Bitcoin seems to dip down in 1~2week time frame. If it goes over 7.8k, this assertion is invalidated.

Anyway, many fear the dip, at the same time they want the dip.

however, it is very uncertain because below 6k we don't know where the bounce lines are,

where it should 100% bounce, where we should buy.

the fact about dip is alluring, but it confuses us because it would keep dip more and more!

I think the market numbers and sentiment are exactly the same as 2014 July.

RSI keeps dropping, OBV keeps dropping, everything keeps dropping. however, we must understand that btc didn't bounce off where it should have been bounced off. that is because, we are looking at patterns and numbers from the latest few months, not the 2014 massive

dip. we should always study the worst to secure our money.

Here I want to make 3 key points, before we go below 6k. these, I think for now can be some numbers you look at.

-Support

Many argue where the bounce lines are, where it should bounce off. 5500? 5200? 5400?.

Well..nothing is sure, nothing is super support.

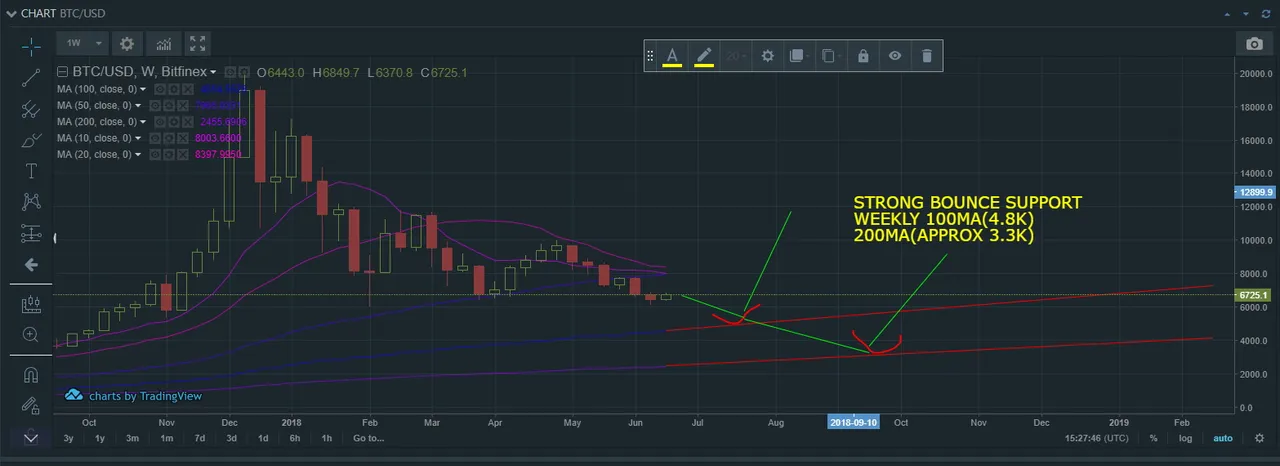

I think weekly 100ma, and 200ma is the most convincing bounce points,

where you can hardly lose much money when bought at the spot, right timing.

100ma, 200ma in weekly basis has been a very strong support since 2015,

which, has not been touched for a very long time. I believe if we touch this area, bounce should come in high possibilities.

-RSI

Before crumbling down to 6k area, we saw support at Daily RSI at 30, and made a V curve move up to 40, even over that.

however, the trend is declining, and considering the low trading volume, we must be more conservative. In 2014,

the chart bounced off even lower than the most common oversold territory.

I suggest daily 20~25 RSI, Weekly 28~30 area should be the bounce point, if we break down below 6k.

- Where to sell for short term day~two day trading

From Feb, the bears were in control of the market, most of the times. When they do, they always controlled one thing.

do not let Bitcoin to surpass over Daily 10, 20 MA.

If Bitcoin goes over that, it can be a sign of recovery, but most likely, in this low volume and uncertainty, it should bounce off those points and dip down.

We can see the same outlook just now, where BTC has been rejected 3~4 times from the 6.8k area. current moment, 20 MA is about 6980~6990, which is a very strong resistance.

so, we have to be surprised if btc passed 20MA, but at the same time get ready

for buying action if it breaks 20 MA and holds.

It should normally mean BTC would break through RSI resistance and make move into 'normally bought territory'.

BUT! for safety, always try to sell at 10ma, and 20ma if we start to dip below 6k.

that is it for now, will come back with other ideas.

All the best in crypto investing!!