Week 39 - Investment moves

- Today US market conditions @ 11:15 am EST

- Sept 23 Option Trades

- This week (#39) passive income

- Borrowing money (Debt/loans/ mortgages)

- My Bitcoin moves

Today US market conditions @ 11:15 am EST

Here how the market is trending right now:

Sept 23 Option Trades

Today's options trades are as follows:

This week (#39) passive income

This week's dividend is modest with $244 coming into my account. At this point, I might add two more QQQM shares this week (if I sell some more dividend stocks). I will decide on/after Sept 27, when I get the dividend into my account.

Borrowing money (Debt/loans/ mortgages)

Let's talk about the concept of borrowing money. We all know that compounding interest is very important in finances.

We often think about the two extremes. Someone who has zero savings and zero retirements but is always in debt (student loans, personal loans, credit cards, borrowing from family, etc). We understand that someone who "pays compound interest" to other people. It takes super hard work to get out of debt and stay out of debt.

On the other side, we think about someone who is debt-free and has a bunch of income-producing assets. Real Estate investors are not debt-free, but they use positive cash flow to measure how successful they are.

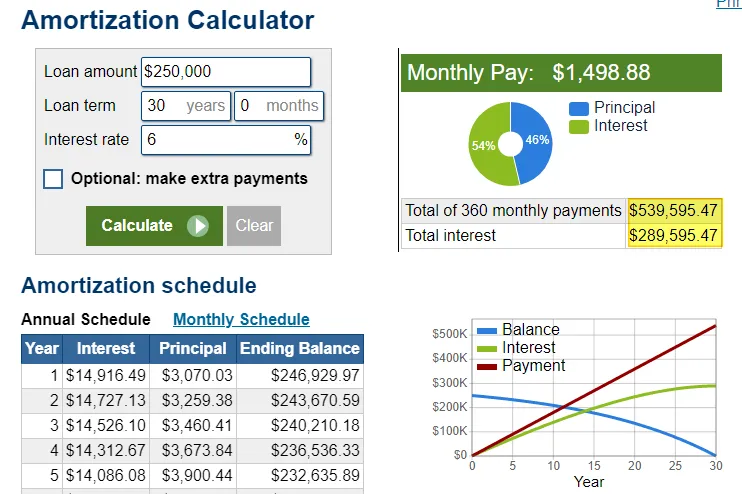

When you purchase a house, we have entered a 30-year process of getting that LOAN paid off. At today's rate, a 300K house can cost you over $530K in payment or 289K in total interest.

Most people don't stay in the same house for 30 years, but rather we move or upsize from the starter home into the next home. That means you need to pay the commission (up to 6%) and then start this LOAN process again. The halfway point of a mortgage is at the 22-year mark. Most people stay less than 10 years before getting a new loan.

Q: Are you okay with borrowing $250K and paying $539K in total payments?

A: The answer is YES. Most people are just fine with this idea.

Q: Would you borrow $5K or 10K dollars to buy Bitcoin?

A: The answer is NO. Most people would call this a dumb idea.

Why do most people feel this way about homes and Bitcoin?

We are taught that a home is the best investment ever.

We are told that most millionaire get their wealth from real estate.

In today's post, I will not debate any of these points, but rather often some unique point of view.

Michael Saylor, CEO of MicroStrategy has been investing in BITCOIN using the publicly traded company that he runs. How does he do it? Some of the cash comes from operating a business. But the method Michael uses is to issue DEBT (borrowing money cheaply) and buy an asset that he believes is the best asset ever (and no, that is not REAL ESTATE). He uses DEBT to buy BITCOIN. He has been doing this since 2020. He is one of the largest owners of BITCOIN today.

My Bitcoin moves

If Michael Saylor is doing this on a large scale, then I think I can do this on a small scale. I'm not talking about leveraging or using margin loans, but rather how can I do this with $25 or $50 a month? The average American consumer can borrow money in many different ways. If I can use this method, then I should have similar results to what MicroStrategy has been doing since 2020.

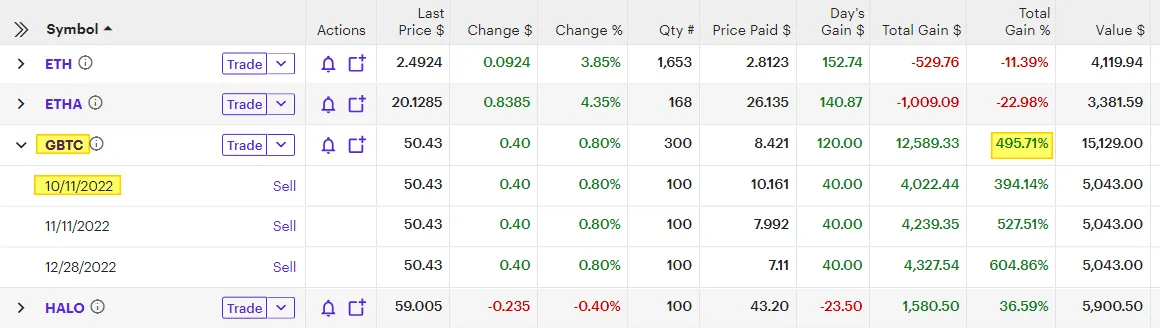

I added GBTC to my portfolio in 2022:

Then in 2024, I added ETHER ETF when it was available this year.

This is a reason why I think RIOT and MARA might also be good investments as Bitcoin miners. So I added some exposure to RIOT. Now, I'm doing this on a small scale because I still believe in RISK management.

Even if you have debt, I still think it makes sense to add $25-$100 a month into Bitcoin. If Bitcoin goes to zero, you only lose less than 2% of your total portfolio value. But if Bitcoin moves from $60K today to $500K you have just 8x your money. For those of us who got in early, we making 10x, 20x, or 50x of our original investment.

The next step is for me to add a small amount each month and continue to risk less than 1% of my paycheck. So far, this concept has worked well. Now we all know the PAST does not mean the FUTURE will follow the same path. The issue is most people still think BITCOIN is a bad investment and your HOME is the best investment. Why not hedge and do both? Investing is not an EITHER OR position.

Have a profitable day!