Peter Schiff will be debating Bitcoin in the coming weeks, so I decided to establish a step-by-step explanation for why Peter is wrong.

Peter is so certain about his contrarian opinions on the US and world economy because he is certain that he is reasoning from a superior set of premises. The whole world is reasoning from Keynesian axioms, and Peter is reasoning from Austrian axioms, and hence arrives at superior conclusions, predictions, and explanations of the data. It is for this reason that he and all Austrian economists could see the 2008 Financial Crisis coming from a mile away, and every expert in the world was entirely blindsided by it.

This same confidence has bled over into his contrarian position on Bitcoin, presumably because he is certain that he is reasoning from a superior set of premises. He assumes that the Bitcoin community is arriving at illogical and irrational conclusions about Bitcoin, because they are reasoning from a set of faulty premises.

The following is Peter's core argument against Bitcoin condensed into a syllogism:

P1) Bitcoin has no Intrinsic Value.

P2) Anything that lacks Intrinsic Value cannot store value.

P3) It is irrational to invest in something which cannot store value (or be money).

C1) Bitcoin cannot store value (or be money).

C2) It is irrational to invest in Bitcoin.

Step One: Define 'Intrinsic Value'

Philosophically speaking, it is true that Bitcoin has no Intrinsic Value, but only because nothing has Intrinsic Value. The "Subjective Turn" in economics initiated by Carl Menger in the late nineteenth century did away with the Intrinsic Theory of Value and gave birth to the Austrian School of economics. It is odd, then, that Peter, an Austrian thinker himself, is going on about Intrinsic Value, when every Austrian should know that value is always Subjective, and therefore the only things that can truly be said to have Intrinsic Value are all subjective things, such as love, and pleasure, life, and happiness. All objects and commodities, can one every have Instrumental Value, in that they are instruments we value because they allow us to obtain things we Intrinsically Value.

This is why it is import to define "Intrinsic Value." We can only assume that when Peter Schiff says that Bitcoin has no Intrinsic Value, that he is to referring to something else. It is my strong intuition that when Peter speaks of Intrinsic Value, he is actually referring to Direct Use Value.

Direct Use Value is the value that individuals get from a good as the result of directly using it. For example, the only reason I value my toaster is because I can directly use it to toast bread. The toaster, therefore, has Direct Use Value. Though, notice that it still does not have Intrinsic Value. The toaster has Instrumental Value, because I value directly using it, not simply for the sake of using it, but in order to obtain something else I value: toasted bread. And toasted bread too, is only Instrumentally Valuable, because I do not value toast for the sake of toast, but because it is an instrument for obtaining pleasure and sustaining life. Life and pleasure, two subjective things, are the only parts of that equation which could be called Intrinsically Valuable. I desire life and pleasure not to obtain anything else, but for themselves. They are ends, rather than means.

So, when Peter says that Bitcoin has no Intrinsic Value, what he is really saying is that Bitcoin has no Direct Use Value, which is to say that, "You can't do anything with a Bitcoin except sell it to someone else." By contrast, gold has direct use value, because, not only can you sell it to someone else, but you can also directly use it for ornamentation and a variety of industrial uses.

Step Two: Saleability Makes A Money, Not Intrinsic Value

I don't think it is even necessary to establish that Bitcoin has Direct Uses. There are millions of goods out there that have Direct Uses, and yet will never be money. And it is not the thing with the most Direct Use Value that eventually emerges as a money, it is the thing with the highest Saleability.

Saleability refers to the ease of selling a good in the market. Things are more or less saleable depending on a set of distinct characteristics which include durability, portability, and a limited supply.

Something extremely portable and durable, but which has a near infinitely abundant supply, won't be very saleable in any market, because why would anyone want to buy something that is already abundantly available?

Something that has a good limited supply, but which decays after a few weeks, also will not be very saleable, because people would only want to buy those small amounts which they can either use or exchange away before it decays and loses all of its value.

