each of us a pure spring of transparent water amidst the boundless desert. In the blockchain you can write down any important information. It is not subject to removal and modification, which excludes once and for all the possibility of any fraud after an important operation. And the technology used smart-contracts is the most honest intermediaries between the seller and the buyer, who can really be trusted even when carrying out a very large transaction.

The platform will connect traditional finances and digital assets. Users will be able to carry out transactions around the world using a plastic card, electronic wallet, SWIFT-transfer, SEPA-transfer and various crypto-currencies. CRYPTO CREDIT CARD will provide a miniature bank in the hands of each client.

Thanks to the platform, users can directly interact with the financial services of intermediaries, but at the same time independently monitor their assets.

Adding a large number of external financial services, access to which each user can get directly through this platform.

With the help of the platform, users will be able to do what was once possible only by signing agreements with several separate financial companies: storage, transfer and cashing of funds; investing in stocks, bonds and digital assets, managing them; loans and mortgages. Now for all these services you need one multifunctional platform - CRYPTO CREDIT CARD.

The modular design of the system provides access to numerous services without overloading the user, and without compromising the operation of the system as a whole. The client adds only the necessary functions by installing the purse extensions from the add-ons directory.

Now users without access to complex and numerous banking procedures will be able to access local currency. They do not need to pay hundreds of dollars as a commission for exchange or as payment for service. The platform will become a large-scale system that will ensure converting and transferring money around the world with a minimum interest. Payment facilities can be used in almost 200 countries, more than 36 million receiving points. Partnership agreements on the issue of cards with large companies engaged in credit cards have been formed.

Create a multi-currency wallet that will be attached to a plastic card and can be used around the world.

Possibility to receive cashback, when buying goods and services using Crypto Credit Card in various retail chains, hypermarkets, cafes, restaurants with which a cooperation agreement will be concluded. Cashback will be up to 30 percent of the amount spent.

Asset management takes place through a single center: with applications developed for Windows Phone, iOS, Android, users enter online banking and get instant access to assets. The center, which manages finances, is understandable on an intuitive level, operates on a modern platform, is distinguished by its original design. To invest, exchange, charge, transfer easily and comfortably.

Favorable conditions for loans. Using the technology of blockchain, the user will be able to choose the loan appropriate to his requests. The project will monitor and collect the best proposals for consumer loans and micro credit markets. The user will be given the opportunity to pass through the repayment of interest and principal.

Creation of an investment service - PAMM - an account that will allow investors to earn money by not selling independently, but by providing this function to the manager.

Use of the CCCR token to perform all operations within the site, the demand for which will constantly grow due to the expansion of the client base.

The maximum level of security was ensured: This was done thanks to the comprehensive studies of the crypto-currency market. All the incidents that took place on trading platforms were analyzed. As a result, the light was seen by an advanced security system that provides tracking of potential threats, eliminating compromising data, stealing funds. The platform will be appreciated by users, for whom safety and trust are paramount.

The exchange of crypto-currency is unique: the project provides round-the-clock access to the crypto-currency market. Legal norms are observed without fail. The toolkit intended for financial analysis is effective.

Mobile banking will allow the user through the CRYPTO CREDIT CARD to make purchases both on the Internet and in existing payment terminals around the world (including Apple Pay and Android Pay). Opening an account on the site will be free of charge. The card issue will be $ 20, service for the first year will not be charged, then it will be $ 10 per year. The payment will be made in the "active account" currency, which means that the user decides which account to bind to the payment card for making transactions.

With the help of mobile banking, you will be given the opportunity to transfer to other users. Transfers between users will be free and instantaneous based on the availability of their own accounting system.

Mobile banking will allow you to convert the currency with a minimum commission. The fee for converting crypto currency into fiat and back will be up to 2% of the transaction amount.

Thanks to a well-established loan-seeking mechanism, the project will allow the borrower to make a decision based on the financial information provided. The client will be able to find the best loan offer, which is ideal for his needs. It is no longer necessary to walk through numerous banks and spend time filling out applications. With the help of this project it will take only a few minutes.

