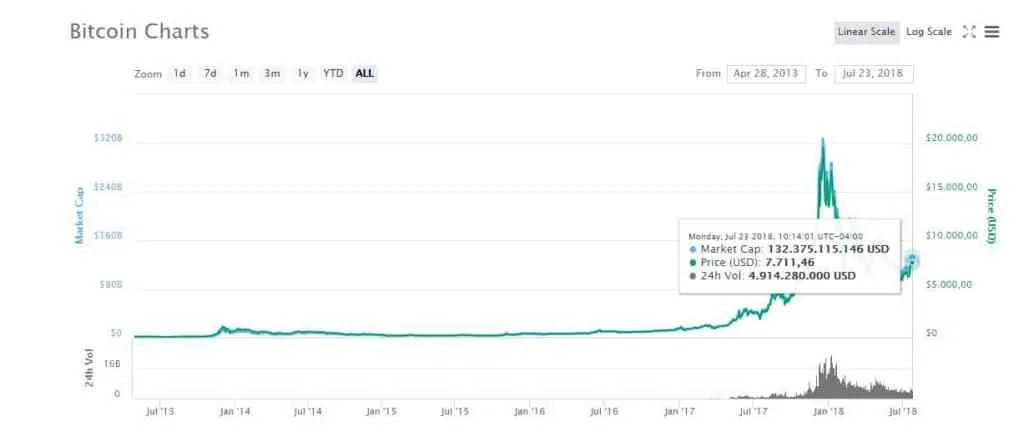

While the cryptocurrency market registers an increase of 1.48% in the last 24 hours, and six of the top 10 are in red, bitcoin (BTC) revalues 3% in the same period to reach $ 7,711.

Bitcoin grew 16% in the last week and 31% since the minimum of the year, when it fell to $ 5,879, according to the figures of Coinmarketcap. The altcoins increased 2.4% in the last week and only 0.2% in the last day.

The total capitalization market increased by 7.9% in one week, from $ 266 billion to $ 287 billion, that is, it registered half of the BTC increase in the same period. The remarkable evolution of the market compared to the BTC in the week is that while this has remained booming, the market experienced a similar increase last Tuesday and managed to exceed two times the level of $ 300 billion , but then fell an little more than $ 12 billion to reach its current value.

Among the first 10 cryptocurrencies per capitalization market, only three experienced an increase in the last 24 hours: Bitcoin Cash (BCH), 1.96%; Litecoin (LTC), 0.77% and Cardano (ADA) which was revalued by 0.56%. The remaining six exhibit losses ranging from -0.2% for Tether (USDT) to -3.43% for IOTA (MIOTA). The dominance of the BTC (dominance) has risen continuously from May 7 to the current time, from 37% to 46%.

There are several factors that may have favored the BTC, among them the decision that is expected from the Securities and Exchange Commission (SEC) on a request for a Quoted Investment Fund (ETF) for bitcoin , presented by the Chicago Board Options Exchange (Cboe Global Markets).

Another possible reason for the bitcoin boom is the neutral position with respect to the cryptocurrencies of central bank governors and finance ministers of the G20, expressed last Saturday at a press conference by the president of the Central Bank of Argentina , Luis Caputo, who explained that there was consensus among the participants in the Conference that the cryptoactives do not represent a risk for the global financial system.

These factors, along with the efforts of bitcoin developers with entrepreneurs in the cryptoactive ecosystem to encourage the scalability of Bitcoin and the increase in safeguarding and securing solutions that are emerging, are possibly giving institutional investors more confidence to enter the market. this market.