Here is a Sneak Preview of my Guest Speaker Address to a big "Bitcoin" meet-up in Austin, Texas next Monday evening.

I'm still working on what I'll say, but knowing me, it's probably going to be controversial. Here's the meet-up organizer's flyer - I'll allow them a little poetic license with the facts.

Presentation Overview

I thought I'd give you the general outline and points of controversy and solicit a few hoots and catcalls. Dare I mention BitShares in the same company as elites like Bitcoin and Ethereum?

Why, exactly, are they considered "the elite" anyway?

And what about Steemit, Peerplays and EOS? Don't worry, they are covered as part of the growing "BitShares Industry." And with all the high-quality, legal ICO's we've got coming and able to operate at light-speed, Katie bar the door!

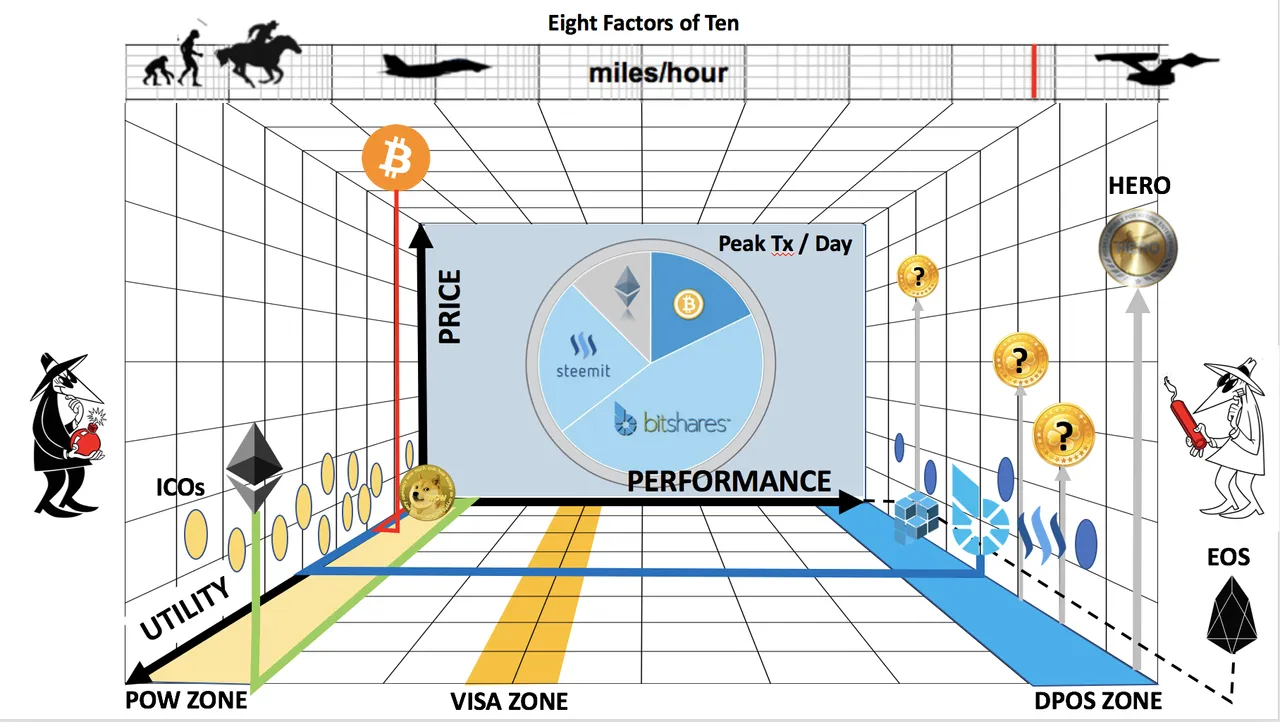

I understand why coinmarketcap.com uses market cap as a popular way to rank the thousands of coins out there. After all, that's directly proportional to "price" which is what everybody wants to see grow for the coins they bet on. But market cap is such a lagging indicator. It predicts the past! What other metrics can better predict the future? I've picked two of them. I'm sure you can think of more.

People speculate on Price under the theory that "nothing succeeds like success." That's true, but what will ultimately matter is adoption. And that, I think, is more a factor of Utility and Performance. At least that's what I'd like to think my high-priced engineers are looking at when they choose which platform to build on. If I ever thought they were basing my company's choice of foundational platform on its token price or its popularity with their peers, I'd have their heads.

