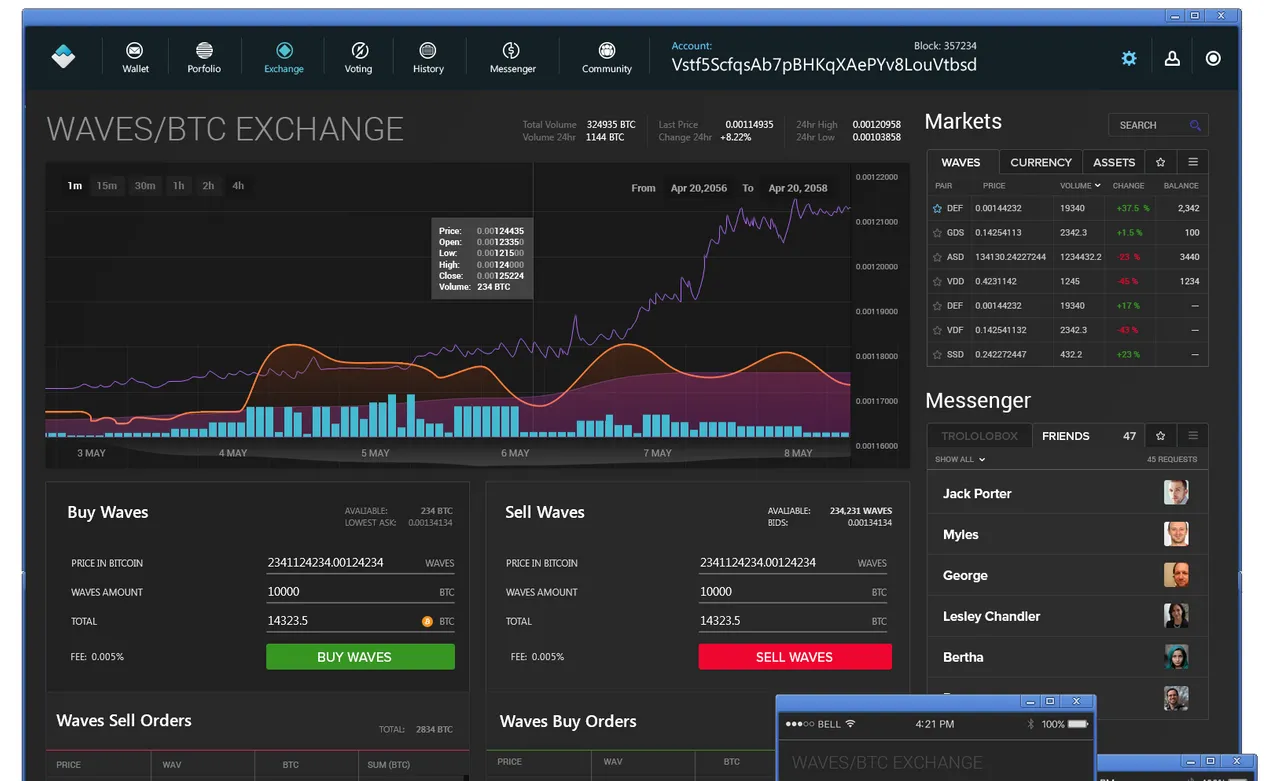

Mock-up of the forthcoming WAVES DEX GUI - it will be interesting to see if they can actually make it look this pretty. Also the black background may not be to all tastes.

Introduction

A while back I wrote a post about some of the issues that people were having on Poloniex - one of the larger bitcoin exchanges and THE largest altcoin exchange.

People were having difficulty making trades at peak times and in some cases were unable to access the exchange at all.

More worryingly it seemed that a large number of withdrawals were having to be "manually verified" before going through - in some cases people were waiting more than a week.

This is a particularly worrying sign for those who have been in cryptocurrencies for a long time because these type of withdrawal issues are often the first signs before an exchange fails.

We saw it with MT GOX in 2014 and we saw it with Cryptsy for months before it failed.

One of the solutions for these sorts of issues that I (and many others) have suggested in the past is the use of decentralised exchanges (DEXs).

Sadly most people who are new to cryptocurrencies have no idea what a decentralised exchange is or more importantly why you would need to use one.

The Problem With "Centralised" Exchanges

One of the good things about cryptocurrency is the idea that we don't need to trust anyone and we are in full control (normally) of our own coins/tokens.

We get to send them out and move them around as we see fit. There is no one to regulate the blockchain and control who can and can't make transactions.

This can be a double-edged sword though.

When it comes to something like Bitcoin, YOU are responsible for looking after and securing your coins.

If you mess up in some way, then there is no central authority that can help you out, since no single person or government controls the blockchain.

If you get robbed, then unless there is some way to pursue the person who robbed you in real life, there is no way to get those coins back.

In a similar way to this, when you use a centralised exchange like Poloniex, Kraken, BTCC etc, you are handing your money over to another person and trusting that they do the right thing with it.