The purpose of using the application is to make the entire process of obtaining a loan remotely, starting with a credit score, helping clients choose the right product from the relevant lending institution.

Aggregator Loan Platform is the best way for online search and comparison of financial products and services among all offers. In addition, users will be able to get recommendations in real time. Customers of the mobile bank can choose the best loan offers from all partner banks and activate them in one click. That is why CRYPTO CREDIT CARD is a revolutionary solution for the credit market, which gives users the opportunity to choose and adapt services in accordance with the needs and requirements of customers.

Unlike classical consumer lending, cryptocurrency lending will be supported by the balance of the cryptocurrency in the project account. This guarantees a minimum interest rate, will provide an opportunity to convert funds from cryptocurrency into fiat for daily expenses, and simultaneously to generate profit from the cryptocurrency.

The rise in prices for cryptocurrency will help to ensure the beneficial use of credit. The client at any time can close the loan or a part of it or take a cryptocurrency as collateral. Thus, repayment of the principal debt and interest can occur through the growth of the rate of the cryptocurrency. The client will now be able to pay off the debt offline, without the need to refinance or look for other options for repayment.

In the passive mode, the client will be able to repay the principal and interest due to the use and placement of the cryptocurrency in the trust funds. On the platform, the trust management service will function. Professional traders will be able to profit up to 20% per month from the amount that is on the crypto-currency account.

Within the C3 app the user creates separate accounts for fiat and cryptocurrencies.

User specifies the default fiat account for payments with the Crypto Credit Card.

The payment will be made in the ‘active account’ currency, which means that the user decides which account to link to the payment card for making transactions.

Then, the user sets the secondary account that will be used if there are no sufficient funds on the primary.

If that account is a cryptocurrency wallet, the system will stake the needed sum as a security for a loan in fiat instead of exchanging (selling) the crypto assets.

CRYPTO CREDIT CARD will create its own crypto-exchange, thanks to which customers will be able to trade digital currencies.

A PAMM account is an investment service that enables investors to earn money without trading on their own. Managing client funds, the manager receives additional income. The manager makes transactions on the account, using both his personal capital and the funds of his investors. Profits and losses on the account are divided between the manager and investors, based on their share in the account. If the manager receives a profit, the amount of funds on the PAMM-account increases, and the profit is distributed between the manager and investors on the basis of the amount of their initial investment. Investors pay the manager some of their profits in the form of compensation. The amount of compensation is determined by the initial offer of the investment manager and depends on the amount invested.

As mentioned above, the project's internal currency will be the CCCR token. The demand for it will grow for a number of reasons. And the owners of the tokens will have the following advantages:

The ability to pay commission fees to the tokens of the CCCR. All users of the project will pay commission fees only tokens of CCCR. The increase in the number of participants in the platform will lead to an increase in the number of transactions and, accordingly, the total amount of commissions on them. Thus, the participants of the platform will need to buy CCRN tokens and pay them a platform commission. Consequently, an increase in the number of participants will lead to increased demand for tokens and an increase in their value.

Possibility to pay CCCR tokens with banking services. Project services, such as mobile banking or crypto-brower services, can be paid by CCCR tokens.

For token owners, the cost of the platform services will be fixed in a fiat currency. And despite the forecasts related to the growth of the CCCR token rate, the holder of the token, which purchased them during the ICO at a fixed cost, will be able to save, as the services for it will not increase.

Within three months after completion of ICO, the team plans to add a token to all the most known exchanges.

To promote the project, ICO is a marketing strategy that allows you to raise funds for the development and promotion of the platform, and help potential users understand the advantages and capabilities of the company's product. The funds raised during the ICO phase will be used to obtain a license from the Swiss payment institution in accordance with the requirements and laws on payment institutions and electronic money.

