At the moment the recent correction, which was due and in line with technical analysis, has resulted in #bitcoin's short-term future in a bit of a limbo. Will it go back to $5,000? Will it continue to drop?

There are several conflicting forces some of which are bears and some of which are bulls. I will try to break them down so you can be, just like me, a bit more confused...

For the record I am just a regular person, I do not trade professionally, I am a crypto-enthusiast and try to keep up through social media and a couple of telegram chats. So any comments very welcome. I think the Steemit community is a good place to search for alternative interpretations of the situation.

1. China

We have been hearing all about it. China's authorities are cracking down on #crypto. My interpretation is that they do not seek to ban, but to regulate crypto transactions and exchanges. There has been some announcements of exchanges closing (more on this later), some did so ahead of any direct orders, but it seems now things have ramped up.

"Chinese authorities have ordered Beijing-based cryptocurrency exchanges to stop trading and immediately notify users of their closure, signaling a widening crackdown by authorities on the industry to contain financial risks.

Exchanges were also told to stop allowing new user registrations as of Friday, according to a government notice. The notice was signed by the Beijing city group in charge of overseeing internet finance risks and circulated online. A government source verified it to Reuters."

However as I pointed in my previous post chinese traders could simply use foreign exchanges and banks for deposits/withdrawals, much like we do in the UK. Besides, China is not the trading epicentre it once was; BTC is now more widely adopted globally and other markets could easily pick up the slack.

On the other hand, there seems to be signs of insider trading involving individuals in positions of power, which leads me to conclude that it is not the end of BTC in China, and this has been reported on the pro-BTC media.

China And the Bureaucrats Deadbeat Brother in Law Bought the Dip pic.twitter.com/ab2rIMLSbS

— JB. 비트코인 Whale Club (@APACllc) September 15, 2017

CONCLUSION: positive news from China will be needed regarding the criteria for exchanges to re-open or alternative ones to be set up for Chinese trade to return to its former levels. Nevertheless, if this never happens this is not the end of #bitcoin. The rest of the world continues on. HOWEVER THIS IS A BEAR.

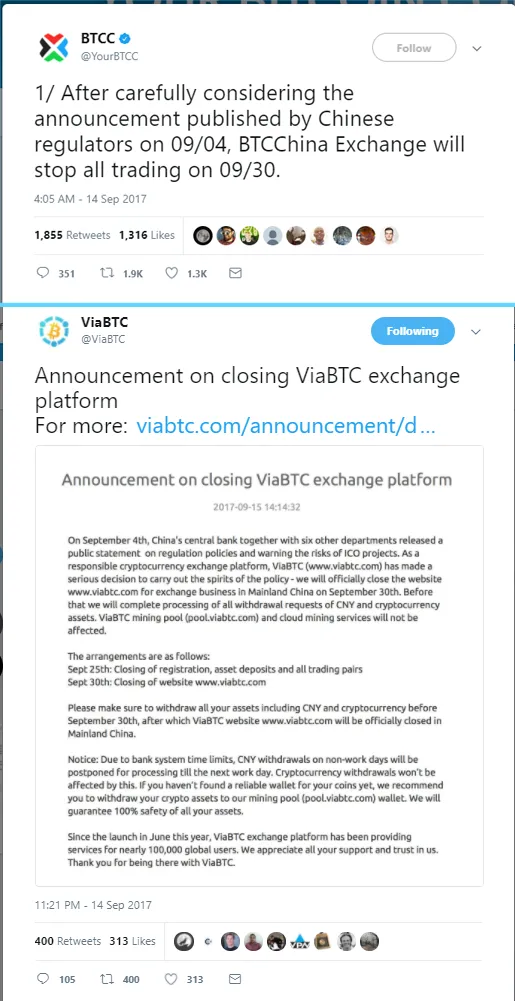

3. Chinese exchanges ceasing trading.

Many press announcements have been made about exchanges in China closing, even before the regulators made any demands official. BTCC and ViaBTC will close on the 30th of Sept, while OKCoin and Huobi will be allowed to stay open until the end of October because of their large customer base and the fact that they did not participate in ICOs, it has been reported.

However Charlie Lee made a good point on Twitter (which he deleted) pointing out the withdrawing funds might be difficult towards the end given exchanges might lack the fiat to fulfil requests... What will happen? No one knows...

CONCLUSION; As closure approaches, sales from China will continue to happen (even though they have alternatives) and this represents a BEAR. And the closures coincide with....

3. Hard forks

Another factor worth considering are the new hard-forks. There is a paucity of information out there which is really lacking in any detail but there are 2 upcoming bitcoin hard forks. You can read @techius article here but this is the summary;

On 1st of October, we will see Bitcoin Gold split at block 487, 427.

At some point in November, Segwit2x will hard fork at block 494, 784.

This is relevant because we all know how lucrative the last Aug 1st hardfork was for those that prepared accordingly. I foresee many people will want to keep a good amount of BTC around so they can cash in on the 'free money'. However details are sketchy, there is a campaign of support removal for Segwit2x with its own hashtag (#no2x) and Bitcoin GPU seems to be just a concept on a poorly translated website.

CONCLUSION; imminent hard forks are on the cards, though severely lacking in backing and detail. However I can see traders and investors wanting to cash and hold BTC at the time of the splits thus representing a BULL.

FINAL ANALYSIS

I have used TA for a while now and I tend to trust it more than the news. This is what I think will happen. In a one day chart using GBP, both the Ichi clouds and existing support/resistance levels show that around about the 30th of Sept we should have gone back up to £3,400 (~$4600). RSI shows us as consistently undersold and we have already touched the 100 MA... The only way is up.

Will we hit the $5000 ATH again? I don't know. Too much uncertainty still and a lot of issues to get out of the way. Certainly news from China establishing regulatory frameworks and passing the hard forks will help. I am feeling bullish though and I still think that the long term trend points to $5000-6000 by Christmas. Let's hope it happens cause I could do with some extra cash by then!

Thank you for listening Steemians and please do comment if you agree or disagree. I look forward to further discussion!

Image sources

Bull v. Bear, 2 (original), 3 (Twitter), 4 (original)