Real estate is the way the ordinary people have collected the value and finally deposited the money. After all, after World War II, almost all corporations applied for access to credit through politics, and governments responded kindly to keep them in power. Due to the combination of easy and free money, there has been an increase in the development of decades in construction, materials, land and essential financial products.In return, the business cycle was released, and the basis of entire economies came to the fore as a theft and fraud. Bitcoin parasites can be an opportunity to reducing regulated governments, to make the building a new way of equity. Are there.

Real estate as a relinquishment

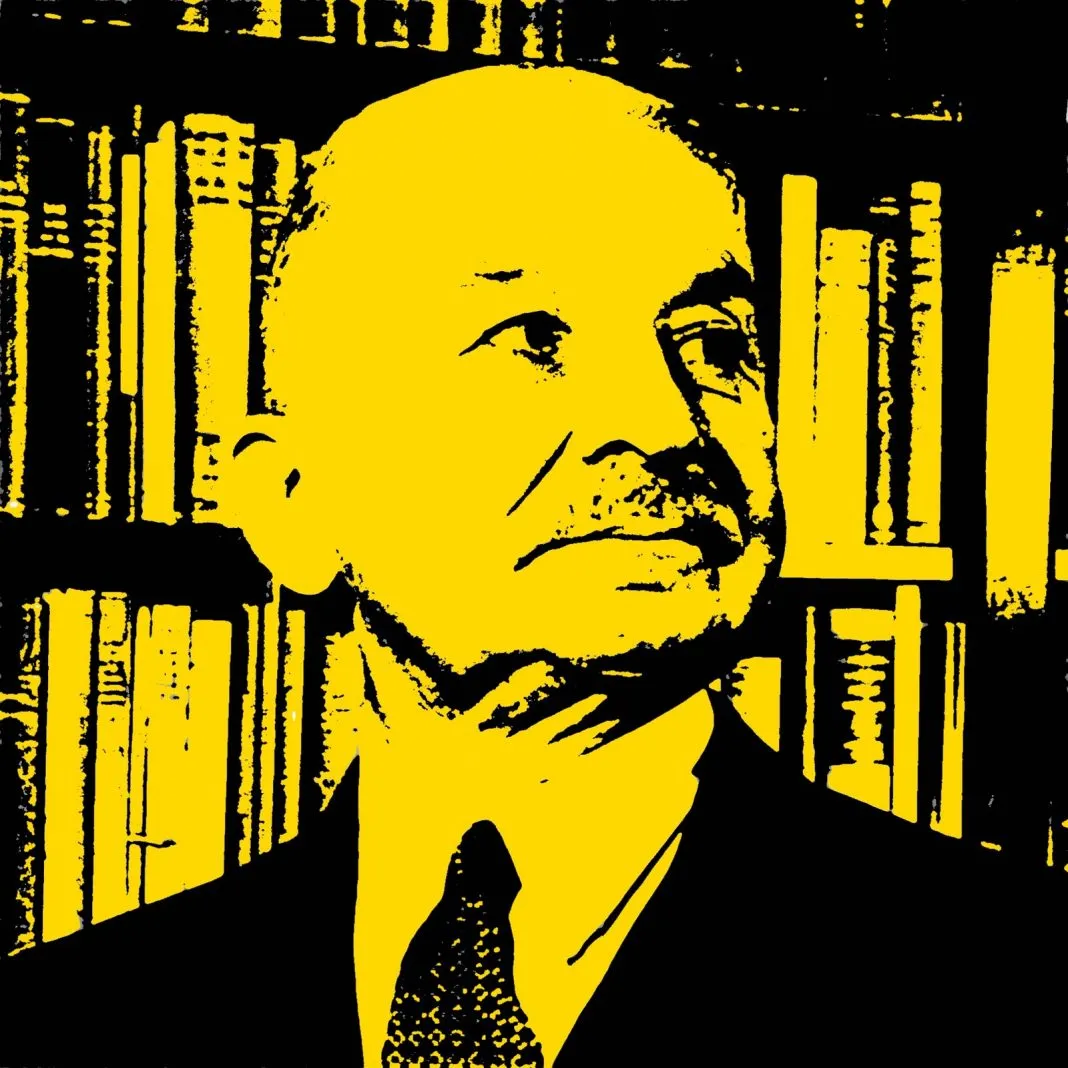

The Dean of the Austrian School of Economics, Ludwig von Mises, wrote extensively on the subject of the moneylifting. Although he lived in the American Circles of the Marginal Pelkoncevative and as a liberal economist, this assumption gained quite popularity until the Great American Depression of 2008.

