To value Bitcoin’s utility value as a network according to Metcalfes law we need to have a overview on the number of users. This law and network effects in general have often been discussed within the Bitcoin community and for money it is in some way more valid than for any other form of network.

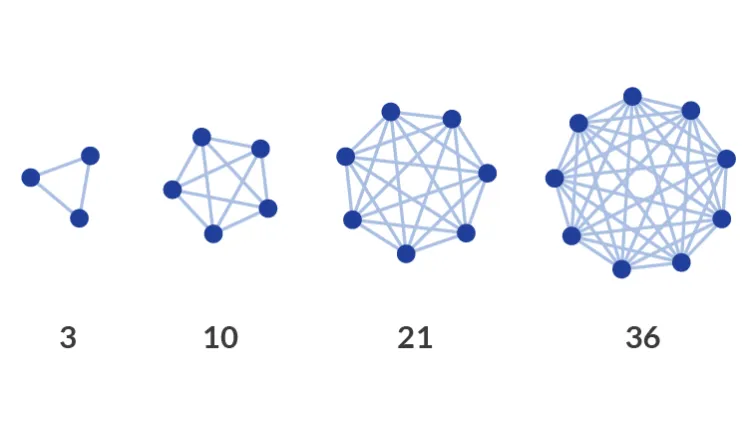

(Utility of Network rises with number of users)

The number of users determines the value of a network as the amount of possible connections rises squared. The more people are using social media / dating app / plattform xyz, the more it makes sense to join that network. The more people use a specific language, the more it makes sense to also use this language.

English became a global widely adopted language through its network effects and the same way Bitcoin can become the first global neutral asset if these network effects + game theory kick in and push the value up to new highs. You could say that the network effect of a money - a value-network - determines its chace to become economic reality.

The chances that this happens and continues rises with the number of actual already existing Bitcoin users and that’s why we are so excited about the number of actual users that we already have and why the current fair value might be best modeled with the number of users squared.

However These times are complicated wherein Bitcoin became more adopted via many layers and with different forms of ways through which people de facto become users of the network. The early network effects in combination with the proof-of-work brought us to the stage where we are now and formed the basis for Bitcoin being the asset that it is now.

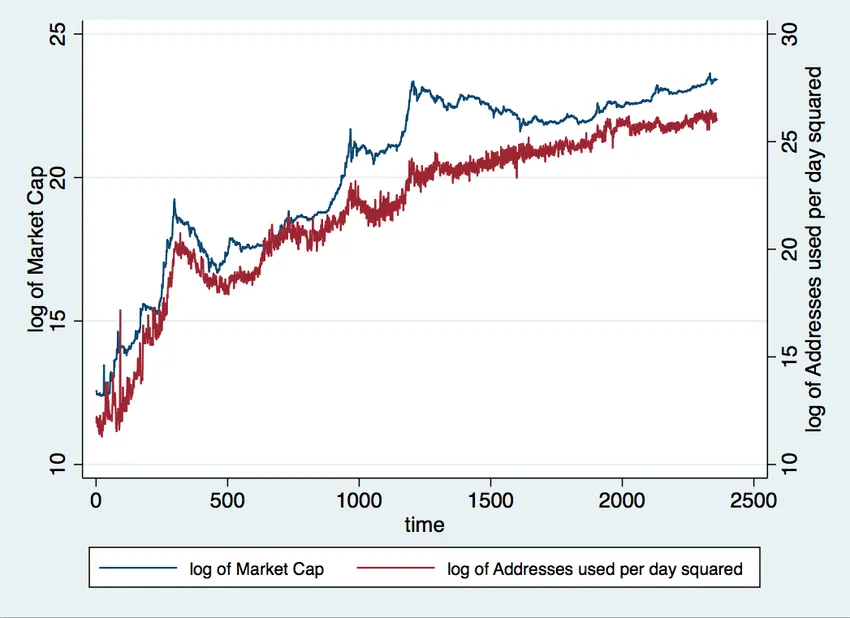

The days back then where Bitcoin started you could say that a user is always a person that has at least one wallet address, owns a minimum amount of bitcoin and does at least a certain amount of transactions per time unit. This means you could determine the number of users from public available on-chain data, model the utility value from that and compare this value to the actual market cap:

(in this model daily active adresses count as one unqiue user)

This became more complicated as exchange users effectively became Bitcoin holders and therefore Users without the need to have their own wallet.