With centralised exchanges you are trusting that:

- They will not lose your money via hardware failure, lost credentials or other negligence.

- They will keep it secure against theft, hacking etc - whether they are from internal or external sources.

- They will not steal it from you and will behave honorably.

- They will not go out of business - in which case your money could end up stuck.

That is a lot of trust to put into a body that is completely unregulated (at the present time) and may not even be in the same country as you.

If something goes wrong as it did in multiple cases in the past (MT GOX, Cryptsy, Mintpal etc) - you could end up losing all your money and you will not have any kind of government protection (like you have with banks).

Cryptocurrency exchanges are not regulated and your deposits are not insured. You are handing your money over to a complete stranger or group of strangers and hoping that at some point they will give it back to you.

Perhaps you are starting to see why this might be a problem?

This is where decentralised exchanges (DEXs) come in.

Decentralised Exchanges

Decentralised exchanges allow you to trade in a safe manner because they are not controlled by any central person or authority.

It is beyond the scope of this article to go into exactly how they work (there are a number of methods including the use of smart contracts).

The basic idea is that the exchange or a central "site" never holds your money. You keep the money and hold it in your account until you make a trade.

When a trade is made it is between the buyer and seller alone. -In some ways it is like a trustless escrow service.

This way you don't need to trust a central party to make a trade. If a DEX fails in some way there is no way for you to lose your money.

Great So Why Isn't Everyone Using a DEX?

There are a few reasons why most people are still using centralised exchanges rather than the DEX option:

Most people don't know they exist.

Many people don't know why they would want to use a DEX.

There is sometimes friction in changing exchanges and people are lazy.

Lack of trades and liquidity - this is one of the main reasons and is kind of a chicken and egg issue. Until more people use DEXs there won't be enough volume for many traders to use them, which then prevents more people from using them.

The interfaces are often not as good as the best centralised exchanges and this may reflect a lack of ability to invest in the UI.

I think many of these issues will start to be overcome as time goes on. The interfaces will improve as will people's awareness of what DEXs are and why they are needed.

Current DEXs

This will not be an exhaustive list (feel free to add any I miss out in the comments):

