What 90 days can do to an asset class – this is a comeback, confirmed and sealed at this point!

In December, we hit the $3,200 level and I published a report explaining that this is precisely the point-of-low-risk at which I’m comfortable building a new position. Many gurus criticized me. We got emails that the charts looked bad and that selling would continue down to the $1,200 range. I didn’t budge in my analysis and I’m damn happy for sticking to my guns.

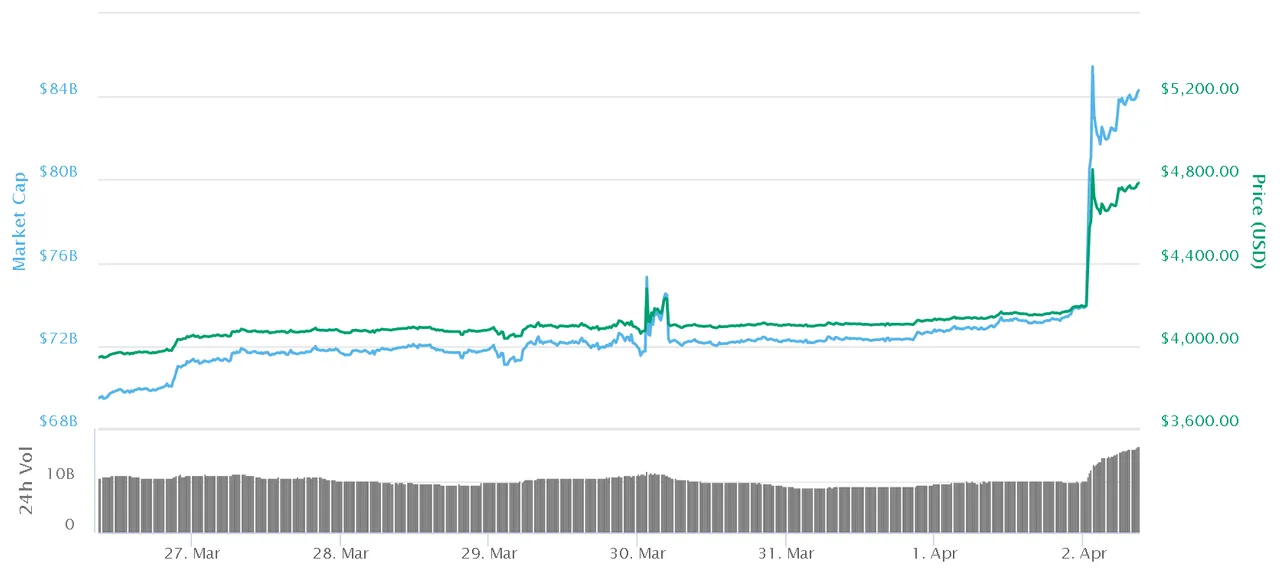

Bitcoin has exploded more than 16% in a single day and touched $4,800, with other major cryptocurrencies following BTC’s lead. I got the 2017 shivers, goose bumps, and butterflies, but we’re still a long way from the Promised Land. Still, a 34%, 83-day gain is massive – I’m locking in some of the gain in my short-term trading portfolio and letting the rest ride.

_Courtesy: _cointelegraph.com

It’s the second consecutive day of solid gains for Bitcoin and other well-known cryptocurrencies against the U.S. dollar. This is a blowout start to the second quarter of the year. I can’t tell you how many people thought this sector was headed for the graveyard – that 2017 was a bubble that took all the air out of it, with no gas left in the tank for a comeback.

The only way to describe the sudden price increase and the surge in Bitcoin’s volume (the biggest cryptocurrency in terms of market cap, which other cryptostend to follow) is stunning, as it follows several months of a calm, range-bound drift from $3,200 to $4,100 with moderate volume.

At the peak of the intraday price movement, Bitcoin exploded as much as 23% in a matter of minutes, briefly breaching the $5,000 level (the highest that BTC vs. the USD has been since November of last year) and gaining $1,000.

At the same time, the 24-hour trading volume of Bitcoin easily surpassed the $10B barrier.

_Courtesy: _coinmarketcap.com

During this 24-hour period, Ethereum (ETH) rose from around $142 to nearly $160, Ripple (XRP) shot up from slightly above $0.30 to $0.34, and Litecoin (LTC) increased from slightly more than $60 to the $70 level.

Bitcoin and the blockchain have weathered a storm that would have crushed less resilient asset classes.

The first quarter of this year witnessed a basing process, and Bitcoin found its footing. The launch of JPM Coin by Jamie Dimon and JPMorgan only confirmed crypto’s maturation and adoption among the elite investing class.

Despite criticism from cryptocurrency experts and even some high-ranking regulatory officials, the SEC has persisted in denying or delaying multiple attempts to list a Bitcoin ETF. Given the commission’s stubbornness, some industry experts are doubtful that we’ll see a Bitcoin ETF at all this year.

To provide some perspective, the first Bitcoin ETF was proposed to the SEC by the Winklevoss twins on July 1, 2013, and it took until March 10, 2017, for it to be rejected!

_Courtesy: _thenextweb.com

From $146 billion the previous day to a peak of $163 billion, this one day has single-handedly added over $17 billion to the collective value of digital assets.

There’s a mystery buyer that is bidding up the price, but the impact has been made.

I’m telling you that we’re taking part in a critical period for blockchain and tokenization – I will have BIG news very soon!

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com