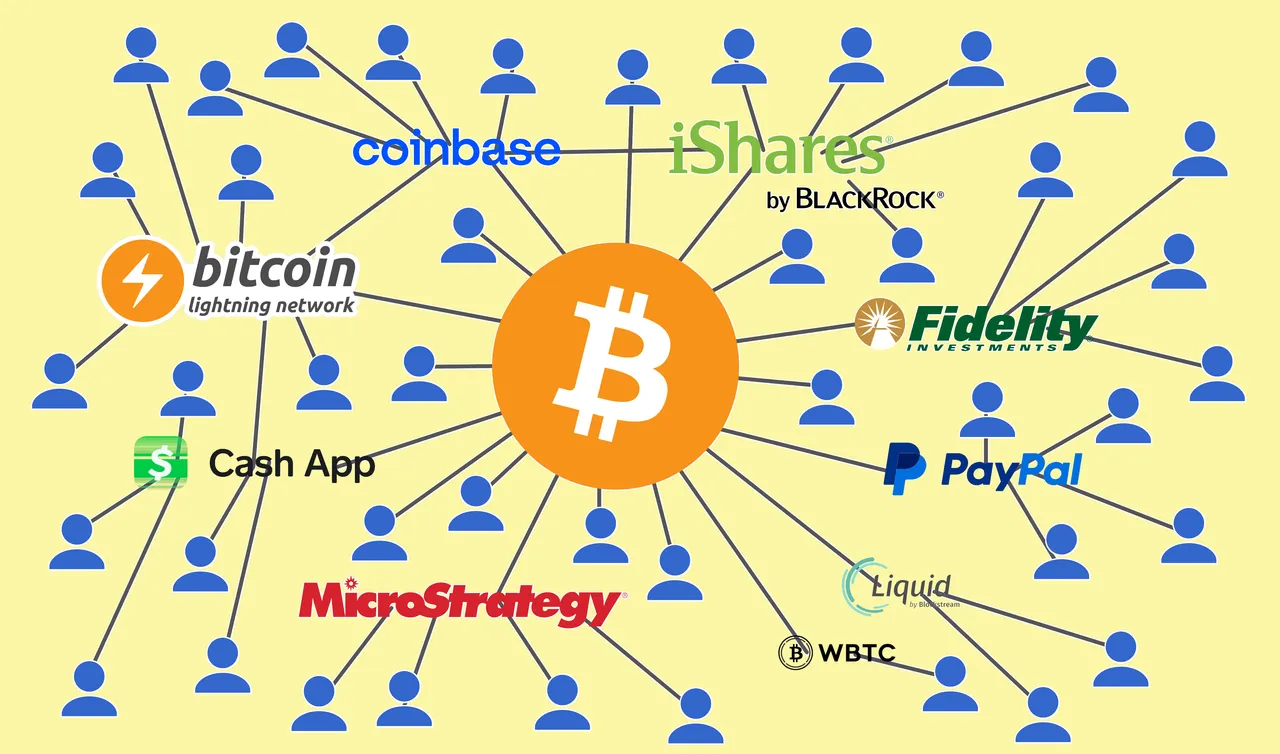

Now we are so far that every user of PayPal, CashApp, Strike, other kindlike services and the users of major security exchanges where Bitcoin ETFs are available or the clients of banks who offer Bitcoin custody services can easily become Bitcoin users without the need of a self hosted Bitcoin wallet or on-chain transactions.

Thanks to these second Layers there is nothing like a hard cap of maximum users anymore that was restricted by the maximum amount of expensive Bitcoin transactions.

There is lightning, there is Liquid, there is Ethereum with wBTC effectively being a second Layer and there are all other „Altcoin“ Networks that effectively can be second layers with Bitcoin-pegged tokens.

(Some of the second layers of Bitcoin)

It might not go hand in hand with the view that only Bitcoin users with their own wallet or even their own node are true Bitcoin users, but it is the economic reality of Bitcoin layers.

