Whenever Bitcoin experiences a run in price, the bubble callers come out of the woodwork. You'll have to forgive them, as they've been "right"a few times. (Note: definition of "right" open to interpretation)

However, their accuracy can be mostly credited to (literal) "dumb" luck, as neither Bitcoin, nor tulips themselves, actually bear any resemblance to what we know as "Dutch Tulip Mania."

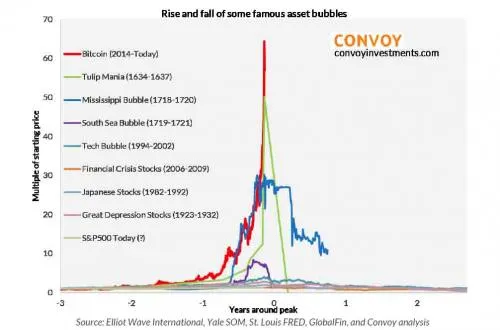

Perhaps you've seen this chart:

For those unaware, perhaps the most famous bubble in history is the "Dutch Tulip Mania". The mainstream knowledge has it that such a furious bidding war broke out for tulips in Amsterdam in the late 1600s that it made most modern stock market bubbles look like a bunny hill. Supposedly, the truly insane delusion of crowds bid a single rare tulip bulb to a price in excess of a luxurious Dutch estate, and men were thrown in jail for the accidental destruction of a flower.

Of course, none of that is true in any way. Here are 3 generally unknown reasons why Tulip "fever" was bullshit.

Demand for tulips was already at a cyclical high. The "Thirty Years War" (1618-1648) had taken a vast toll on the Dutch people. Wikipedia notes that the war "ranks with the worst famines and plagues as the greatest medical catastrophe in modern European history" with "population loss in central European states "ranging up to 50%". In other words, there was already high demand for Tulips and every reason to assume that would continue for the foreseeable future

The top of the bubble, or the point that everyone makes their "Tulips went up XXX%" calculations from, is a lie. The "trade" marking the top of the bubble, the one everyone uses to calculate the total bubble percentage? Never happened. A careful perusal of existing Dutch records show that not even ONE SINGLE bankruptcy was recorded or attributed to the "bursting of the Tulip Bubble".

Most Tulip contracts had an opt-out clause. This means that, effectively, you could pay money to speculate with limited downside. Consider this example: You are watching the tulip market rapidly appreciate. A market maker allows you to buy the option to receive delivery of $100 in Tulips at today's value in 1-month, for $100, with a delightful catch – for a mere $1, you can reject delivery in one-month and destroy the contract. Sound like limited downside and extreme upside? Well, that's exactly what it is, and this is why so many tulip contracts traded.

In other words, tulips were not a bubble. They were a (mostly) rational response by market actors to unusual demand outside normal statistical variance.

So the next time that you hear someone call Bitcoin a Tulip, go ahead and tell them you're fine with that. Bitcoin being a rational trade with vastly outsized risk relative to the upside is a good thing for all of us.

Then walk away, because they won't get it, unless they, too, were bored enough to write a paper on Tulips when studying for their PhD in economics.

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: My Economics Thesis, Wikipedia, Smithsonian Magazine

Copyright: FirstCoinCompany.com, Bouq.com