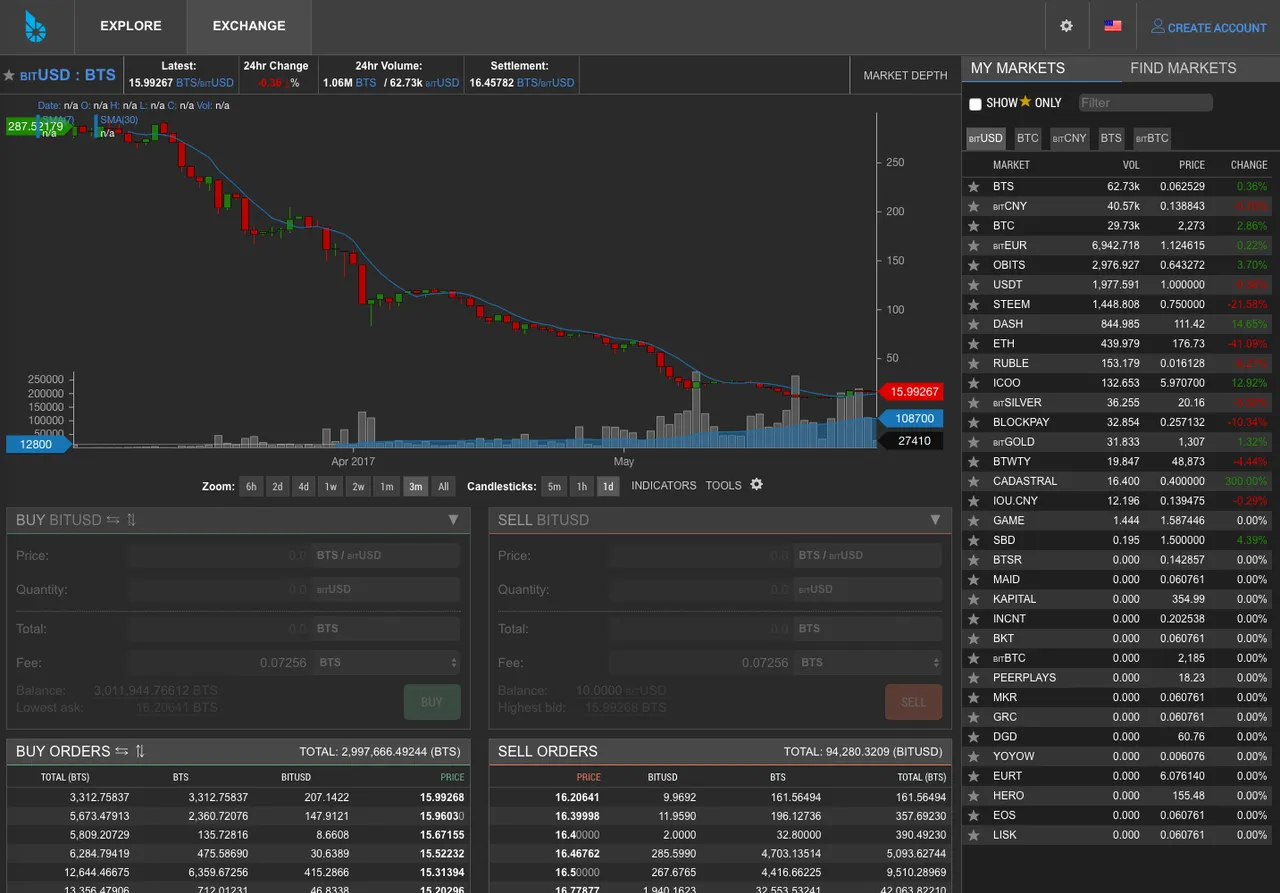

Bitshares - this is one of the most well known and oldest DEXs. I have used it a few times without any problems. It has a big community behind it and is continuing to improve. Also it is based on the superb graphene technology so is likely to be able to deal with future scaling issues more easily than others. The UI is probably better than most of the other DEXs but not quite on a par with Poloniex yet - hopefully it will continue to improve in this area. It also hosts many ICOs if that is your thing.

Bitsquare - this runs through an app which you must download to your computer. It also uses TOR to help increase your privacy. I have only really used it once and although the interface looked nice there was so little volume that it I was unable to make any trades. One to watch though.

WAVES - still pretty new, this DEX is still quite basic. It runs through the WAVES wallet software. I have used it a few times and it works but it does need some further polish. The new UI that is currently being worked on looks pretty amazing (better than Poloniex in my opinion) but we will have to see if it actually turns out to be as good as the mock ups (see banner image at the top of this post). WAVES is also an ICO platform.

HEAT - also very new and I haven't really used this. The interesting thing about HEAT is that they are in partnership with the Dutch bank ABN AMRO - so I find that interesting as it would make "strange bedfellows". Banks are probably the antithesis of DEXs so it is strange. Anyway there is not much to see right now.

NXT - to be honest I don't really know much about NXT but am just adding it here for the sake of completion. Perhaps someone who is more familiar with it can fill in the blanks.

KMD/Komodo - is also working on something called the "EasyDEX" - described as the "Most Secure, Easy and Native Decentralised Exchange" but there are few details at the moment other than that sentence in the wallet and a note saying "Coming Soon".

OpenLedger - I don't really know much about this and was under the mistaken assumption that it was the same as Bitshares. It is something I need to look into more as I do like investing in ICOs and crowdfunding - something which (if I understand the website correctly) they are focussing on.

Others - there are several others that are still currently being worked on but haven't really released anything (unless I missed it). I was originally very active in the Ethereum community and I have been looking forward to ETHEREX for some time - I have since lost track of its development (please let me know if there are any major updates).

Shapeshift and Blocktrades

Shapeshift and Blocktrades are an intermediate solution between centralised exchanges and DEXs.

They allow you to make an instant trade without making an account and they act as a kind of instant escrow for the trade.

They are a good intermediate solution but there are a few problems:

They are closed source (as far as I know) so you can't check their code yourself and make sure that it is secure.

You can't set trades to execute at future points in time.

You have to trade immediately or not at all and the price is fixed to a particular market rate.

They are a good option if you want to sell quickly and with the minimum hassle but they are not really suitable for other types of trading activity.

Atomic Swaps

This is something that I only heard about recently via a Coindesk article.

Apparently this method of trading allows you to exchange different currencies across blockchains.

The example the article uses is trading Litecoin for Vertcoin.

You don't actually need any extra software (in theory at least).

The snag is that both blockchains need to use the Lightning Network and "atomic trades" is a planned feature.

So right now it is not even something that actually exists. If it does actually work then it could be a way of "baking in" decentralised exchange capabilities to multiple blockchains.

If it works, the biggest problem (in my opinion) will be getting it activated on Bitcoin, without that it will be hard to see people actually using atomic trades for any significant volume.

Considering that there is still some skepticism about the Lighting technology in the Bitcoin and cryptocurrency community that may never happen.

Conclusion

It is quite obvious that DEXs could be a safer way for people to trade cryptocurrencies. The multiple losses that people have incurred as a result of centralised exchanges failing is perhaps one of the most compelling reasons for their use.

Sadly life is rarely that simple or easy.

Most DEXs are still in a fairly embryonic state meaning that they are not as easy or simple for people to use.

Further most people probably don't even understand enough about the risks of using centralised exchanges to understand the need for them.

It is inevitable (given the nature of cryptocurrencies) that we will have more centralised exchange failures and that people will lose their money.

This will force them into considering DEXs as an option.

Sometimes it takes harsh lessons for people to learn how to do things right.

Thank you for reading