Name of the token: CCCR

Blockchain platform: Etherium

Standard token: erc20

ICO start: December 4, 2017

End of ICO: May 31, 2018

Accepted crypto-currencies: BTC, ETH, LTC, DASH, FTC, BLK, RDD, DOGE.

The minimum purchase will be: 10 CCCR tokens

Maximum purchase: no restrictions

The price of the token during the ICO will be constantly changing and will be:

April 1 - April 15: 1 CCCR = $ 1.25

April 16 - April 30: 1 CCCR = $ 1.5

May 1 - May 14: 1 CCCR = $ 1.75

May 15 - May 31: 1 CCCR = 2 $

To collect funds, a special bounty program is developed, which takes place at the site of a bountyhunter and everyone can take part in it.

Beginning: 05 April;

The end: May 31;

The project budget is: 1 982 436.90 СССR.

Performing tasks on the bounty, the company rewards each participant with tokens, depending on the type of task the participant performed.

With the proposed project, a list of tasks can be found here.

2016 - market research;

15.11-29.11.2017 - holding a presale;

04.12.2017-31.05.2018 - conducting the ICO;

the first quarter of 2018 - a closed beta version; the introduction of customer service and support services to advise users;

the beginning of the second quarter of 2018 - the production of maps;

second quarter 2018 - open beta;

second-third quarter 2018 - license payment system C3;

the third quarter of 2018 - expansion of the loan aggregator; extension of C3 PAMM;

second / third quarter of 2018 - increase in the number of credit alternatives (including cryptrading and microcrediting) for our customers. Cooperation with banks to attract credit proposals at the international level;

fourth quarter 2018 - obtaining a banking license.

The CRYPTO CREDIT CARD project team has about 40 specialists. They have extensive experience in banking solutions, investments, and in the development of Blockchain and IT technologies. Members of the team for many years successfully built relationships with international banks, established partnerships with regulatory bodies and engaged in market analysis, the development of trading systems and the expansion of a specialized user base. The team aims to provide a multifunctional platform that combines a secure internal infrastructure with a clear interface. Simple registration, instant access, processing of direct payments, asset mobility and customer support determine the features of the platform's vision by the project team.

Sergey Salynin is the general director of the project, a successful entrepreneur, former vice president of the payment system business and top manager of several international companies;

Boris Misik deals with legal issues of the project. Chairman of the public organization "Guild of Lawyers of Russia", member of the expert council for consumer markets under the Public Chamber of the Russian Federation, the founder of IQdocs and EyeOnInnovation;

Michael Sennikov is an expert in the financial community of the community. Top manager of a number of European investment companies. Head of the Commission on Block Technology Technologies of the Eurasian Council of Small and Medium-sized Enterprises;

Tatiana Bulakh is a financial journalist, co-founder of the telegram channel "Crypto Brunettes";

Iraida Radchenko is a financial journalist, co-founder of the telegram channel "Crypto Brunettes"

Summarizing the project CRYPTO CREDIT CARD, I would like to note that the idea of the project is excellent. The platform will allow to "erase" all borders that are created, when it becomes necessary to convert from one currency to another, to make international transfers quickly, safely and with minimal commissions regardless of geographical and banking boundaries. The project will become an ideal platform for all traders, miners, internet marketers, webmasters and freelancers.

Invest in the project CRYPTO CREDIT CARD!

Website: https://cryptocreditcard.io/?uid=uid10463

White paper: https://cryptocreditcard.io/pdf/wp.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3211502.msg33366000#msg33366000

Bountyhunter: http://bountyhunter.club/reg17717

Facebook: https://www.facebook.com/CCCRLTD/

Twitter: https://twitter.com/Crypto_Card?lang=en

Telegram: https://t.me/cryptocreditcardc3

My profile bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1204273

Username: aleksvip15

Facebook: https://www.facebook.com/aliaksei.fetsiukou.5

VK: https://vk.com/aleksvip15

0x70057A69853E9E89D59e1e8e56576F3C2230Ea78