July 25th

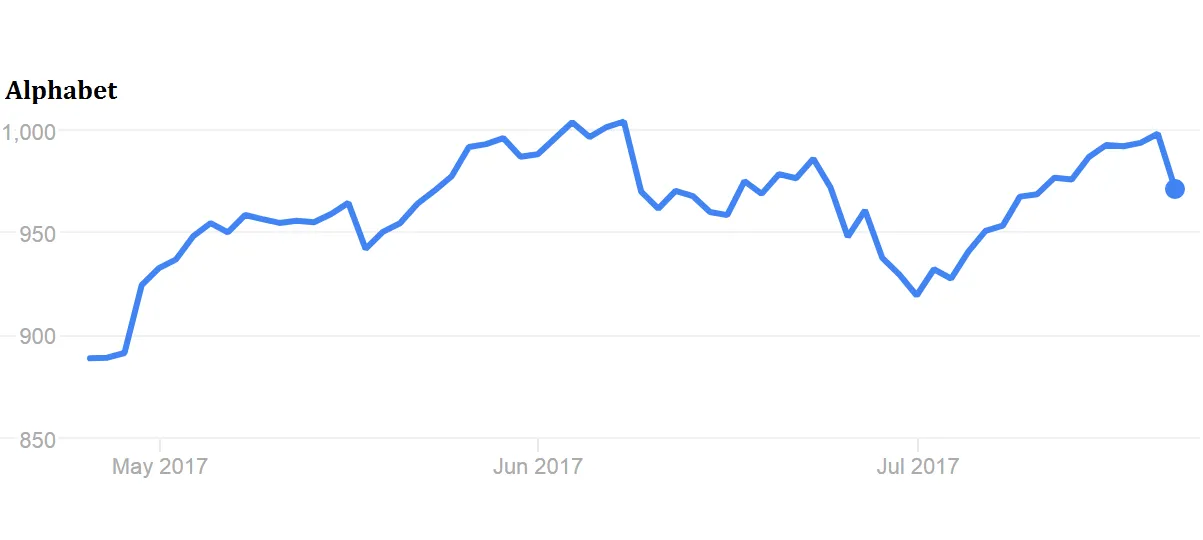

The shares of Alphabet, Googles parent company, fell as much as 3,5% after second quarter results, caused by the rising traffic costs to expand googles growing advertising business and an antitrust fine from the european union. Also the company has plowed a lot of money into its cloud-computing business.

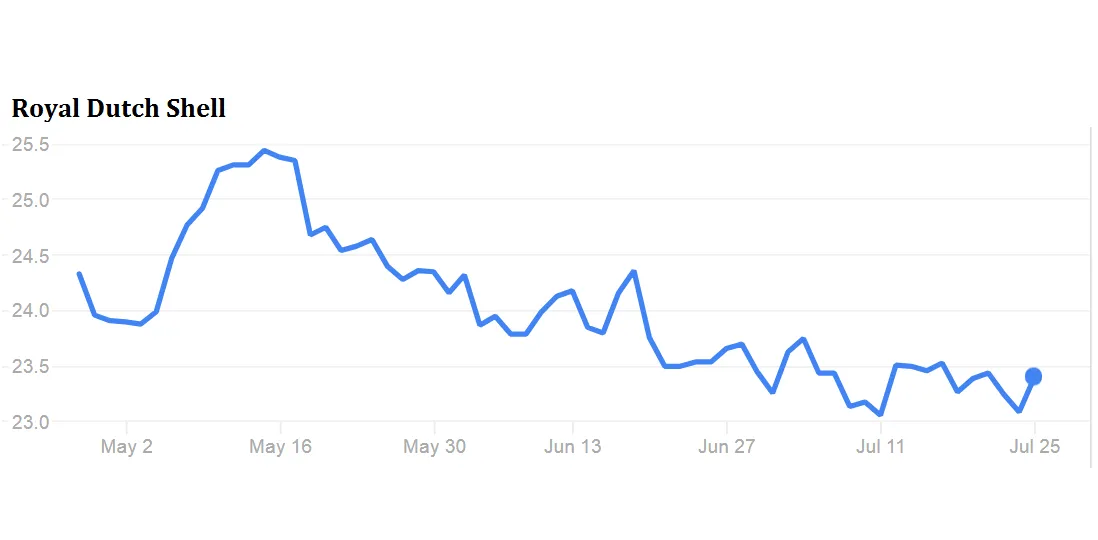

Oil markets unimpressed after OPEC-Meeting

At the OPEC meeting on Monday in Russia, which included some non-OPEC producers, Saudi Arabia announced it would cut August exports to 6.6 million barrels a day, which would be a million less than a year earlier.

UAE’s minister of energy Suhail Mohammed Al Mazrouei, stated that there are several challenges in the market at present. The main challenge for the current OPEC-Non-OPEC production cut is that several countries need additional revenues to fuel economic recovery/diversification, such as Iraq, Iran or Libya.

The oil price does not have a high potential in the short term. For long-term investors, the Royal Dutch Shell share is a recommendation with 7% return.

especially for investors who are not yet in the portofolio, a purchase may be interesting as the dividend payment is due on August 10th.

Interessting news für crypto currencies:

Bitcoin options will get federall authorisation and will be avaiable this fall

LedgerX LLC won approvel from the US Commodity Futures Trading Commission to operate as a federally regulated exchange for derivatives contracts setting in digital currencies.

They plan to offer one to six month bitcoin to dollar options contracts in late september to early october.

Contracts for ether and other are expected to follow.

This could be another step to increase the acceptance and familiarity of crypto currencies in the market