Two days ago, Forbes has revealed exclusive information, which has long-term impact on Bitcoin, but information went unnoticed by cryptocurrency investors. Perhaps, it’s hard to evaluate importance of this news, without knowledge about Northern Trust fundamentals.

Chicago-based Northern Trust is a financial services company with offices in 19 U.S. states and Washington, D.C., as well as 23 international locations. Northern Trust has almost $10.7 trillion in assets under custody and administration. It works exclusively with institutional investors, corporations, and high net worth individuals. Over 20% of the wealthiest families in the United States are clients of the company’s wealth management division. Northern Trust operates since 1889 and performed so well, that even during the 1920s the company’s assets actually grew during the Great Depression.

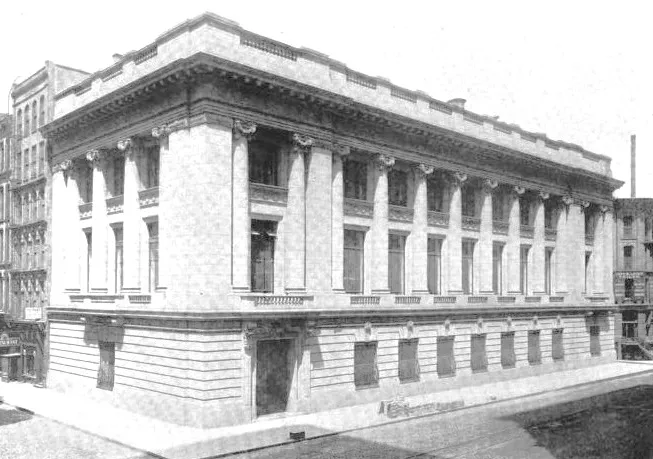

The Northern Trust Company Building in 1907

Northern Trust has expanded its interaction with blockchain technology and cryptocurrencies across multiple divisions. Company opened its exclusive fund administration services to a select group of hedge funds that work with Bitcoin and Ethereum.

In special interview with Forbes, Pete Cherecwich, the president of Northern Trust’s corporate and institutional services, shared his vision on cryptocurrency importance:

“You can take anything today. You can take movie rights, you can take all sorts of entities, and you can create a token for those. We have to be able to figure out how to hold those tokens, value those tokens, do those things.”

According to Pete Cherecwich, three mainstream hedge funds are diversifying their portfolios with cryptocurrency investments. Northern Trust has been helping several hedge funds to compare reporting numbers with records of customer’s cryptocurrency custodian.

Cherecwich, who was an executive and lead operational roles at State Street Bank, expressed his opinion about fiat-currency future: “I do believe that governments will ultimately look at digitizing their currencies, and having them trade kind of like a digital token — a token of the U.S. dollar — but the U.S. dollar would still be in a vault somewhere, or backed by the government,” He also added: “How are they going to do that? I don’t know. But I do believe they are going to get there.”

He also added that Northern Trust has a team of more than a dozen technology and private equity specialists, who are working to produce a suite of services built on the enterprise version of blockchain software “Hyperledger Fabric”.

Teeka Tiwari, editor at Palm Beach Research Group LLC (US-based publishing company that offers financial advisory related to income-based investments, asset protection, and smart speculation) made an exclusive video for customers, emphasizing importance of this event. “To work with Northern Trust you can’t be some little Mom-And-Pop fund, under 1 billion, you must be a major fund” said Teeka Tiwari, adding “and this is hugely bullish”.

Peter Cherecwich