I think they are ready to give another form in the coming years.

According to the Austrian doctrine, the moneylendant starts the economic cycle, the bounce and the bust with which you are probably very familiar. The central bank is the main culprit, created by monopoly of their money supply, which is called fiduciary money: Paper or digital money fully backed by a given government's trust and credit, without the barriers other than inflationary pressures , Which governments have been fighting for more than a century using central banks.

Inflation acts as a debate, which can be done by circulating more bills or figures, otherwise in healthy or tight currency, and it is an opportunity to give gifts like a guarantee of housing for politicians. The trade has won off enough dollars, to keep pesoos and to create a wealth effect, but not enough that the business units of the government have become useless.

The central bank can artificially slow the method rate through the price of money, interest rates, it is a tap which controls the flow.

Disinvestment is a mandatory result, even with the innumerable people of the tools available today, one might think that someone would be crazy to be able to predict the level of economic production, adequate investment allocation, research and development. Yet what it basically does a central bank do

With the guarantee of mortgage, by socializing housing risk, privatizing profit, reporting to central bank property bookmakers, landlords, construction companies and equipment manufacturers, brokers and investment funds which the industry "win" Producers spent time on resources and housing because thousands of dollars were armed in retail exposure to retail customers.

It was a matter of time before the markers were able to repay the outstanding debt and return to creative financial instruments, which would otherwise be in existence, proved to be jerky for political eccentricity.

As we now understand, the US economy, the world's reserve currency, has broken rapidly. As the Dominoes slammed, people abandoned construction workers for newly built houses, unemployment insurance,

In the bankruptcy of federal courts flooded the world in foreclosure, and the world's largest banks were added to the list. In a private and independent economy of Kalyan, a merciless mistress. In our modern central bank economies, it is really beneficial to understand the stupidity of government madness with stupidity. They will bail you out.

The practical approach to disinvestment is not bust, but the explosion of bubbles or bounce. To understand that the time of boom is suspicious in a central bank economy, and modern economy is mostly centered

At this time it was also that the White Paper of Satoshi Nakamoto was published in response. With the advent of Bitcoin, possibly after getting out of the fad of all the motives of the politicians and their components

Real Estate Against Bitcoin

Historical appreciation of real estate can be an imagination, an illusion, a collection of value. It can be a matter of real estate in a voluntary, organizational free economy, and it can be cheap and without any fuss on equity.

It is difficult to know without going back without stricter dishonesty and redistribution policies. We are where we are

Paul Moore, in a column of Bigger Pocket, totally ignores the theory and history nine years ago, and says, "I'm especially passionate about the majority real estate." With authorization, anecdotes and half truth, that "bravery" comes down from real estate in my proposed debate.

Bitcoin is estimated to rank, he argues, insists on investment that he is related to investment, The adult way of wealth is boring now and forever. In November, Jamie Damon gave credit for the decline in the price of bitcoin. We can not quite clarify what may be the reason for Mr. Moore, but he has not stopped thinking about it instantly if Yahoo's claim can have real estate market from day one. Um, called Mr. Moore, 2008, and would like to discuss.

Nevertheless, he said, "I want to know how other property classes of multi-family are compared," he wrote. "The numbers indicate that majority and retail are: 3 times better than S & P 500, [...] better than 9 percent, 4 times better than private equity" and so on. As an investment, the rest of the bitcoin is hook and soft, words like scams and lotteries to leave the decisive effect before any real idea. Oh, and he has cards

Bitcoin has broken almost a decade, but has been able to remain flexible, and has the advantages of real estate in the context of the future of wealth accumulation. Investors can buy it in fractions. Obstacles are notorious for entering the housing market, but all bitcoins are a smart phone

In fact, future investors have been raised in real estate aid: They have learned to spend instead of being saved,

Because the bond economy demands due to inflation, and now no one can pay the payment under anyone. The average price of houses is spread to such an extent, even if they have escaped, they will have no luck, in fact, the relative ease of purchase of bitcoin and the lack of central control, the next-generation investment for the excitement of the government Seems to be attracting.

And therefore, in the future crypto looks: without limitless government boundaries, without boundaries It can reduce housing prices closer to reality

Do you buy bitcoin or real estate? Tell us in the comment

SOURCE https://news.bitcoin.com/bitcoin-could-overtake-real-estate-as-a-store-of-value/