Content adapted from this Zerohedge.com article : Source

Jamie Dimon made the world aware of his feelings on Bitcoin. He spent months going around slamming the cryptocurrency at every opportunity. This made headlines which sent shockwaves through the relatively minor industry.

JPMorgan has come out with the "Bitcoin Bible" detailing every aspect of the currency.

Executive Summary

Introduction

- J.P. Morgan researchers from across a wide range of expertise analyze various aspects of Cryptocurrency (CC) to gain insight on this market and its potential evolution in this report. CCs' extremely rapid growth, and then fall, both in terms of number of CCs and prices and their challenge to the current financial infrastructure, are forcing all market participants to closely monitor and understand this new market.

- Cryptocurrencies are virtual currencies that are created, stored and governed electronically by an open, decentralized, cryptography system. CCs can be used to exchange money, to buy certain goods/services or as an investment. There are over 1,500 cryptocurrencies with a market cap of some $400bn as of February 8, 2018, with Bitcoin being the largest representing a third of the market according to CoinMarketCap.

- Launched in early 2009, Bitcoin (BTC) is the dominant cryptocurrency with a market cap of $140 billion (representing one-third of the CC market) and nearly 17 million BTC units in circulation (capped at 21 million). Bitcoin was the first major cryptocurrency and has spawned many competing CCs and technologies, many of which still fall back to Bitcoin as a support currency. Bitcoin itself has split into two cryptocurrencies, Bitcoin and Bitcoin Cash, to improve liquidity.

Technology

- Cryptocurrencies are the face of the innovative maelstrom around the Blockchain technology that is bringing both massive price volatility and a constant trial-and-error of new product try-outs and failures.

- CCs are unlikely to disappear completely and could easily survive in varying forms and shapes among players who desire greater decentralization, peer-to-peer networks and anonymity, even as the latter is under threat. The underlying technology for CCs could have the greatest application in areas where current payments systems are slow, such as across borders, as payment, reward tokens or funding systems for other Blockchain innovations and the Internet of Things, as well as parts of the underground economy.

Applications

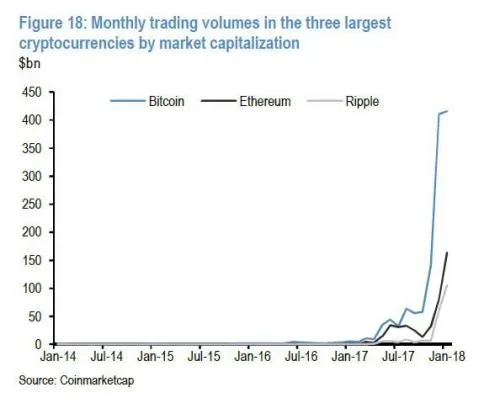

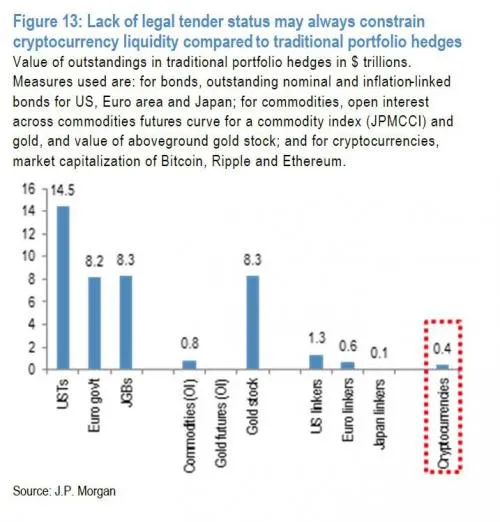

- There are over 1,500 CCs with a market cap of $400bn. Transactions in the three largest CCs average $550bn per month and come mostly from individuals. Ownership is highly concentrated. The opportunity set around direct CC trading appears relatively limited for banks, while the two Bitcoin futures recently launched are seeing only $140mn in daily trading.

- Blockchain saw its first expression through Bitcoin – the first CC – but is more likely to ultimately see its greatest application outside of CCs across other financial and non-financial transactions, even as Blockchain itself looks set to evolve fast as the market learns about what works best.

- There is the potential for increased usage of Blockchain in cross-border payments, settlement/clearing/collateral management as well as the broader world of TMT, Transportation and Healthcare but only where any cost efficiencies offset regulatory, technical and security hurdles.

- Hedge funds have been moving into this market making up most of the 175 CC funds but AUM remains only a few billion dollars. Asset managers are experiencing limited success in bringing products to market and have not been able to launch CC funds or ETFs without support from the SEC or major distributors.

- While about half of the early CC transactions happened in the underground economy, the share of this is declining, with investing and speculation now taking a much larger share.

Challenges

- It will be extremely hard for CCs to displace and compete with government-issued currencies, as dollars to euros and yuan are virtual natural monopolies in their regions and will not easily give up their seigniorage profits.

- CCs are experiencing heightened volatility and will face challenges from both technology (such as rising mining costs and hacking) and regulators who are concerned about anti-money laundering and investor protection, as CC payments are irreversible and there is no recourse.

- Security concerns have mounted in Bitcoin exchanges as hackers have infiltrated a number of CC exchanges generating large losses, while regulators are challenging anonymity.

Non-adapted content of this Zerohedge.com article:

https://www.zerohedge.com/news/2018-02-11/jpmorgan-publishes-bitcoin-bible