The order books of cryptocurrency exchanges around the world represent relatively thin markets, increasing the opportunities for price manipulation. One route for this manipulation involves taking certain related positions in the spot and in the futures markets. Influence can flow in both directions between the two markets, as everybody knows.

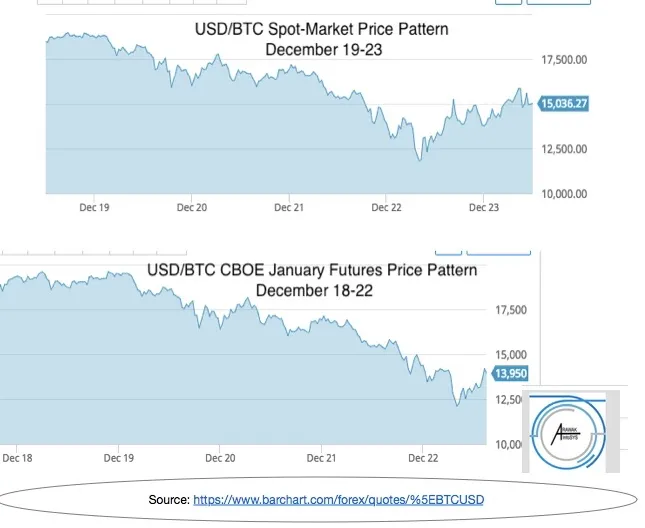

The chart which follows illustrates the usual similarity of the price tracks of the two markets. (Apologies for the unduly light blue colouring of the chart in the source document. Please focus on the curve at the top of the blue area.) Notice that the first date of the futures market chart is one day before the first date of the spot market chart.

Arbitrageurs are key players helping to maintain the said similarity. They will buy in one market and sell in the other to make small profits on unwarranted price divergences between the markets.

The abstracts and literature cited under two topics in the Arawak_InfoSYS “Knowledge Repository” comprise materials that you can use to get a quick overview of what is involved. The topics are: “Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries” and “How can the actions of futures traders affect the spot price of bitcoin?“

The influence of the futures-market trading on the spot market price pattern may be particularly interesting if it turns out that the “big” institutional money is going to participate in bitcoin trading largely via regulated derivative instruments. Some analysts have forecast this future development.

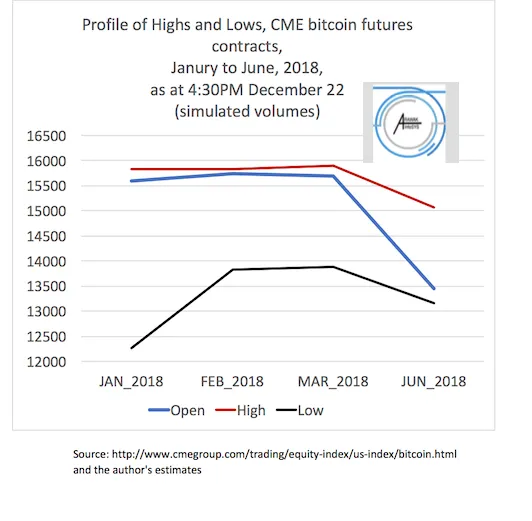

In the next chart, I have simulated what the price profile for the forward month prices of bitcoin futures at the CME (from January to June) would be, if the volume of contracts at each month was the same as for the January 2018 contract (roughly 2,400). Think of this simulation as giving you a rough estimate.

The chart is based on the actual midpoints between the High and the Low prices at each forward month. That is, the midpoints are computed from real data. The pattern formed by the curves does not suggest that these institutional traders are bullish for the next six months.

However, there are two cautions to note. The actual contract volume is very much larger for January (2,369) than for June (5), which means that the data provide a seriously inadequate sampling of sentiment across the months. Secondly, the pattern that is shown here is highly sensitive to disruption from the arrival of consequential news.

When I was actively trading stock options, I found statistical support for the hypothesis that the overnight futures price patterns provided good indications of how far (in percentage terms) and in what direction the relevant spot prices would change over the coming day of trading. This was for the broad stock indexes.

Despite the weaknesses in the data presented above, they suggest that the message in the futures price pattern deserves your consideration.

At the Arawak_InfoSYS “Knowledge Repository”, you will see abstracts from the best available texts and videos that provide basic education about the bitcoin futures. Beside the text of each abstract, a link takes you to the original source document.

The abstracts are classified under the following subject headings.

- Basic education about bitcoin futures contracts at the CME

- The relative frequency of selling versus buying futures contracts

- How can the actions of futures traders affect the spot price of bitcoin?

- Impact of futures trading on bitcoin’s price volatility

- Managing counter-party risk in bitcoin futures trading

- Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries

(“Look Grandma! No one-word tag names for topics. Instead, informative phrases to delight humans and make the bots angry.”)

So, Arawak_InfoSYS “Knowledge Repository” will be a “go to” place for those who wish to find a helpful assembly of abstracts and links to the most useful published thinking about key aspects of the impacts of bitcoin futures trading on the price pattern of the underlying bitcoin asset (the pattern of the so-called “spot price”).

P.S. This article is all “green content’. You will not find it anywhere on the Internet, except at Steemit. It would be nice to put the Arawak_InfoSYS “Knowledge Repository” right here inside Steemit; but it will disappear about 20 minutes after being uploaded and then almost nobody will know it was even uploaded to Steemit. Also, those who know it has been uploaded will have a very hard time finding it. Thus, for 99% of the Steemit sub-community that might find this piece useful, it never existed; unless (I have now learned from a Steemit veteran) I first spend 12 months selling myself and growing “5,000” followers. Great formula, gals and guys!