Well, crypto peops, it’s fairly obvious that capitulation is upon us. What's that? You thought it was already here and went long on BitMEX with 100x leverage? On that kind of trade 15% of your position just goes to cover the fees!

Whoops... and... it's gone.

That's what they say these days at least. The once powerful meme mines of Crypto Land have been recently reduced to repeating South Park over and over again. These are desperate times, but we haven't hit despair yet. (More on that later.)

The only question to ask now is, “How low can you go, bitcoin?” The question is hella appropriate given the growing likelihood that King Bitty is definitely drunk on vacation on some tropical island playing a game of Limbo.

Ethereum has gone off to Antarctica, a place no one, not even good old VB, ever thought it would ever go again. Double digits. The poor kid's fortune has gone from something like a half billion to somewhere around $50 million. If he cared the least bit about money, he'd probably be devastated.

But the best minds in crypto - VB, Charles Hoskinson, Matt Spoke - DGAF about money. They kinda guessed the nature of the people that had come into the space in 2017 and 2018, as evidenced by this quote from VB, "I'm skeptical that people involved in cryptocurrency are better people than people involved in the banking system."

That's a nicely sobering thought for a 24-year-old.

And while pretty much every other altcoin is down a dizzying amount, most more so than the Big Daddy BTC, we and the entire blockchain industry really need to keep in mind another VB quote from that same Forbes interview, "If crypto succeeds, it's not because it empowers better people. It's because it empowers better institutions."

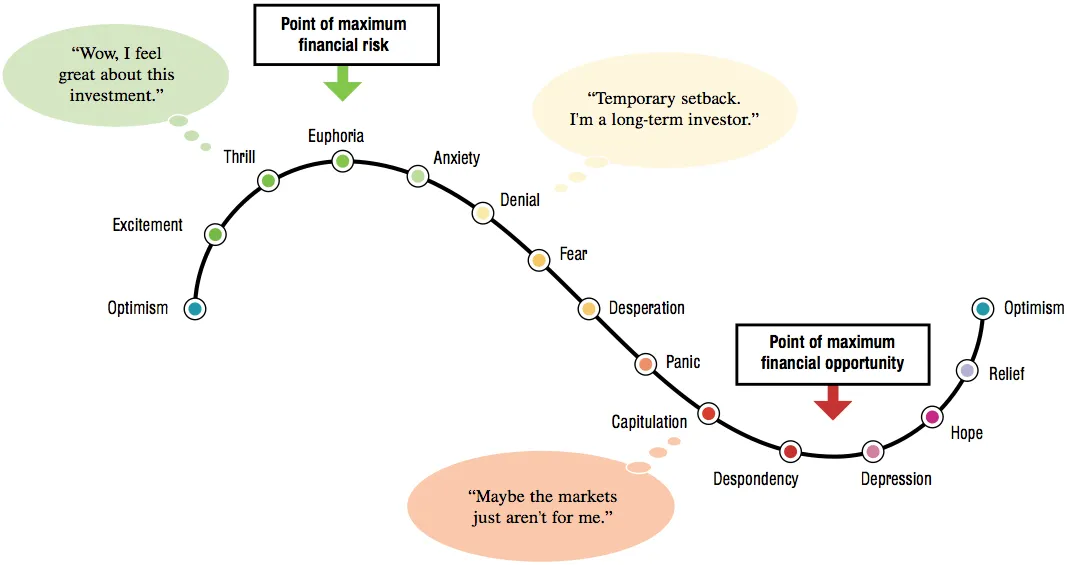

Investor psychology can be a real bitch. Especially when there are no accepted valuation models to properly value cryptocurrencies. As such, the capitulation downswing in a blow off phase like the one happening during this bloody weekend in crypto is being driven completely by investor psychology. Thus, it can go quite a ways down.

