Our current financial system relies on regulation and trust parties that enforce its rule. A great example is the recent try by several companies to issue an Bitcoin ETF.

The SEC rejected the proposal of many issuer starting with the

Why limits were required in the past

The U. S. Securities and Exchange Commission (SEC) has a three-part mission: Protect investors. Maintain fair, orderly, and efficient markets. Facilitate capital formation.

As a result the SEC is a gate keeper and simply decides who and which products are allowed to operate in this case in the US and on wall street. This is required because without any rules there would be chaos and especially no recourse in case of scams.

With these rules the SEC and US government gets to put rules in place and have a gate keeper that enformces these rules. Additional there is the legal system that will deal with parties that do not follow them. This creates order, rules and protection which ultimatley creates trust in market actors. For instance anyone buying an ETF can just trust that what this product claims to do actually is enforced, because it is approved by the trusted party and if rules are not followed, consequences would be enforced.

A whole country at work

This is critical: In order for all of this to work a whole country, in this case the United States needs to be in place. Consequently this creates somewhat of a monopoly. The SEC is the King of all financial products backed by the power of the state.

The cost

Because of this monopoly and hurdles to get approved, creating financial products is risky and expensive. Of course if you manage to get approved, there is likely a big profit opportunity, which in turn has to be paid by consumers.

These cost come down to

Direct Fees: The organisations offering these products need to recoup their expensenses, risks and make a profit. Consumers have to pay for this

Indirect Fees in the from of taxes: The state also requires large resources to function and we can look at GDP vs taxes. In the US this is about 24% of GDP. If you are employed, have property and generally a bit richer this part for you tends to be much closer to 50%. For instance the top federal tax rate in the US is 40%, add state taxes, property and sales taxes and your exposable income is reduced easily by 1/2.

An expensive financial system: About 20% of GDP is required just to make our financial system work.

Limited products and innovation. This is not something we can put in numbers, but logically there are a lot less products than the market would accept. This I believe is the biggest cost of all and the reason why there has not been much innovation in the financial sector in the last few decades.

Central Planning: Along with single authorities like the FED and the SEC comes the central planning aspect, that if either the FED or the SEC are wrong and do not perform the correct actions, there is no punishment to them until the entire system collapses, leading to likely bad decisions overall. Are these authorities really incentivised to act in the best interest of the public, in this case the USA? I think likely not. Preserving power and generating benefits from this power is likely more important.

All of this cost to create one thing: Trust. Without it we can operate and function.

Example: Winklevoss ETF

The winklevoss twins started working on their ETF in 2013. They created the product, built an exchange, a price index and tried to comply to the rules of the SEC

Since then they have gone thru several iterations and rejections by the SEC. Now it is 2018 and they have little but failure and expenses to show for it. Furthermore the public still does not have the benefit of the product that has been built.

There is cost, failure and no benefit. Until the SEC changes their mind and approves the product.

