We always hear naysayers screaming for a crash whenever stock markets reach an all time high. The truth is the crash WILL occur one day, perhaps sooner than we thought.

“The bull climbs stairs, the bear jumps out the window.”

Having had a few years of experience in the market, I would set aside a portion of my net worth on long term investments, but also use a portion of cash to trade shorter term. Because crashes occur so fast and violent, we would preferably want to capitalize on such high volatility in the near term by trading with some form of leverage (only if you can handle it, not financial advice. Leverage is a double-edged sword)

But firstly, Investments for a financial crisis

Cash (parked in liquid, low risk dividend yielding investment vehicles temporarily before being deployed to buy the bottom of the crisis)

What do I mean by low risk dividend investments? Some examples are Real Estate Investment Trusts (REITS), typically a sound 5–8% annual dividend with considerably low price volatility and fiat currency margin lending on crypto exchanges (7–15% annual dividend based on personal experience)

Bitcoin and other cryptocurrencies

It is probably the most prominent and sole effective hedge against the financial system. When banks go down, everything else goes down with them.

Silver (physical bullion)

I personally recommend Royal Canadian and/or Johnson Matthey 100oz silver bars due to their global brand recognition, liquidity and low premiums.

Now for the fun part,

Trading short term to take advantage of the crisis

Have you heard of the VIX? The CBOE Volatility Index

The VIX acts like a “Fear Indicator” of the markets.

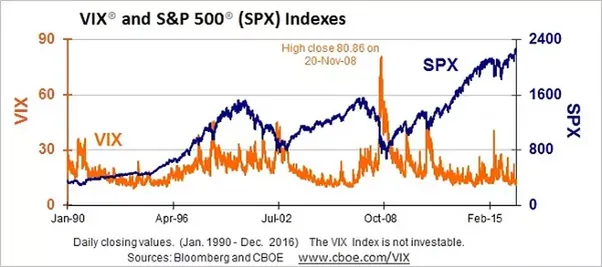

When volatility is high, markets tend to be going down fast and with huge volume. Take a look at this historic chart.

As you can see, during the good times when prices are moving up, the VIX tends to stay low. There is a reversion to mean and a base where the VIX tends to hover at. But when prices drop, the VIX can shoot up real high real fast. Just look at the 2008 financial crisis period on the chart for a good example.

This is where you as a shorter term trader can profit massively from.

There are VIX futures where you can trade with leverage. But do keep in mind to understand the concept of futures first and do your own research before trading.

Alternatively,

You can simply short stock indices.

Shorting is a bet that prices will go lower, and you profit/lose from the difference. Just like buying a stock, but in reverse.

There are many brokerages and CFD providers that offer user friendly and professional financial products and trading platforms that allow you to do this and with good amounts of leverage.

The best investors make money when the market goes both ways.

If you would like to discover more money making methods, check out my Youtube Channel: King Money Mastery

https://www.youtube.com/channel/UC4JRkbCGTTWwn4Jvoc2Q9Gg

See you on the other side.