For anyone involved in the crypto world, you would have to be living under a rock, taken a holiday to the moon or just taken a long nap to not of heard about the recent Bitmain IPO announcement. For those who have crawled out, woken up or landed back on planet earth, I will update you on the developments of Bitmain and will give some details on what the future holds for the crypto mining community.

The crypto mining giants who specialise in ASICs mining are producers of the powerful antminers seen today. The mining company who in June almost reached a 51% hash dominance, have recently announced an IPO (initial public offering) to early investors. The announcement has caused great controversy mainly because there are several angles this can impact the crypto space, and everyone seems to be split on what this can do to the market.

The criticism comes from the Bitcoin community (especially the GPU miners) in that the overall dominance that the Bitmain mining pool holds gives them too much power over the space and takes away the decentralised element of what cryptocurrency is about. It has also been released that the company holds over a million Bitcoin Cash. This could capitulate the currency if Bitmain were to sell a large portion of their holdings and could put them in a vulnerable position in the future.

With Jihan Wu, an early founder of Bitmain being an open supporter of Bitcoin Cash, the BCH community see this only as a positive. Having such a big company behind them, the BCH investors feel this is a forward step for them. Questions were also raised about the IPO in general. You must ask yourself why would Bitmain need to sell portions of their company to the public? Certain speculators predict an exit scam after the offering. Others see this as an opportunity for the company to move on to other projects.

Whatever the future holds for this intriguing situation, a monopoly in mining will cause a lot of problems. With ASICs taking over and slowly killing off GPU and CPU mining, Bitmain has been proven to manufacture the most efficient mining hardware in a space where ROI is already low.

What needs to happen to tackle the Bitmain dominance?

Well it seems the era of ASICs mining is going to be around for a while, competition for Bitmain is emerging. With new companies manufacturing mining chips and creating their own ASICs miners.

Let’s have look at 3 of the top emerging companies delving in to the ASICs sector.

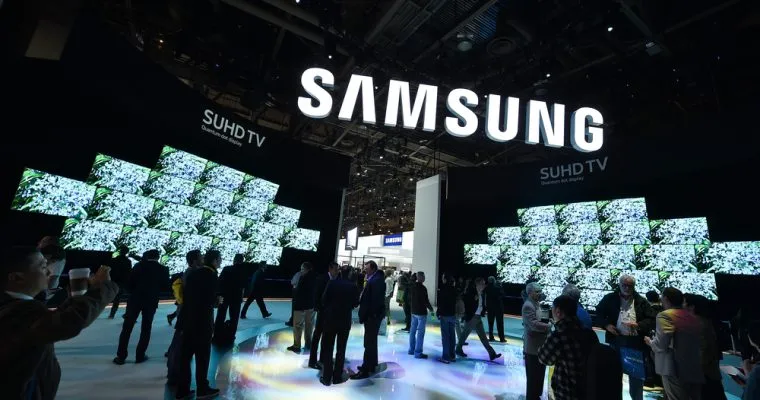

- Samsung

The global electronics giants have recently announced that they’re currently manufacturing mining chips. The chips will be a competitor to TSMC, the Taiwanese chip manufacturer for Bitmain. These new chips could inspire Samsung to create their own ASICs or bring in new hardware manufacturers.

- GMO

The Japanese company announced its B2 miner on June 5th which boasts greater hash power estimated at 24 TH/s compared to Bitmains 14 TH/s. GMO has a long history in the tech field In Japan and could provide strong competition for Bitmain in an industry which is very un-competitive.

- Innosilicon

The A9 ZMaster by Innosilicon is self-proclaimed to be the world’s best equihash miner. On release of the A9, the miners were twice as efficient as Bitmains release causing bitmain to lower their prices.

With Bitmain controlling the mining industry at the current time, there seems to be several companies that want to disrupt that.

Will Bitmains monopoly continue?......Time will tell.