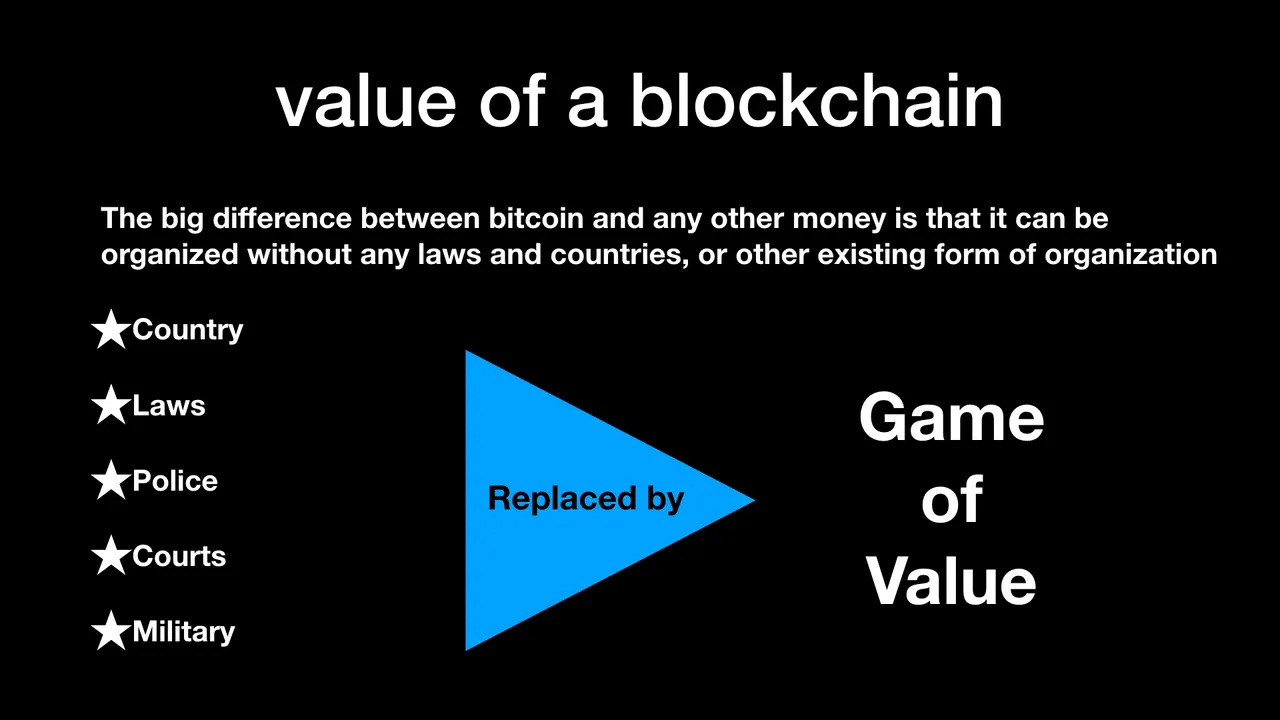

The solution of bitcoin: A game of value

Bitcoin functions fundamentally differently. It does not live within a state. Instead all of the governance that is required for it to run is done by its internal governance, which is essentially a game of value. Game in the game theoretical sense as mathematical functioning system. This is why some say bitcoin is backed by math. I think it would be better to say that is it run by mathematics and economics: Game of value.

This is very very significant. Bitcoin has invented a new form of organisation that does not require the state to function. As such it removes all the cost described above and replaces it with something that is more efficient (there is still cost) but also allows for new things to built that were not possible before.

Open to all

Additionally of functioning outside of the state and in a new way, bitcoin is also open and in competition to everything. In fact bitcoin now provides an alternative financial system that even the existing system such as wall street has to compete with. But bitcoin competes with itself as well. Anyone can create an alternative version of it, which is happening with the creation of all the other cryptocurrencies. Imagine the Internet and how innovative it would be if every app would need the permission of ATT to be launched. The internet has created powerful companies like facebook and amazon, because nobody had to ask for permission. Bitcoin does this to the financial system. It goes around the SEC just like the internet went around the phone companies.

The mistake of the ETFs

An ETF is bringing bitcoin into the existing financial system. I think an ETF will create a way of allowing parties on wall street to participate in bitcoin. However it does not really create anything new of value. Anyone can buy bitcoin already with a bank account, no ETF required.

I believe the problem of an ETF is that it inherits all the cost of the existing financial system.

The new functionality that bitcoin provides must be leveraged to built new financial tools and products. Asking for permission is the wrong approach. It misses all of bitcoins potential.

Instead it is up to entrepreneurs to built a new product that does not rely on laws and the approval of the state or its law enforcement to function. We need to build a crypto product that creates new solutions that are more powerful and work independent of the SEC or any other countries institution. It must leverage the core innovation of bitcoin: independent governance.

Bitcoin is hard

Doing anything in the blockchain space is hard, because we have no idea what potential of the technical really is. Could anyone predict how social media would change the world when the internet was invented in the 90is? But if you figure it out real value and rewards will reaped.

We are just getting started.

Summary

In summary I think a bitcoin ETF is almost pervers. We need instead systems that leverage the organisation form that was created with blockchains and cryptocurrencies to create new solutions that could not be done before. This is why I look for such system to invest in. Steem was one of the examples that attracted me because it creates a new way of doing social media, without need of companies and states and external laws.

These systems must provide value. That is the most important thing. We will know if bitcoin is successful by watching its market cap grow. If it is surpassed we know it is failing and competition took over. Yet if bitcoin becomes big, everyone needs to use it or be left out of its value. Organisations that want to profit will find a way to do so.

Wall street is driven by profits. Owning bitcoins has made many people rich. This is the biggest attraction. An ETF may spur short term demand but in the end does not add to value for bitcoin. We need to make bitcoin or any other cryptocurrency better, create value to organically grows its market cap. Then people will join because they have to (to make profit).

Don’t worry about the ETF or institutions ability to buy in. Lets focus more on how bitcoin can create actual utility. If you want to build something, study the functionality and leverage it for real solutions. Like facebook, google and amazon did. They used the internet and changed how their business fundamentally works.

We need financial products that leverage the new organisational capabilities bitcoin provides.

What do you think?

Is the ETF really that important? What do you think will it be approved and what will be the implication.

What du you think about this article and how bitcoin does create value?