Bitcoin is a cryptocurrency and a digital payment system[13]:3 invented by an unknown programmer, or a group of programmers, under the name Satoshi Nakamoto.[14] It was released as open-source software in 2009.

**bold** Bitcoin

Bitcoin logo.svg

Prevailing bitcoin logo

ISO 4217

Code XBT[a]

Denominations

boldSubunit

10−3 millibitcoin[1]

10−6 microbitcoin, bit[8]

10−8 satoshi[9]

boldSymbol

BTC,[note 1] XBT,[note 2] ₿ (U+20BF, BitcoinSign.svg)[note 3]

millibitcoin[1] mBTC

microbitcoin, bit[8] μBTC

Coins Unspent outputs of transactions denominated in any multiple of satoshis[7]:ch. 5

boldDemographics

Date of introduction

3 January 2009; 8 years ago

boldUser(s)

Worldwide

Issuance

boldAdministration

Decentralized[10][11]

Valuation

boldSupply growth

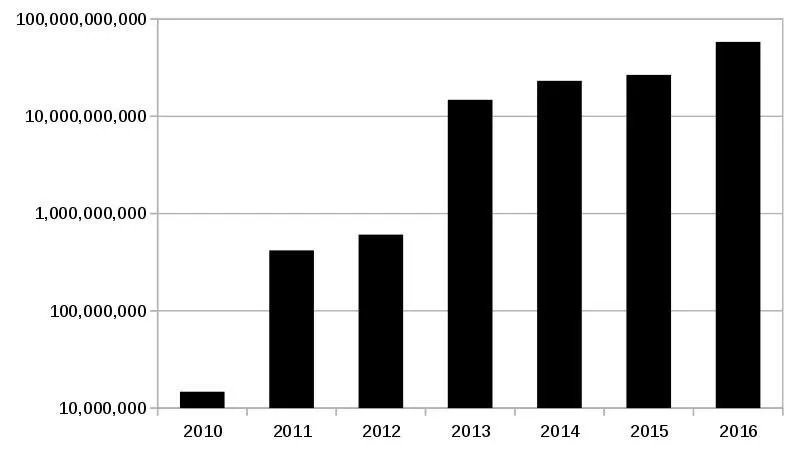

12.5 bitcoins per block (approximately every ten minutes) until mid 2020,[12] and then afterwards 6.25 bitcoins per block for 4 years until next halving. This halving continues until 2110–40, when 21 million bitcoins will have been issued.

Economics

Bitcoin is a digital asset[88] designed by its inventor, Satoshi Nakamoto, to work as a currency.[22][89] It is commonly referred to with terms like: digital currency,[13]:1 digital cash,[90] virtual currency,[9] electronic currency,[25] or cryptocurrency.[91]

The question whether bitcoin is a currency or not is still disputed.[91] Bitcoins have three useful qualities in a currency, according to The Economist in January 2015: they are "hard to earn, limited in supply and easy to verify".[92] Economists define money as a store of value, a medium of exchange, and a unit of account and agree that bitcoin has some way to go to meet all these criteria.[93] It does best as a medium of exchange, as of February 2015 the number of merchants accepting bitcoin has passed 100,000.[20] As of March 2014, the bitcoin market suffered from volatility, limiting the ability of bitcoin to act as a stable store of value, and retailers accepting bitcoin use other currencies as their principal unit of account

General use

According to research produced by Cambridge University in 2017, there are between 2.9 million and 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. The number of users has grown significantly since 2013, when there were 0.3 to 1.3 million users.[21]

Acceptance by merchants

In 2015, the number of merchants accepting bitcoin exceeded 100,000.[20] Instead of 2–3% typically imposed by credit card processors, merchants accepting bitcoins often pay fees in the range from 0% to less than 2%.[94] As of December 2014 select firms that accept payments in bitcoin include:

Payment service providers

Merchants accepting bitcoin, such as Dish Network, use the services of bitcoin payment service providers such as BitPay or Coinbase. When a customer pays in bitcoin, the payment service provider accepts the bitcoin on behalf of the merchant, directly converts it, and sends the obtained amount to merchant's bank account, charging a fee of less than 1 percent for the service.

Legal status, tax and regulation

The legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed its use and trade, others have banned or restricted it. Regulations and bans that apply to bitcoin probably extend to similar cryptocurrency systems.