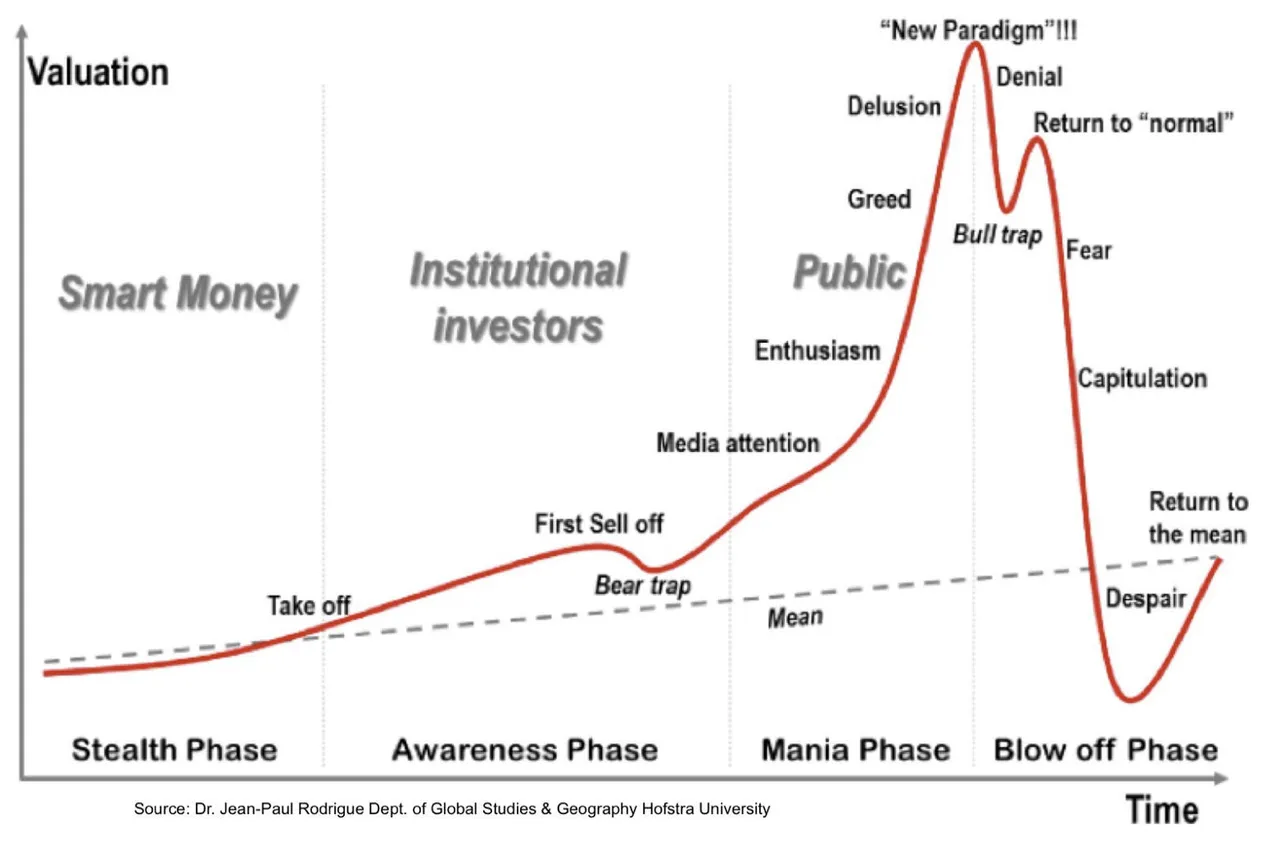

Note in the following life cycle of investment, though, that capitulation is not the last stage in the investor sentiment cycle. Yes, it is the stage which can encompass the longest and most significant price decline in percentage terms, but it is only after a very healthy dose of capitulation that we get to despair, where we can then, and only then, finally start to hope and dream about a "return to the mean." Never mind the dizzying heights of the "New Paradigm"!!!

I think we still have a little ways to go still before full despair, but god knows we’re a whole lot closer to it than when the bell rang on the stock market on Black Friday. These 24/7/365 markets really do a number on investor psychology. That's why it's probably best to prepare yourself going forward like a Zen Master would.

So I'll leave you with this little great resource from OptionAlpha in the hopes that we all, myself included, can do better next time. And to remember what our emotions feel like, really viscerally feel them and capture them, when it's time to buy... and when it's time to sell.

In the meantime, everybody... Limbo!