Simply having Direct Use Value, or what Peter calls Intrinsic Value, is not enough to make something a money, and, in fact, is not even a necessary requirement. It is possible to value something purely for its capacity to store and transfer wealth, and this value, if we concede that it is not itself a kind of direct use, we can call Exchange Value, or even Monetary Value.

Step Three: Money Does Not Require Intrinsic Value

As an Austrian, I will assume that Peter Schiff is taking the Misesian Regression Theorem as a premise, and reasoning from there to the conclusion that Bitcoin cannot be money, because it has never been a commodity valued exclusively for its direct uses.

It is important to acknowledge that the Regression Theorem is based in logical argumentation, not historical data. A hypothetical primitive market of pure barter and direct exchange is a scenario imagined by economic theorists, and has no historical support. Mises did not establish a Universal Law, he conjured a logical explanation for how moneys can first emerge in a situation in which there are no already pre-existing moneys. All moneys that emerge thereafter, must be traced back to that first commodity money, but themselves do not need to emerge in that same way.

And further, once a money is already established, direct use value is not a necessary characteristic for it to continue to function as money.

Mises was quite clear on this point:

Many of the most imminent economists have taken it for granted that the value of money and of the material of which it is made depends solely on its industrial employment and that the purchasing power of our present day metallic money, for instance, and consequently the possibility of its continued employment as money, would immediately disappear if the properties of the monetary material as a useful metal were done away with by some accident or other. Nowadays this opinion is no longer tenable, not merely because there is a whole series of phenomena which it leaves unaccounted for, but chiefly because it is in any case opposed to the fundamental laws of the theory of economic value. To assert that the value of money is based on the non-monetary employment of its material is to eliminate the real problem altogether.

Here we see that Mises himself disagrees with Peter. "Intrinsic Value" or Direct Use Value is not a necessary requirement for something to be a viable store of value, not is it required for something to acquire and maintain Monetary Value. That is, unless you are referring to an imaginary non-monetized market of direct exchange and barter.

Murray Rothbard, another hero of the Austrian School of Economics, echoed this from Mises:

It does not follow that if an extant money were to lose its direct uses, it could no longer be used as money. Thus, if gold, after being established as money, were suddenly to lose its value in ornaments or industrial uses, it would not necessarily lose its character as a money. From then on, gold could be demanded for its exchange value alone, and not at all for its direct use.

Again, we see that Peter's critique that Bitcoin cannot be a money, and cannot store value, and will eventually crash to a price of zero, is ill founded.

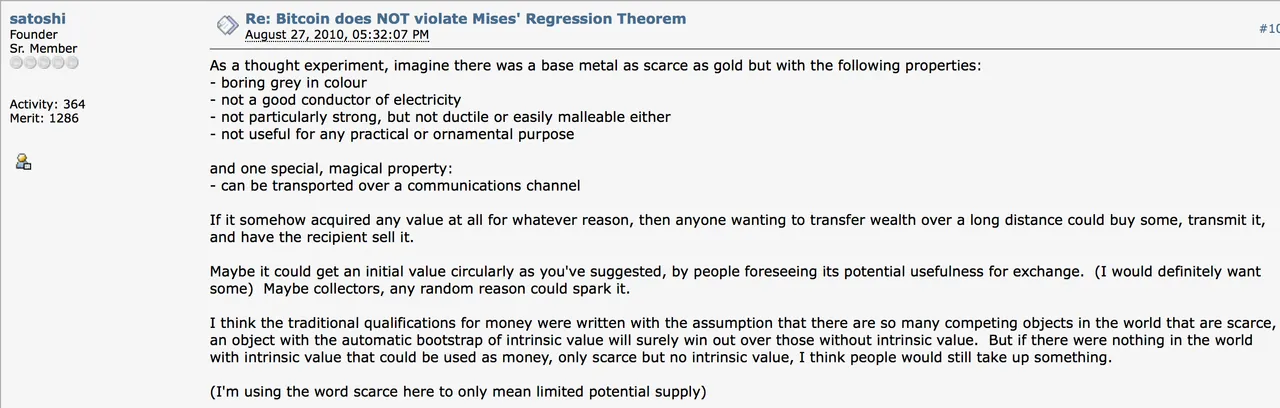

Satoshi Nakamoto, not surprisingly, also disagreed with Peter's dogmatic misunderstanding of Mises, as expressed on the BitcoinTalk Forum in 2010 before disappearing forever:

