This article is not investment advice. I am not an investment advisor. This is just my take on blockchain and cryptocurrencies.

Should you worry? This question depends on your answer to the main question: Do you think Blockchain is here to stay/ Is this the next phase of the digital revolution? In other words; Is Blockchain a market/industry disruptor?

If Blockchain is a market/industry disruptor, everybody who is investing now is an early stage investor. Maybe not 5 am early but definitely not waking up at noon. Let's say an early early majority investor at the latest. If Blockchain is a market /industry disruptor, than we are at the beginning of a growth market.

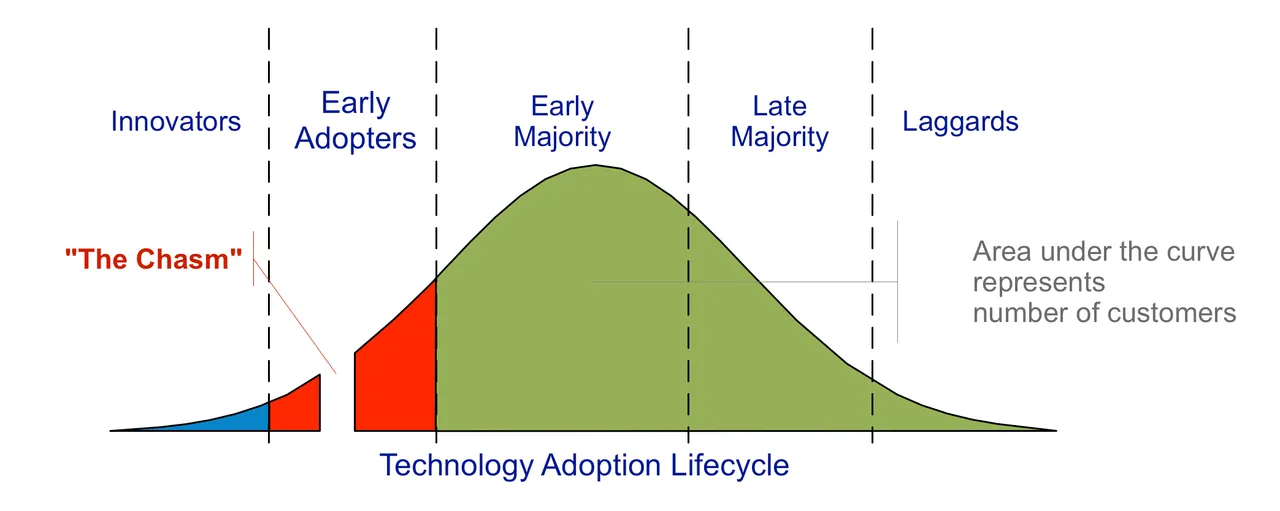

The chasm is the tipping point in a products life-cycle. This moment is also called "Crossing the Chasm". At that point the public has adopted the product enough to start the snowball effect. Businesses are accepting Bitcoins because enough people are using Bitcoins and more people are using Bitcoins because more businesses accept them. Ofcourse there need to be advantages in using Bitcoins and to the general public it is still not clear what these advantages are. On the other hand, the Burger King in Russia will start to accept Bitcoins this summer (https://cointelegraph.com/news/burger-king-to-accept-bitcoin-in-russia-this-summer).

In his book "Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers" (1991, revised 1999 and 2014), Geoffrey A. Moore describes this moment. Abbreviation from https://en.wikipedia.org/wiki/Crossing_the_Chasm : The most difficult step is making the transition between visionaries (early adopters) and pragmatists (early majority). This is the chasm that he refers to. If a successful firm can create a bandwagon effect in which enough momentum builds, then the product becomes a de facto standard. However, Moore's theories are only applicable for disruptive or discontinuous innovations.

