Reflections on last weeks bloodbath

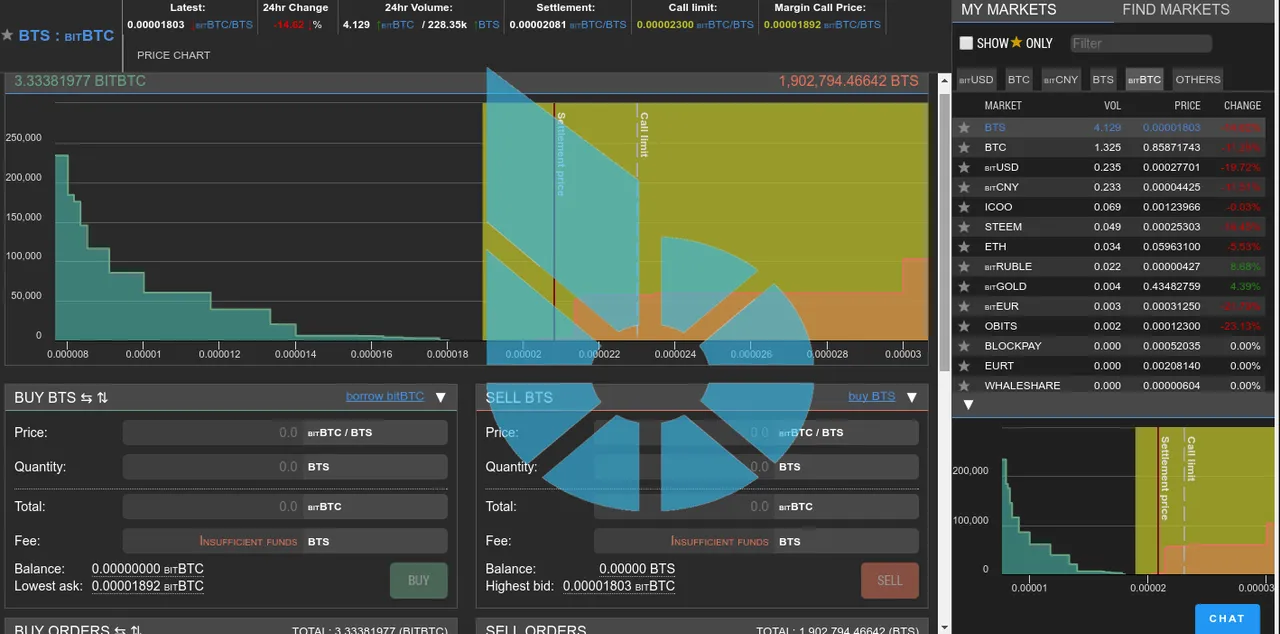

On September the 13th, while the streets ran red with blood, the order book on the DEX ran gold with margin calls and liquidations. Many of us witnessed it, some of us lost small or even large fortunes, a few made out like bandits increasing their position tremendously. This is now the 2nd or 3rd time I've witnessed shareholders get called and even liquidated, and it has become apparent to me that there is critical infrastructure currently missing from the ecosystem. While we have several trading bots, it's obvious we need a very basic bot that can track debt positions for shareholders going long on BTS, and provide notifications when certain thresholds are hit and/or when the price moves more than a user defined percentage in less than a user defined period of time. If I was better at coding (or had the time to teach myself), I would have created something like this myself. I have every reason to believe that from a shareholder's perspective, a creation of a tool like this given away for free to the community would add enough value to the ecosystem to justify the effort and/or expense.

tl;dr: We need to create a piece of software that can send emails, IMs, SMS, and make phone calls to notify users when their margin levels fall bellow a threshold deemed acceptable by the user.Simple and straightforward. I doubt I'm the first to say it, but since the need is still unmet it obviously merits mentioning again.

The yields of my reflections

One concept that has interested me since I first heard Bytemaster mention it in an interview years ago, is a Mutual Aid Society on a blockchain. As far as I know not much came of it after it was first proposed, but I believe we may have a use case worth exploring for it right here within the community of our shareholders. Even if we already had a notification system, what about anyone holding a debt position who is unable to react quickly enough (a distinct possiblity since our markets operate 24/7/365)? Our ecosystem would be more robust if we had a safety net (or better yet multiple safety nets, that compete with each other based on their parameters), would this not make our ecosystem more robust? Would this not be an absolutely ideal application for a decentralized M.A.S? A decentralized autonomous robotic entity within BitShares, that would act as a safety net for all those Heroes who issue price-stable currencies into existence by collateralizing them with their shares.

I imagine it would be strictly voluntary, with membership dues that would be proportional to some combination of a rolling average of a user's debt positions, and probably additional metrics - essnetially the complete reinvention of "credit ratings" for a completely different type of financial system. Even defining "credit rating" within the the context of the BitShares ecosystem will obviously require brainstorming and debate on our parts.

The MAS software entity would need to be able to maintain a pool of BTS, that would presumably originate from membership dues, and it would need to be able to dynamically add collateral (and remove it when the danger is past) to members' debt positions without any kind of human intervention. I have little doubt that what I describe is impossible to implement on BitShares as it is today - I imagine this would require a hard fork somewhere along the way (luckily DPoS chains are agile enough that they can upgrade themselves when there is a clear need), but I definitely think it may be possible. If my fellow shareholders are in agreement that this is something we want and need, I have complete faith that if such a safety net is possible to implement in a trustless fashion, this community is fully capable of devising the best possible way to do so.

To be honest, with the coming Sovereign Hero campaign (taking into consideration that some of the materials I've seen for it involve encouraging new business adopters to expand the supply of HERO by borrowing it into existence), it is my opinion that an MAS-based safety net intended to protect against margin calls and liquidiations is probably a piece of absolutely mission critical infrastructure.

Edit: I realized I only included the link to 2nd blog post by Bytemaster on the subject. Here is the first. I'm also starting to realize that STEEM is probably the culmination of his efforts then...