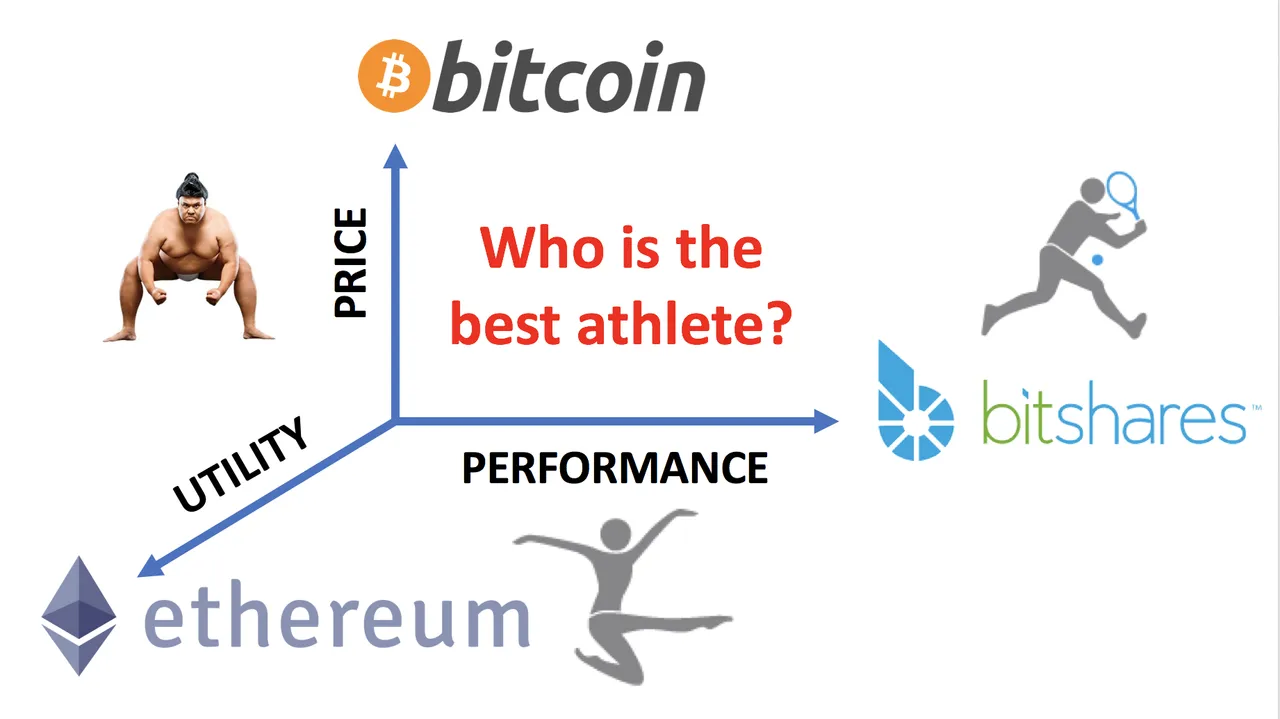

What happens if we compare merits on a 3-D graph?

Suddenly some new insights come into focus!

The first thing you should notice is that I have plotted the coordinates of several well-known cryptocurrencies on the three axes of Price, Utility and Performance. Bitcoin, Ethereum, and BitShares all sit at the max for the axis they dominate and fall significantly short on the other two.

The Price axis is linear, while the Performance axis is logarithmic - spanning eight orders of magnitude between Bitcoin and BitShares when you consider the product of latency, bandwidth, and efficiency. That's the difference between the performance of the pony express and NCC-1701 (no-bloody A,B,C, or D).

The Utility axis is the most subjective with Bitcoin having just one function made more useful by its level of adoption. Ethereum's utility is greatest because it is "Turing complete" and "Programmable" by anyone. BitShares is somewhere in the middle as a full-featured smartcoin factory and decentralized exchange. (It is also Turing complete and programmable using the C++ language, but you have to get approved by its owners to make any changes.)

All the other ICO coins and clones sort out into three regions of the cube, generally associated with the coordinates of these three platforms. EOS lies "outside the box" at this point, but is likely to soon stretch all three dimensions.

The most striking feature of the chart for me is how clinging to mining has kept the other two "leaders" confined to the narrow Proof of Work "POW Zone" characterized by transactions per second under 30, latency measured in minutes to hours, and contributions to global warming comparable to a squadron of coal power plants. The Delegated Proof of Stake "DPOS Zone" puts the BitShares family in a whole different category by itself, setting records in the VISA band at 3300 TPS and scalable into the 10,000 to 100,000 TPS band to handle all the world's needs.

This will be decisive, because Performance the only thing that should really matter to companies building on it. What, exactly, is the benefit of your platform having flexibility for anyone to change your code on the fly or a market cap that doesn't affect the users of your product in any material way?

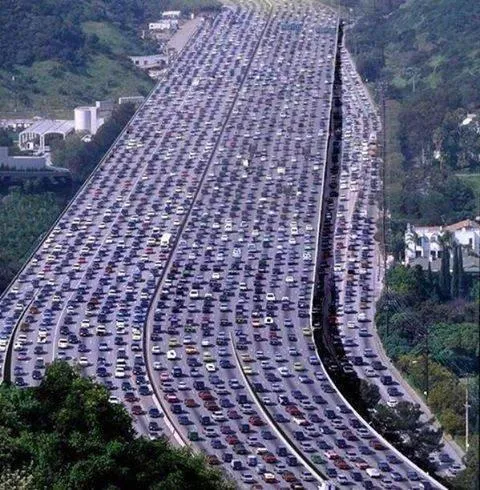

This is where I make the most hay when talking with CEOs of companies getting ready to deploy a new blockchain based business. I point out all the products being developed in the POW zone and they beam, "Isn't that great? We were smart to pick the same platform everyone else is using!"

Then I ask them what happens to their millions of anticipated customers when all those new products come on line competing to use the same 30-or-less transactions per second? Won't it be like cleverly putting their mission-critical traffic on the same crowded highway at rush hour?

They don't usually fire their technical advisors until after I leave their board room.