Blockchain in real estate. Today Atlant.io

It was a matter of time till the real estate market, which is over $217 trillion big, was approached by the blockchain. This market at the moment is highly inefficient due to the fact that there are lots of intermediaries with very high fees.

There are several ICOs which have been launched or are in the launching process this year.

The one which we will focus on today is Atlant.io, not to be mistaken to Atlant Investment hype.

Blockchain will entirely reshape the title insurance industry. By registering real estate on a distributed ledger, blockchain could streamline the manually intensive practice of examining public records when validating titles in real estate transactions. According to Goldman Sachs estimates, blockchain driven property records could drive up to $4bn in cost savings due to reductions in headcount and actuarial risk in the US alone.

To quote J. Schneider from Goldman Sachs.

Atlant Token - ATL

The ATL Tokens are Ethereum ERC20 compatible.

The platform enables property owners and developers to tokenize property by creating customized smart contracts and perform a token distribution to either sell property (partially or completely) or attract financing for its construction. The size of the listing fee is initially set at 7% of the underlying asset and, subsequently, determined by voting of the ATL token holders. After a successful token sale, an agreed part of the property tokens is released out of http://atlant.io ATLANT escrow to ATL token holders proportionately, provided such ATL token holders are running an ATLANT node on their computers. There is no passive expectation of income solely from holding ATL tokens.

Source: Atlant Whitepaper

In the presale they managed to raise $1.5mil

Token Distribution

The ICO started on the 7th of September. The total supply of ATL tokens will be limited to 150,000,000 of which 103,548,812 will be issued during the ICO period, and 5,201,188 allotted for the pre-sale, with the remainder going to the team, board of directors, advisers, and bounty program participants.

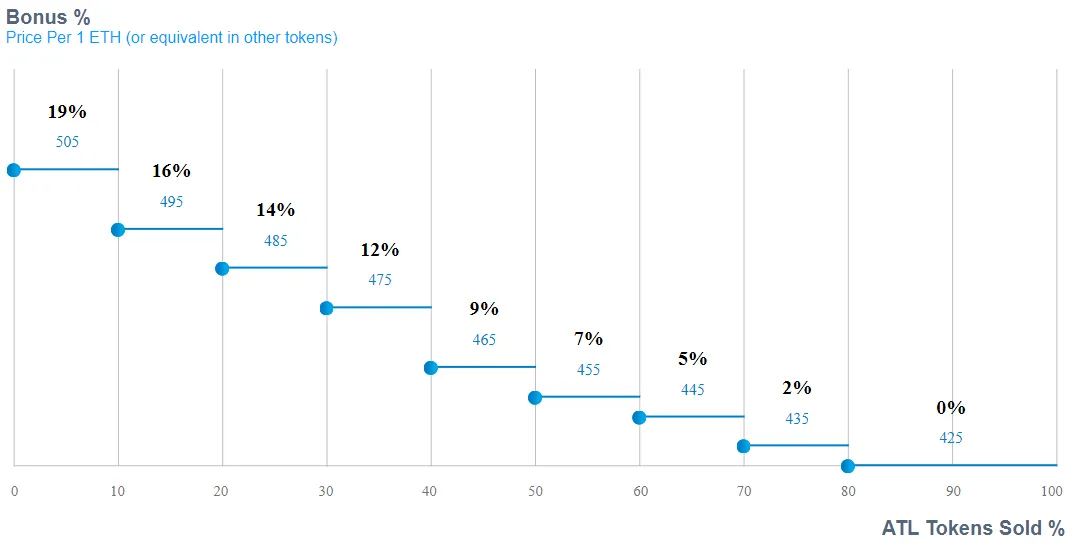

They have also a bonus ICO timeplan:

After the ICO is over, SpaceBTC and BTC-UP will be the first exchanges to list the ATL tokens.

What does Atlant try to do?

They focus on two shares of the real market at first, the high value properties and the rental market.

In the rental market they want to tackle giants like Airbnb which have tremendous high fees and also they will try to diminish if not eradicate the fake reviews, which are done on actual sites by deleting reviews or posting fake ones to increase the reputation.

