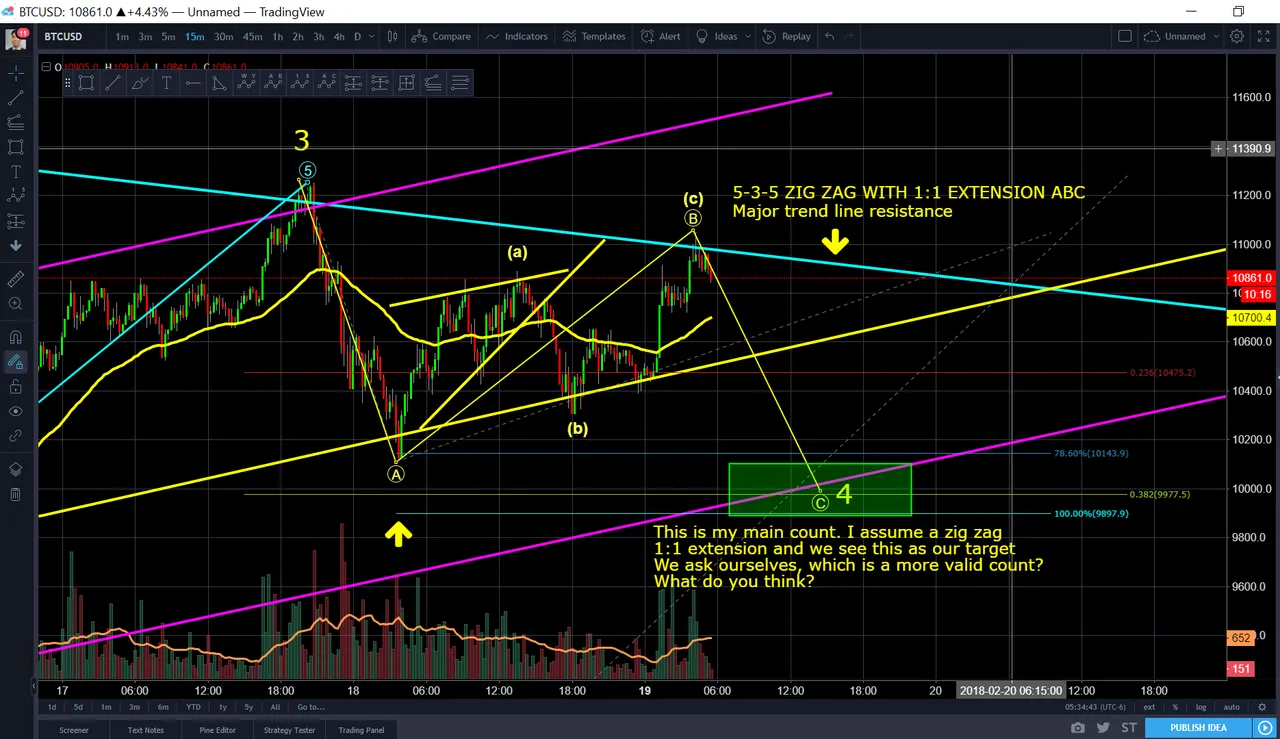

General tone. Indecisive Elliot Wave Count. I do not believe this is the end of correction

We hit a critical resistance. There are two counts of EW which of concern. We have not reached even 382 fib retracement, which would imply that if this is an uptrend, this would be an incredibly bullish market.

Long Term Bias (6+ months) - Bullish

Medium Term Bias (Next Week) - Neutral

Short Term Bias (Today) - Neutral

Long Term Target Prediction - Primary Wave 3, $35,000+ by 2019

Long Term Target Prediction - Primary Wave 5, $50,000+ by 2020

I would firstly like to state the rules of alternation, which summarized implies that corrective wave 2 and 4 have a difference in expression. Simply put,

- If Wave 3 retraces little we can expect wave 4 to retrace more.

My Comprehensive List of Tutorials

Please consider upvoting if it has helped you

Please consider purchasing me a 33 ft' yacht

if you have reached incredible success

Lesson 1 - Bitfinex Tutorial - How to Customize and Set Up Bitfinex

Lesson 2 - How to Analyze Candlesticks Charts with Strategy

Lesson 3 - Moving Averages

Lesson 4 - Relative Strength Index RSI with Advanced Strategy

Lesson 5 - MACD and Histogram

Lesson 6 - Margin Trading Long, Shorting, Leveraging

Lesson 7 - Basic Risk Management

Lesson 8 - Fibonacci Retracement Part 1

Lesson 9 - Fibonacci Extension Part 2

Lesson 10 - Laddering

Lesson 11 - How To Interpret Time Frames

Lesson 12 - Swing Trading Advanced 55 EMA Strategy

Lesson 13 - Introduction To Elliot Wave Theory

Lesson 14 - Using a Basic Excel Tracker for Risk Management

Lesson 15 - Automatic Stop Sell/Buy Executions

Lesson 16 - Advanced 55 EMA Strategy with Time Frames and MACD Part 2

Lesson 17 - 6 Hours Live Trade Scalping. Growing $2,000 Account into $3,500

Lesson 18 - Bitcoin BTC Feb 6 - BTC Update - Summary of ABCDE with live play.

Lesson 19 - Elliot Wave Theory, Fibonnaci Retracement & Extension (Combined with Feb 11 BTC TA)

Lesson 20 - Advanced Elliot Wave WXY With Feb 11 Technical Analysis

Lesson 21 - Using Elliot Wave, Fibonacci, And Extensions To Obtain Targets (Combined witFeb 11 BTC TA)

Lesson 22 - Risk Management, Channels, Fib Retracement, Fib Extension. Summarizing Feb 11 BTC

Twitter - https://twitter.com/PhilakoneCrypto

Youtube - https://www.youtube.com/user/philakone1

If I've helped you, consider buying my dog, Luna, a beer in her tip jar

BTC: 1PruhmsYXU2gPkNw574xZSMyBG4YW5Wnq9

NEO: AaZu8fiiMW3vnizUaSkRj6JoobswkeCKPQ

EOS: 0x2538b728f9682fc1dc2e7db8129730f661753850

Ethereum: 0x2538b728f9682fc1dc2e7db8129730f661753850

LTC: LPeaZpGiF3XdCw5XPN7LXztDagTEZAMgYd

Bitcoin Cash: 1AY2FPANCe5URB71Nvy6tkCgoTS8iHgmZD

XRP Address: rLW9gnQo7BQhU6igk5keqYnH3TVrCxGRzm / Wallet: 4110054236

The ultimate goal is to help the crypto community because I think there's a lack of these type of videos. I want to share everything I've learned because knowledge is only power if passed on. These are educational videos intended to teach how to think through thought-out rationalization.

DISCLAIMER:

Legal stuff here. I'm not financial advisor. This is just my opinion that I'm sharing with the community. All information is for yours to process how you wish.