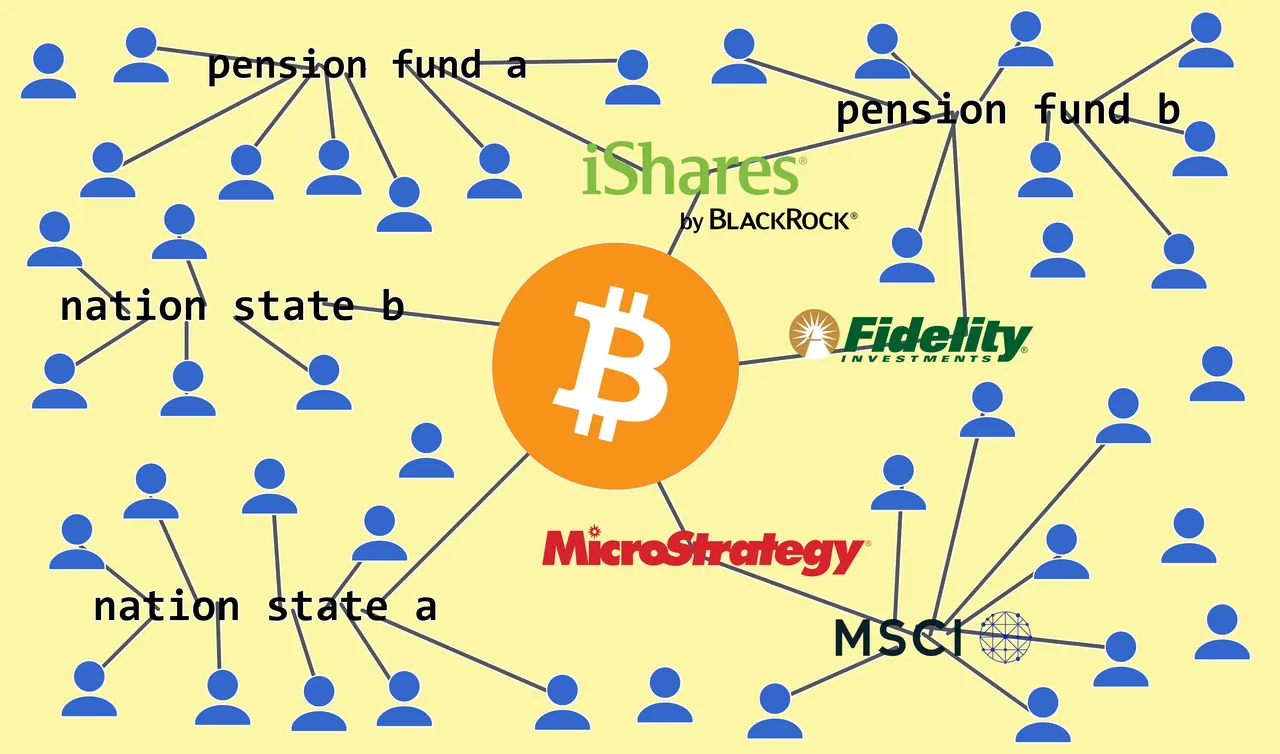

Recently it became even more complicated as people can be considered as Bitcoin users without them even knowing that they have anything to do with Bitcoin. Similar as most people use complex program code in the background of their everyday life applications without noticing it. To be de facto economically a Bitcoin user you don’t have to be a real Bitcoin user like the Bitcoin OGs - you just have to be economically tied to the asset in some way as it is all about Bitcoin’s network effects as a monetary system and not as a communication network as such.

The best recent example for this is the pension fund of Wisconsin adding Bitcoin to its portfolio. Effectively and economically this makes everyone whose retirement is managed via this fund a user of the Bitcoin network without the need of being aware of it. And this won’t be the last pension fund going that step. This dynamic will continue and so more „blind users“ or „indirect users“ follow.

Similar to this every citizen of El Salvador could be considered a Bitcoin user as they all are potential taxpayers whose tax payments can flow into the Bitcoin strategy of president Bukele. And of course the same for stockholders, employees or maybe even customers of Bitcoin companies and companies with Bitcoin strategies like MicroStrategy, Semler Scientific, Block and so on.

(how to think of economic third layers and their fellow "indirect" bitcoin users)

When wealth managers add Bitcoin to their funds more people might become Bitcoin investors without actively noticing it and you could even say that everyone who holds a MSCI World ETF effectively also is automatically a Bitcoin user without having the need to know that - simply because MicroStrategy has become a part of the MSCI World index.