The Regression Theorem provided an explanation for how a money could first emerge out of a barter economy or direct exchange market. The Regression Theorem does not apply to markets that already have a money. Once an economy is monetized, the money can lose its direct use value and still function as money, and it can also be used to establish other moneys.

In a monetized economy, alternate mediums of exchange can emerge without Direct Use Values because the existent money can be used to establish their value. Fiat money, while having no Direct Use value, emerged as money because it was able to establish its Exchange Value via gold and silver. Bitcoin can do the same, because it is able to establish its Exchange Value via fiat moneys.

Bitcoin regresses to USD, USD regresses to Gold and Silver, Gold and Silver regresses to shells and flints. The Regression Theorem is satisfied.

Once prices and exchange were established between Bitcoin and USD, the hurdle which the Regression Theorem exists to explain was already overcome. Peter's idea that all mediums of exchange can only arise out of a commodity previously used exclusively for direct uses, misinterprets the Regression Theorem.

In a purely Barter Economy, the most saleable commodity in the market will likely emerge as a money. Once established as a money it can lose its direct uses and still function as a money, and it can also be used to seed other moneys, even other moneys that do not themselves have direct use value besides as a means to store and transfer wealth.

Step Four: The Problem With Fiat Is Not Lack Of Intrinsic Value

We all know that government issued fiat money is not sound money, and is destined to hyper inflate until it eventually becomes only as valuable as its direct uses. A square of paper with ink printed on it, has virtually zero direct uses, and so paper fiat currencies will eventually be worthless.

Peter takes this knowledge and misapplies it to Bitcoin. He reasons that Bitcoin also does not have any Direct Uses, and therefore is also a sort of fiat currency, that will eventually have to become worthless.

P1) Fiat currencies have no Intrinsic Value.

P2) Fiat currencies will become worthless.

P3) Bitcoin has no Intrinsic Value.

C1) Bitcoin will become worthless.

Above is an example of Peter's reasoning, and is also an example of the Weak Analogy Fallacy. A and B are similar is established in P1 and P3, the conclusion that B must therefore also have the same characteristic that it is established that A has in P2 does not logically follow.

The problem with this reasoning stems from the assumption that the reason that paper fiat money cannot store value is because paper fiat money does not have Intrinsic Value. This is a faulty assumption, which leads to a faulty conclusion.

The reason that paper fiat money cannot store value is because it is missing on of the vital characteristics of saleability, and specifically the characteristic that makes something a good store of value: Limited supply.

Scarcity is a measure of costliness of production and replacement. The cost of printing trillions of new paper fiat money is all but non-existent, and thus the central bankers that control the supply cannot help but to continually increase the supply.

It is this fundamental problem with paper fiat currencies that is resolved by backing them with a naturally scarce commodity like gold or silver. This artificially limits the supply, and thus makes it a better store of value.

Bitcoin, on the other hand, already has a perfectly limited supply, and thus does not require backing in order to artificially limit its supply, and does not have the same pitfall that paper fiat money has with regard to capacity to store value.

Fiat money is not bad because it lacks direct uses. As Mises, Rothbard, and Nakamoto agree, direct uses are not essential to the continued function of an established money. Fiat money is bad because it is not scarce. It is too easy to produce them. The supply is too easily inflated. Bitcoin is very costly to produce, and its supply is extremely and unwaveringly scarce.

