What happened: look at the smart days of 2017. In early January, bitcoin for the first time in several years crossed the $ 1000-th line and began to rise at a crazy pace. By June, the currency had surpassed the $ 3000 mark, but then suddenly rebounded, dropping 36% to $ 1,899 in mid-July.

Why it happened: even when bitcoin made a new boom, many were worried that something was wrong with the code behind the scenes. In particular, bitcoin was slow compared to other crypto-currencies, such as lightcoin and etherium, and its main developers could not agree on how to update the software. This highlighted the outlook for the "fork" with two versions of the canonical blockade of bitcoin, as well as the possibility of future splits, which in turn caused sharp market fluctuations and a significant price drop. Ironically, this fork in August materialized in the form of a competing Bitcoin Cash, but it does not seem to have caused long-term harm to bitcoin.

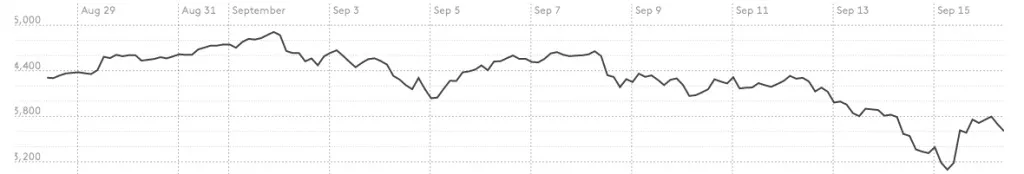

What happened: after fears about the fork were confirmed, bitcoin showed another crazy breakthrough - it rose almost to $ 5,000 in early September before falling by 37% by September 15, discarding about $ 30 billion of the total market capitalization of the crypto currency . However, the restoration began in three days.

Why it happened: while bitcoin movements can be incomprehensible, the main reason for the last collapse can be expressed in one word: China. After he "broke" the so-called "initial offers of coins" (ICO), widespread rumors that the communist government is going to ban the trading of crypto-currencies in general. In response, the most famous exchange, BTCChina, said that it will cease trading. These harsh measures, combined with talk about China's actual monopoly on bitcoin mining, explain the recent fall in the rate of the crypto currency.