As Bitcoins way to higher market cap keeps going up, MicroStrategy ultimately might become one of the worlds most valuable companies which means it will also become a higher weight in the MSCI World ETFs. That way every investor who owns MSCI World will effectively have a Bitcoin allocation of far less than but somewhen up to 1% - And maybe there will be more companies with Bitcoin strategies that will be part of MSCI World Index and who then add up to this dynamic. They don't have much exposure, but basically all these holders of MSCI World ETFs are automatically slightly hedged against the Bitcoin bull case and they don't even needed to know about it.

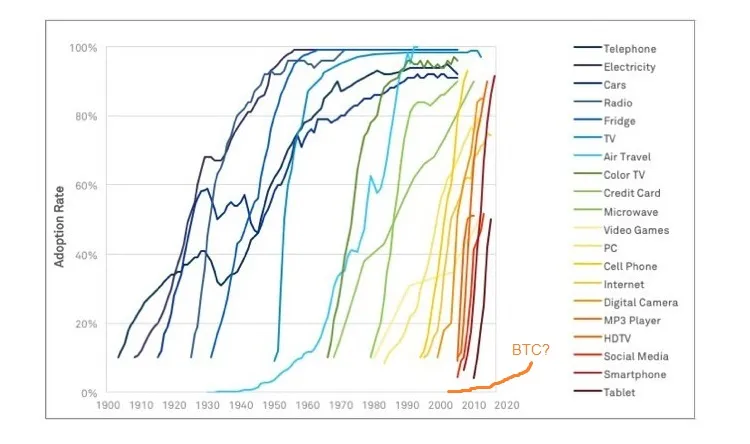

Bitcoin adoption can literally happen without the people actively adopting it. Which stands in contrast to what we know from other technology that we often like to compare with the adoption of Bitcoin:

(Bitcoin adoption comparable to other technologies?)

There never was a money or asset in this history we see here. But after all it depends on strong network effects like with internet and smartphone. Also there is the difference that adopters profit from the adoption rather than just pay for it in order to have consumption and utility like for example buying Internet, Smartphones and TV. It stands in contrast to this consumption that costs money as it is the new money itself.

So we ask the question? How many users does Bitcoin really have? How many now? How many in the future? How many in the first, second and third layers?

Did you know that you are a user of Linux? No? That’s probably because you didn’t notice it - a lot of services you use probably are hosted on servers that run with Linux. Linux is actually widely adoptet, even when we do not see this right in front of our eyes.

Bitcoin is the Linux of money and the English of money as it comes to network effects of an open source money that establishes itself in a sly roundabout way. But most people wont host a wallet or even run a full node same as most people don't use linux on their own devices.

During these three stages through second and third layers it has become more and more difficult to determine who is a Bitcoin user and who isn’t - therefore determining the actual number also is just a matter of guess. Who is part of the economic reality of Bitcoin?

- 10 million addresses that own more than 0,01 bitcoin on chain

- ??? PayPal and CashApp users that hold bitcoin (roughly 300 million users in general)

- 5 million residents of Wisconsin

- ??? MicroStrategy, Block and Semler Scientific stockholders and employees

- ??? employees and stockholders of mining companies

- 6 million residents of El Salvador

- ?? Millions of MSCI World Investors

- ??? Bitcoin ETF investors and indirect ETF investors

- the „50 million crypto holders“ in the US that are supposed to vote for Donald Trump

- ??? employees and shareholders of other companies that are related to Bitcoin

and so on …

I don’t want to calculate anything - I just want to point out that things are getting really crazy and adoption might happen in a way we have not expected before.

With all this we see how complex the network effects of Bitcoin became. Everything has become messed up and it shows how Bitcoin slowly becomes implemented into the existing system and sometimes even without the people need to be aware of it - this new thing is getting accepted by the existing „system of things“

In conclusion we can say, the adoption might be more driven forward than we thought it would be at this point. Depending on what you consider a „User“! - sure the amount of „real direct users“ will rise a lot, but there will also be a lot of „indirect users“ that come because nation states, funds and other institutions get into Bitcoin and bring the people whose wealth they are responsible for to the economic reality of Bitcoin.

With old assumptions like looking at daily addresses used and only looking at layer one and on-chain-data you may come to the conclusion that Bitcoin is overvalued in price compared to the raw network utility value. But with including the second and third layers that should change. When we talk about adoption in terms of how many people are already part or indirectly participating in the economic reality of Bitcoin we must be somewhere between 1% and 10%. We are not sooo early anymore. In terms of network effects that means - nothing else can surpass it - your money will be save there and if you want you can be a layer one user - nobody can prevent you!