Step Five: Bitcoin Is A Series Of Exponentially Larger Bubbles

The conclusion that Peter arrives at that is the result of reasoning from faulty premises, leads him to claim that Bitcoin is one huge irrational speculation Bubble fueled exclusively by greedy people trying to get rich quick, and this exuberance blinds Bitcoin enthusiasts to the point of irrationality.

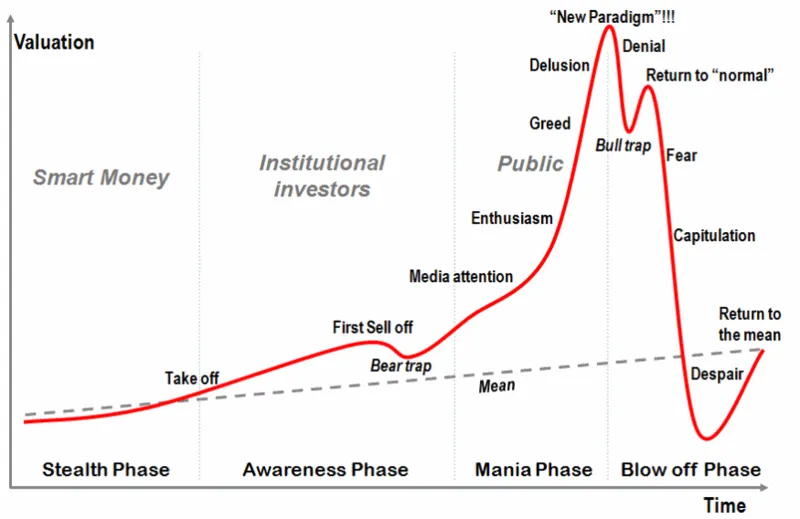

The interesting thing about Bitcoin is that the historical price action seems to follow a consistent pattern. There is a consistent mean increase, punctuated by periodic Bubbles that inflate and then pop, and each new Price Bubble is several times larger than the last.

Bitcoin has bubble after bubble after bubble, they inflate, and then they pop, but when they pop they reach a floor that is higher than the floor that preceded it. So, if you ignore the bubbles, you can see that the value of Bitcoin in the mean has been increasing at a steady rate. It certainly has not been decreasing, and smart investors are not hoping for the next bubble, they are assuming the mean trend of steady increase in value will continue.

Bitcoin bubbles are not like Tulip Bubbles, or beanie baby bubbles, because the usual market response to a dramatic and irrational increase in demand, is a corresponding dramatic and radical increase in supply. People who want to get rich not only start buying the tulip, they also start producing them. The supply of Bitcoin, however, cannot be increased to offset increases in demand, and thus, the price cannot be demolished in the same way that traditional tulip bubbles can.

Imagine a bitcoin bubble that rises, and the crashes, but at the same time it crashes, there is a suddenly influx of new bitcoins that flood the market. Decrease in demand, plus increase in supply, equals destruction. This is the fate of all Tulip Bubbles, but this does not, and can never happen to Bitcoin, because unlike Tulips, the supply of Bitcoin remains constant regardless of fluctuations in demand.

In Conclusion

When Peter talks about Intrinsic Value he is really talking about Direct Use Value. He assumes that Direct Use Value is required for any new money to be established, but that is an incorrect reading of the Regression Theorem, which states that in a Barter Economy the only way for the first money to be established is as a commodity good valued first for its direct uses, which does not apply to an already monetized indirect exchange economy.

He also assumes that lack of Direct Use Value must result in lack of value storage capacity and monetary value, but this too is untrue. An established money can lose all of its direct use value and can continue to function as a money and hold monetary value as long as it maintains good characteristics of saleability.

He finally concludes that Bitcoin is one giant bubble that will eventually crash to zero, but ignores the data which shows a steady trend towards increasing value, punctuated by exponentially growing bubbles, which cannot be extinguished by corresponding increases in supply, as happens Tulip Bubbles.

Therefore, Peter Schiff is wrong.

- KG