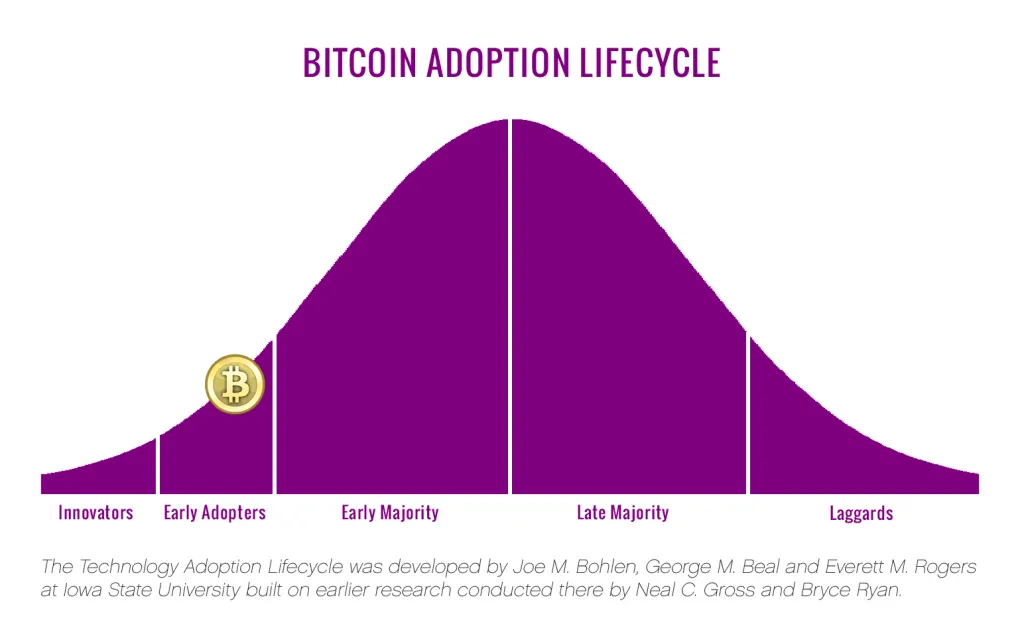

The next chart shows the Bitcoin adoption life-cycle:

We still haven't reached the tipping point of Bitcoin or any of the other cryptocurrencies (the alt coins).

If we are at the beginning of a market with mass adoption as a real possibility, this market will be growing for quite a while. Internet 1.0 lasted till the end of the Dotcom bubble in 2000. Internet 2.0 is still going on with brick and mortar being replaced by online shopping, automatisation and the syngronising of all kind of different systems in the public and private sector. If Blockchain is the next step, than this is the beginning of internet 3.0. How long it will last? Who knows, but I am not selling my investments when the markets are in a downturn. Maybe even buying the dips.

Why am I not selling ? The answer is very simple. I think this is the beginning of the next phase of the digital revolution. When an innovative product is at the beginning of a growth market/industry one thing is for sure and that is that it will grow. Important advantages of blockchain according to Deloitte are:

1.Disintermediation & trustless exchanges

2.Durability, reliability and longevity

3.Ecosystem simplification regarding only one ledger versus multiple ledgers

4.Lower transaction costs

What's also very interesting is that blockchain makes decentralization possible. Decentralization makes it more easy for individuals to realize and capitalize on their idea's. People don't need to open a bank account to sell products world wide, hence less dependency on banking monopolies. This makes blockchain related currencies very interesting. There will be more big time market ups and downs but the average will be growth. There are currently over 750 cryptocurrencies and the great majority will fail, but some will succeed and when they succeed they probably will match the price of Bitcoin or Ethereum.

The best way to tackle this high rate of failure is two things. First, due diligence. Secondly, diversification. The first one is very tough. What to look for? Even a great idea can fail because for instance the timing was off. The second one is more easy. Don't put all your chips in one basket. Everybody who has followed Finance and Investment classes or who is a seasoned investor knows diversification is the vehicle to overcome a lot of risks. You can't exclude all risks, but a well diversified portfolio gives you the best chances to a positive return on your investments and because this is a growth market/industry the payoff could be very good.

What if Blockchain isn't the next phase of the digital revolution?

In that case every downturn of the markets could be the end of one of the greatest Ponzi-schemes of all time. Every drop of the markets could be the beginning of the end of the bubble.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice.