It’s now been close to a decade since the global financial crisis hit. Official interest rates have been lowered and quantitative easing has been implemented, boosting asset prices and, more recently, global economic growth.

Housing, the initial cause of the GFC, is one asset class that has benefited more than most during this period of ultra-loose monetary policy settings, helping to reverse initial price declines in many markets and improve household balance sheets.

As the main store of wealth for many families around the world, that’s undoubtedly helped to boost spending levels and, as a consequence, the broader global economy. However, whether the economic tailwinds provided by housing will continue in the period ahead remains uncertain.

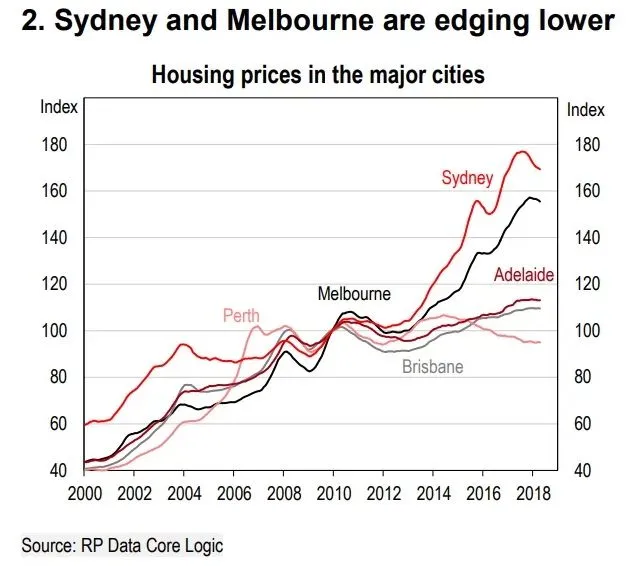

Monetary policy settings are now starting to tighten in many major economies, especially in the United States. And with higher borrowing costs, the prospects of a reversal in some asset classes, including house prices, appears to be increasing.

As seen in the chart above that could turn out to be problematic for the global economy should house prices start to fall. Based on historical relationships, when house prices bottom, recessions tend to decline. However, when prices peak, the number of nations falling into recession almost always increase.

Right now, it appears that house prices may be nearing their cyclical peak. If that is the case, and with history as a guide, the recovery in the global economy seen over the past decade or so may also be reaching its crescendo.