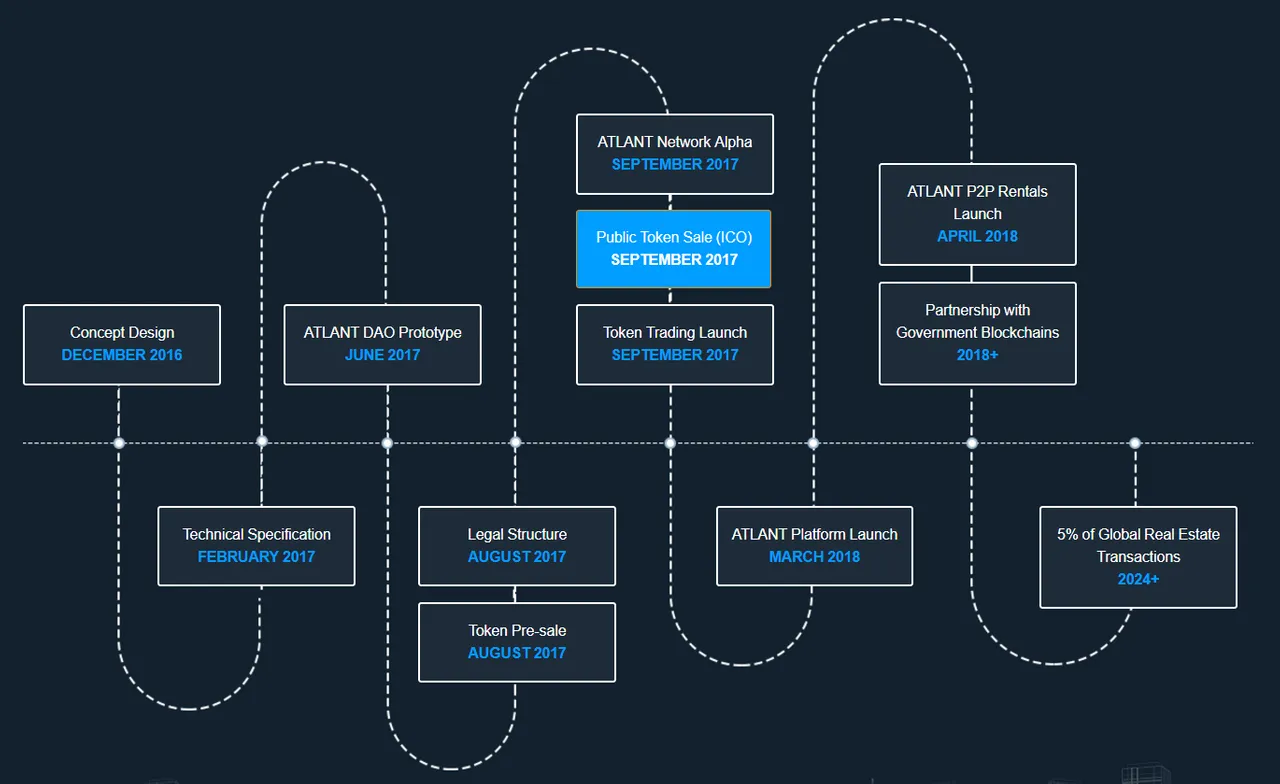

The Road Map

Source: atlant.io

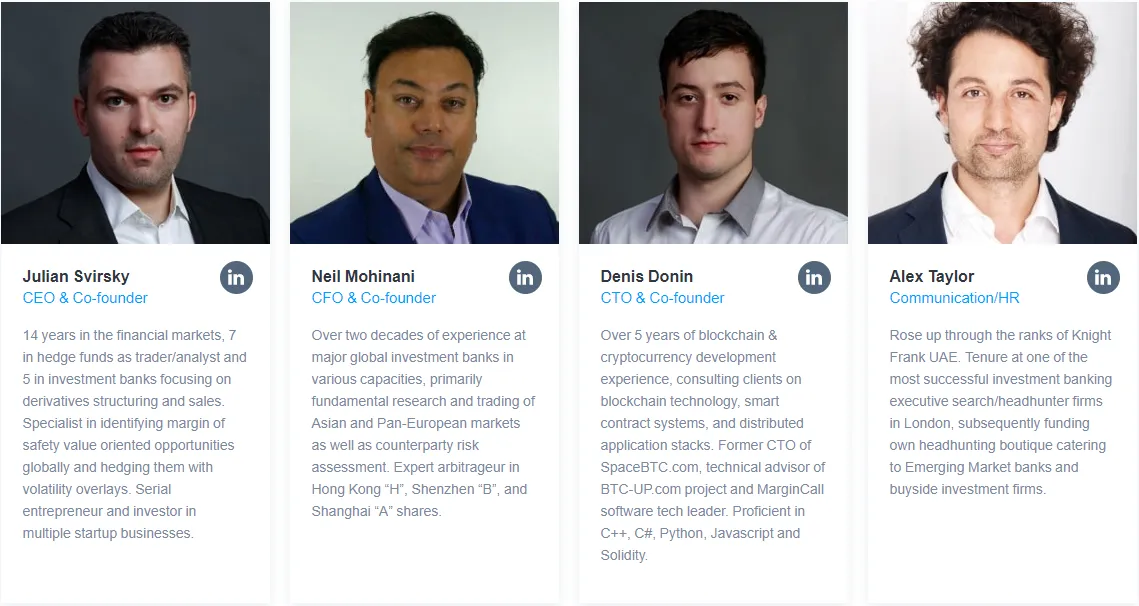

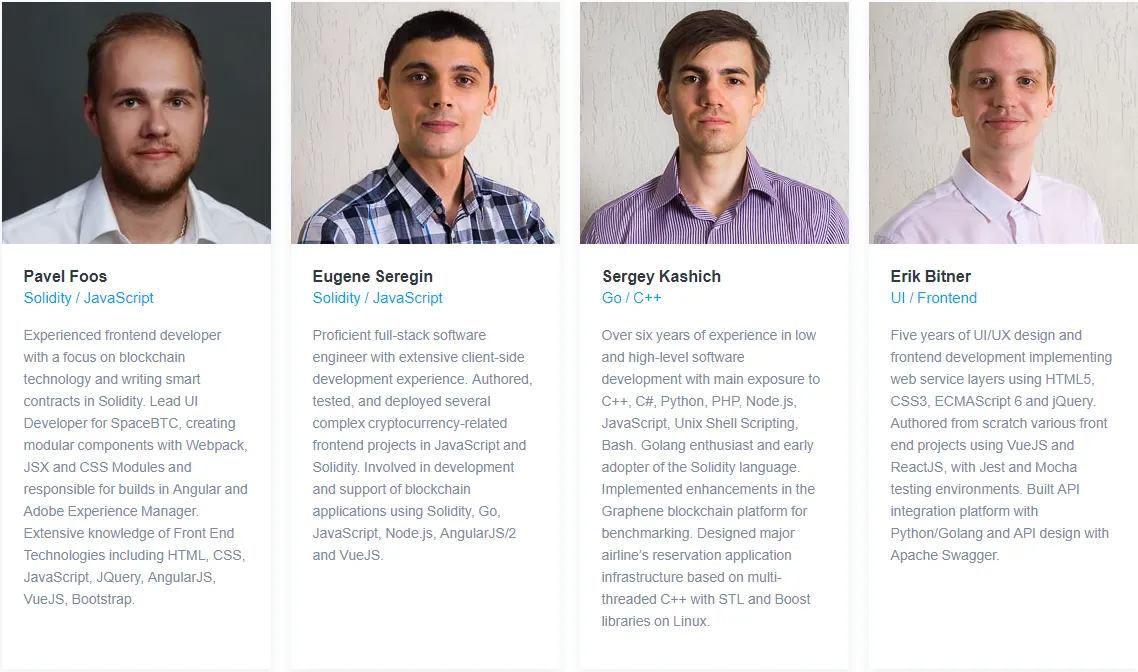

The Team

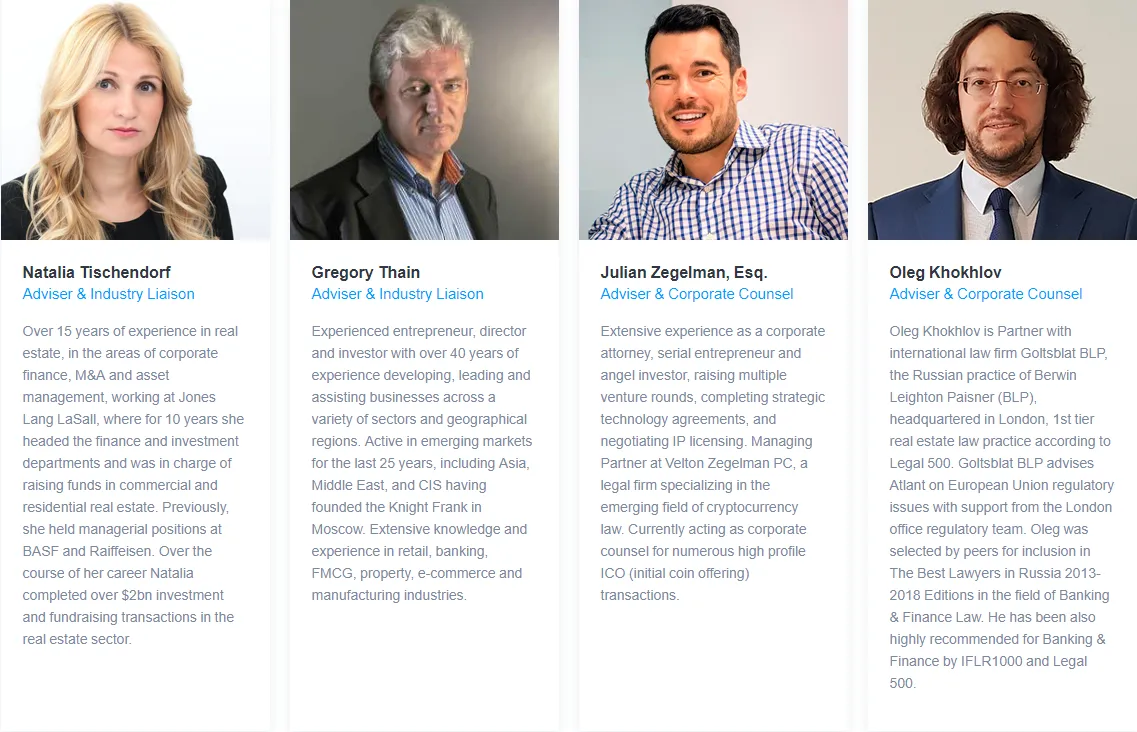

The Advisers

Opportunity

The opportunity is high as they are one of the first on the market. The highs fees are cumbersome for the normal user and by opening it to everyone, everywhere they can gain traction.

Even if they will not get the targeted 5% of the world market, but only 0.05% it is still going to be huge in value

Also the aim to hit the rental market, where most of the working population is moving and does not know the new city, can become huge if the review system is improved, the paperwork diminished and the fees lowered

Risk

- At higher traction with a lot of transactions the speed of the Ethereum Network can cause problems

- The team needs to bring in a real estate expert as they have till now proven business developers, software engineers and legal advisers

- Adoption of the blockchain by the state entities, as they are dependent on this according to the road map

- The road map is very tight, so the team has to put a lot of effort to launch the P2P rental service in April 2018

- The initial focus on $20mil+ properties on the European Market is a very hard share of the market, where the big investment funds are involved in

Let us know in the comments your views on this ICO, the real estate market and what ICO from the real estate market are you interested in.

Disclaimer: The views expressed in this article are solely the author or analysts and do not represent the opinions of ADSactly on whether to to buy, sell or hold shares of a particular crypto currency, cryptographic asset, stock or other investment vehicle.

Individuals should understand the risks of trading and investing and consider consulting with a professional. Various factors can influence the opinion of the analyst as well as the cited material. Investors should conduct their own research independent of this article before purchasing any assets.

Past performance is no guarantee of future price appreciation.

Author: @alexvan