Gold has long been labeled a store of value.

Partly because of it's lack of "perceived" volatility.

In fact, that is one of the key differences between Bitcoin and Gold, at least according to gold bugs.

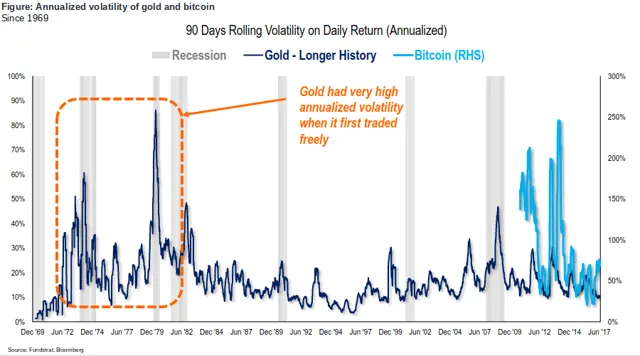

While the volatility might be slightly less with gold, check out this chart:

As you can see on the far left, that is the volatility of gold when it first started to really trade freely.

Check out the far right side of the chart, that is Bitcoin currently, which is also at the beginning stages of trading freely.

As you can see, those are some very similar looking charts.

What is most interesting is how far down Bitcoin has come down on the volatility chart as of late.

It even dipped below that of gold for a few short periods of time.

That is interesting.

Keep in mind, that I am not saying that I think that Bitcoin is a better store of value than gold, or that it will eventually be less volatile, but I do think that the longer it trades and the more hands eventually hold the coin, the volatility will most certainly come out of it.

It will be interesting to see how things unfold as time goes on.

Basically the point in all this is this...

When things are first traded they tend to be more volatile.

That, and something is a store of value simply because people believe that it is.

Right now there are a lot of people out there who would much rather sell an ounce of gold then they would sell a quarter of a bitcoin...

I would imagine some of the money currently invested in gold will find it's way into Bitcoin in the not too distant future.

Image Source:

https://seekingalpha.com/article/4104272-bitcoin-investment-decade

Follow me: @jrcornel